Deloitte warns of ‘fork in the road’ moment for the Australian economy

Anthony Albanese says a respected forecaster’s latest report pointing to a ‘fork in the road’ moment for the economy has endorsed his government’s policies.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

The Australian economy is in a precarious “fork in the road” moment and its prospects will likely hang on the outcome of next week’s all-important inflation reading and the Reserve Bank’s subsequent August meeting, Deloitte has warned.

The critical point will be release of consumer price index results next Wednesday, which will flow into the August RBA meeting that some economists predict could deliver another interest rate hike to cool persistent inflation in the economy.

“Two clear alternatives are possible and each would set very different trajectories for our economy over the year ahead,” Deloitte Access Economics partner Stephen Smith said in the company’s latest Business Outlook report.

“Down one road, a high June quarter trimmed mean inflation result could force the hand of the RBA to lift interest rates once more in early August, further crushing household and business confidence and wiping out the benefits of tax cuts and real wage gains in the second half of 2024.

“Down the other road, the June quarter inflation result may be more benign, consistent with the slower pace of growth in the Australian economy.

“That would see the RBA hold interest rates steady again next month, enabling households to lead a steady recovery in economic growth in 2024-25.”

Prime Minister Anthony Albanese took the Deloitte report as an endorsement of his government’s policy, including the reworking of the state three tax cuts.

“What that report says is that the revised Labor tax cuts, as opposed to the Liberal tax cuts, where working Australians, many of them would have simply missed out, not got a dollar, and others would have received just half of what they’re now receiving,” he said on Thursday.

“That has been important for people and for people’s living standards. So I’m really proud.”

Fears of another rate hike and the negative flow-on effect on economic activity have escalated following a hotter-than-expected CPI print on June 26.

The ABS reported monthly CPI had jumped to 4 per cent in the year to May, up from 3.6 per cent in April.

Economists had expected a more modest increase of 3.8 per cent.

Deutsche Group chief economist for Australia Phil O’Donaghoe said at the time the shock increase would likely push the Reserve Bank of Australia to hike rates in August by 25 bps to 4.6 per cent.

But Deloitte partner and report co-author Cathryn Lee said she believed the RBA would not lift rates.

“We believe interest rates neither will, nor should, increase from current levels and that has been our consistent view for some time, for several reasons,” she said.

“First, interest rates at their current level are restrictive.

“Second, inflation is retreating back towards the target, albeit not as quickly as might have been hoped.

“Third, further interest rate increases are unlikely to temper price growth any more meaningfully than would otherwise be the case.

“And finally, the surge of post-pandemic inflation hit Australia later than it hit other economies, and has therefore cooled earlier elsewhere as well.”

Deloitte warns another rate hike could be the “straw on the camel’s back” given pre-existing weaknesses in the economy.

“Consumer and business confidence remains at rock bottom, household budgets have been decimated by broad cost of living pressures, and insolvencies have surged,” the outlook reads.

“In that environment, Australians and Australian businesses were looking forward to July 1 as the trigger for tax cuts and other relief.

“To have the RBA Board snatch that relief away just as it arrived would be a mighty blow.”

Deloitte expects economic growth of 1 per cent in calendar year 2024 and growth of 1.7 per cent when measured over the 12 months to June 2025.

Treasurer Jim Chalmers said the report confirmed the government’s economic plan was “right and responsible”.

“We are fighting inflation and repairing the budget, without smashing an economy which is already soft,” he said.

“Fiscal policy isn’t a primary determinant of prices in our economy but our budget’s helping to take some of the edge off inflation, which would be higher without our efforts.

“Inflation has moderated substantially since its peak, which was lower and later than in other countries, and the drop in core inflation has been quicker here than in the US, Canada and the Euro area.”

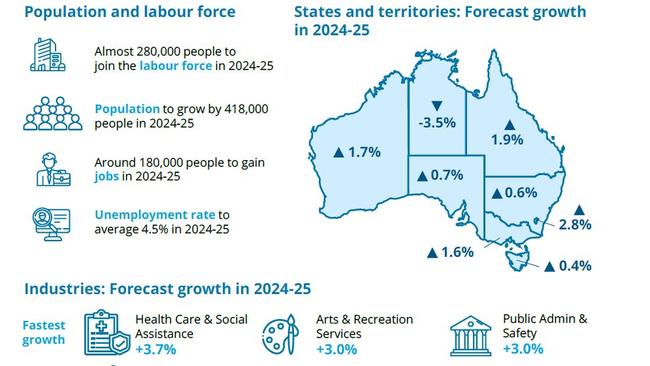

The outlook presents a mixed growth forecast for the states and territories across 2024-25.

Queensland, WA and Victoria will likely grow at a comparatively healthy 1.9 per cent, 1.7 per cent and 1.6 per cent, respectively, and the ACT will likely grow 2.8 per cent.

But NSW, Tasmania and South Australia will record tepid growth of 0.6 per cent, 0.4 per cent and 0.7 per cent, respectively.

The Northern Territory is forecast to shrink by 3.5 per cent.

The unemployment rate is expected to average 4.5 per cent in 2024-25 and the population is forecast to grow by 418,000.

The outlook presents a mixed growth forecast for the states and territories across 2024-25.

Queensland, WA and Victoria will likely grow at a comparatively healthy 1.9 per cent, 1.7 per cent and 1.6 per cent, respectively, and the ACT will likely grow 2.8 per cent.

But NSW, Tasmania and South Australia will record tepid growth of 0.6 per cent, 0.4 per cent and 0.7 per cent, respectively.

The Northern Territory is forecast to shrink by 3.5 per cent.

The unemployment rate is expected to average 4.5 per cent in 2024-25 and the population is forecast to grow by 418,000.

Originally published as Deloitte warns of ‘fork in the road’ moment for the Australian economy