Interest rate rises fail to curb rising house prices

The cost of buying a home is continuing to rise across most of the country as Australians scramble to purchase a property.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

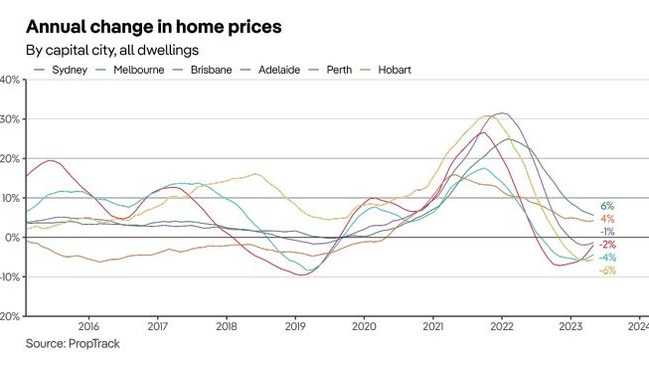

The rebound in housing prices is accelerating despite the Reserve Bank’s campaign to lift interest rates.

National home prices have increased 0.33 per cent in May, bringing the 2023 rise to 1.55 per cent according to PropTrack’s latest house price index.

Every capital city except Darwin recorded an increase and prices in all regional markets rose too except for regional NSW and regional Victoria.

The RBA’s decision to continue to hike the cash rate has “not deterred” the rebound in house prices according to PropTrack’s Eleanor Creagh, as costs have continued to “gather pace”.

“Market conditions have improved following five consecutive months of price growth, driven by stronger housing demand relative to stock on market,” she said.

Despite many cities being at peak levels, future interest rate rises and the slowing of the economy could weigh on home prices in the next few months.

“However, the continued tightness in the labour market, stronger housing demand and the limited supply environment are likely to support an ongoing recovery,” Ms Creagh said.

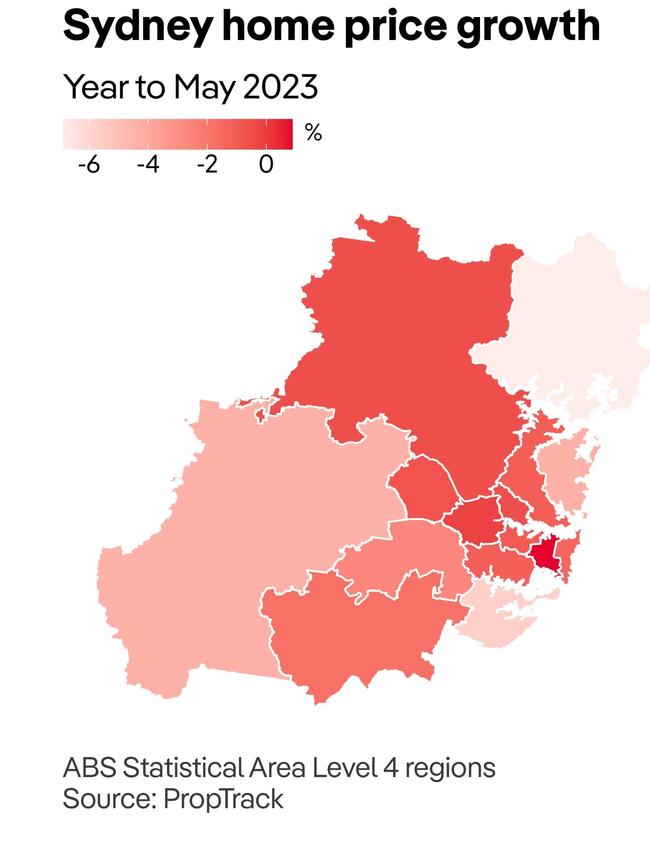

SYDNEY:

House prices rise for the sixth consecutive month in Australia’s most infamous city for high costs.

Prices rose by a further 0.58 per cent to 3.03 per cent from the low in November 2022.

Annual growth remains in the red, down 1.96 per cent in the past 12 months.

Sydney has also continued its reign as the most expensive city, with the median house price $1.02m.

