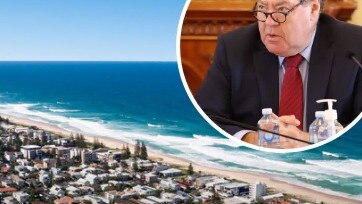

Elderly Gold Coast residents paying the price after wrongly billed for land tax hike

Elderly Gold Coast residents are frightened and panicking after inaccurate land tax bills from the government requesting thousands, reveals a Gold Coast State MP.

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

Elderly Gold Coast residents are frightened and panicking after getting inaccurate land tax bills from state government in the mail requesting thousands, according to an MP.

An 85-year-old woman has paid more than $1033 — only for a Treasury official to later apologise about the bill, the Bulletin has been told.

Others say they have much higher bills. The Government maintains there is a threshold when land reaches more than $600,000 in value but exemptions can be applied for.

Mermaid Beach MP Ray Stevens, acting on behalf of concerned constituents, has warned Treasury officials they are causing unnecessary stress for residents, many low-income pensioners.

He had been told property owners with a valuation over $600,000 had received a similar land tax bill even though it may be their principal place of residence, meaning the bill was not applicable, he said.

Mr Stevens said the 85-year-old Miami woman received a notice of land tax payable on her property of $1033.30.

In a letter to Treasury, he wrote: “She does not have email and was most concerned she had to pay this bill. I have spoken to (an employee) from your office who advises me everyone with a valuation over $600,000 has received a similar land tax bill even though it may be their principal place of residence and the bill is not applicable.

“With land valuations skyrocketing on the Gold Coast, this will mean thousands of the inaccurate billings will be mailed to elderly residents unaware of their exclusion from this tax.

“It reminds me of the scammers prevalent in our communities preying on elderly residents who may pay this bill even though it is not applicable. I will raise this matter in the House (the parliament). Please note (the resident’s) exemption from land tax on your records and amend them accordingly.”

Another concerned property owner from Burleigh Waters said their stress was heightened by receiving no acknowledgement of their application for exemption for months, and the department failing to respond to a follow-up email for 24 days.

“The deadline is now within a week and the complete lack of acknowledgment from my multiple attempts to contact the department is causing anxiety,” the resident wrote, in an email to officers.

Treasury in a response said their officers were attempting to respond to all requests within 10 days.

“Some enquiries can be resolved quickly, but others take more time,” the Treasury staffer wrote.

“If your enquiry is urgent, we’ll do our best to get to it as soon as we can. You don’t need to follow up your email with a phone call. We endeavour to respond to all enquiries within 10 working days.”

The property owner told the Department their assessment included the house they were living in and matched their driver’s licence address.

“I don’t think I’m required to pay it. But I can’t find any evidence of submitting the exemption or update of its result on the website,” the resident wrote.

A Treasury spokesperson said the Government would not comment on individual cases.

“When we identify the value of a person’s land holdings has reached the $600,000 threshold for the first time, we send a letter with information on land tax, the exemptions available and how to apply,” the spokesperson said.

“Landowner’s may claim an exemption for the land they use as their principal place of residence (home).

“Where we have enough information available, we automatically apply a land tax home exemption, without the landowner having to apply.

“Where we do not have sufficient information to apply an exemption, we write to landowners advising them of their estimated land tax liability, the available exemptions and details on how to apply for them.

“If a landowner does not claim an exemption, they are issued with a land tax assessment notice, which includes details of their liability.”

The spokesperson urged lndowners to learn more about land tax emptions and how to apply at www.qro.qld.gov.au/landtax.

More Coverage

Originally published as Elderly Gold Coast residents paying the price after wrongly billed for land tax hike