Softness in the number of new listings has kept prices high, but it‘s far from the only reason prices have increased.

“Positive demand drivers stemming from the shortages in rental supply and strong rebound in net overseas migration have buoyed housing demand,” Ms Creagh said.

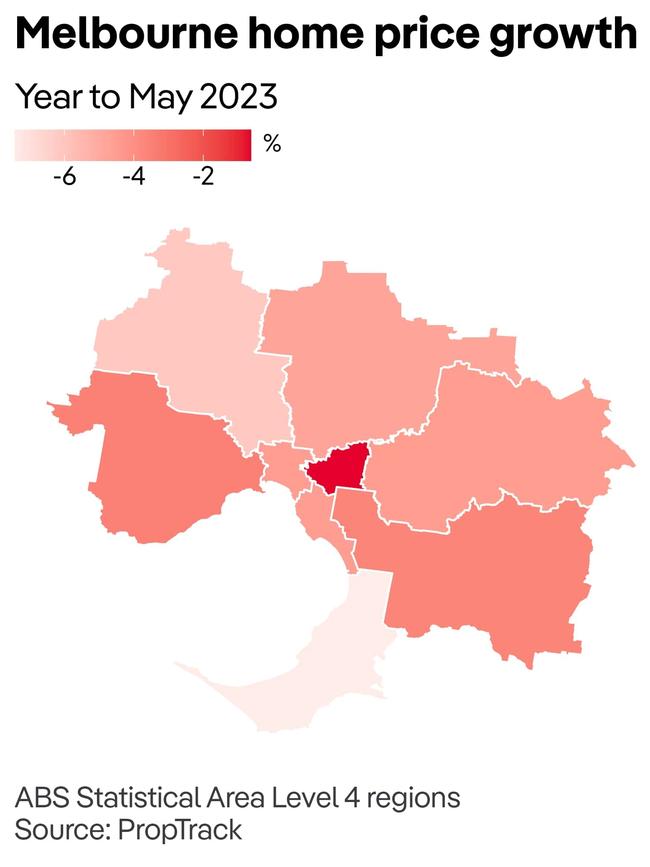

MELBOURNE:

Melbourne experienced its fastest monthly growth in home prices in over a year after a 0.22 per cent rise in May.

Compared with Sydney, house prices in the southern city have been relatively stable, only up 0.38 per cent from their low point in January 2023.

Prices are also considerably lower than they were a year ago, down 4.32 per cent in the past 12 months.

Despite this, Melbourne is not too far behind Sydney and Canberra in terms of prices, with the median value $797,000.

“With the end of interest-rate tightening in sight, much of the uncertainty buyers have experienced with respect to borrowing capacities and mortgage servicing costs is subsiding,” Ms Creagh said.

“Given the rebound in migration and tight rental markets, prices have been resilient to the reduction in borrowing capacities.”

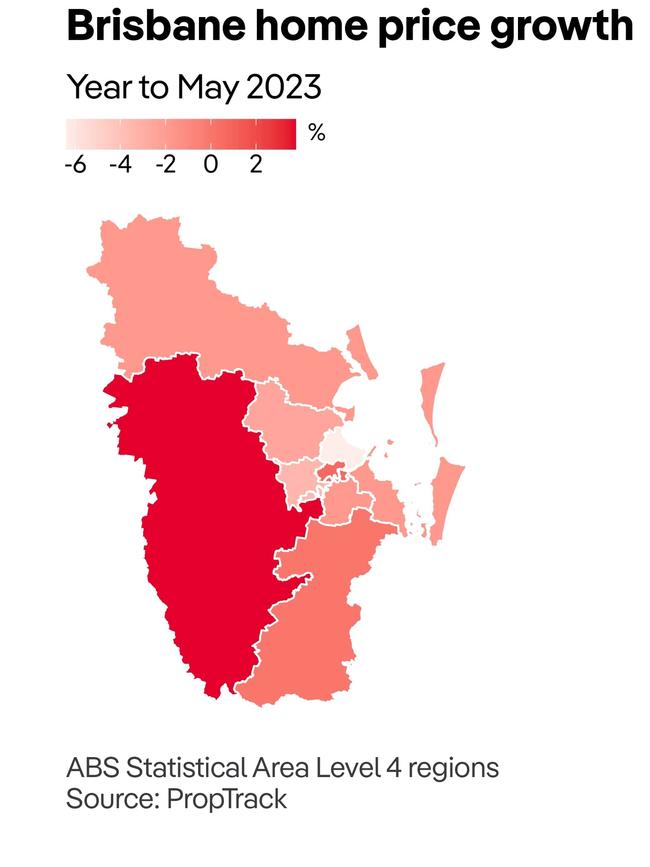

BRISBANE:

For five consecutive months, house prices in Brisbane have risen after increasing 0.33 per cent in May.

Brisbane house prices are now only 1.30 per cent below what they were 12 months ago to sit at a median value of $725,000.

“Strong housing demand and constrained supply are offsetting the substantial deterioration in affordability from rising interest rates,” Ms Creagh said.

“As the rebound has gathered pace, home prices in Brisbane are now up 1.99 per cent this year and down only 1.50 per cent from their peak in April 2022.”

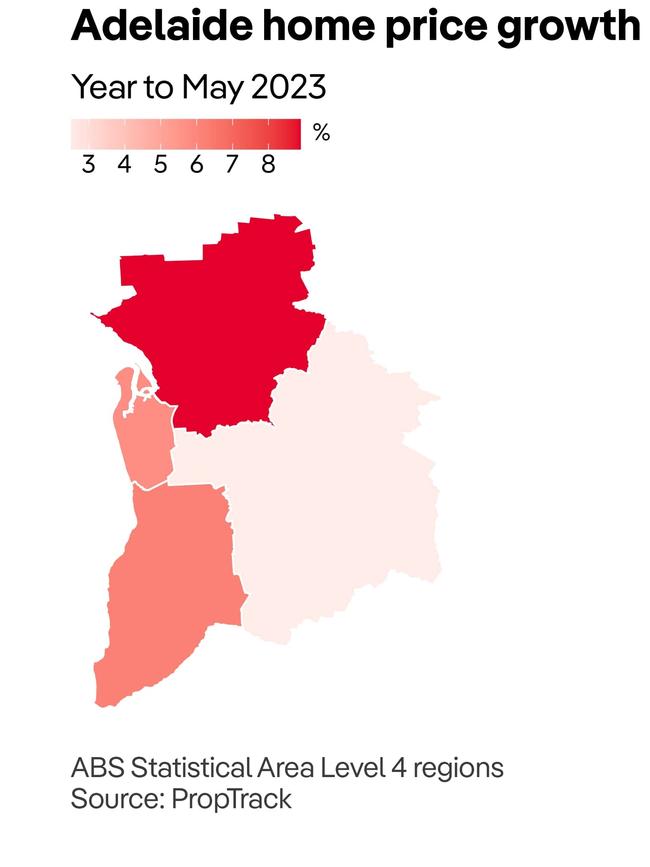

ADELAIDE:

Hopeful homebuyers will be dismayed by recent figures in Adelaide, with house prices rising to a new peak in May.

Prices are up 0.58 per cent compared with April and 2.64 per cent year-to-date to reach a new high, with the median value of a home now $660,000.

“Adelaide maintains its top spot as the strongest-performing capital city market over the past year, with home prices up 5.60 per cent,” Ms Creagh said.

The affordability of homes in Adelaide compared with other Australian cities has allowed prices to remain high as interest rates rise.

This is being aided by low stock levels that have intensified competition for homes.

PERTH:

Homes in the west are also experiencing a new peak, with prices increasing 0.64 per cent in May and 4.21 per cent in the past year.

“So far in 2023, prices are up 3.07 per cent, making Perth the strongest-performing capital city market year-to-date,” Ms Creagh said.

Median house prices now sit at $571,000, making Perth the cheapest city market in terms of dwelling values.

Originally published as Interest rate rises fail to curb rising house prices