CFMEU blamed for driving up costs in building industry

Shocking claims about the controversial CFMEU have been made at a hearing into Australia’s cost-of-living crisis.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

The controversial CFMEU has made Australians poorer, a leading panel of building industry experts has claimed, inflating construction costs on everything from housing to large-scale public works projects while entrenching a culture of fear and exploitation that continues to distort the country’s building sector.

Housing Industry Association managing director Jocelyn Martin made the disturbing claims alongside Master Builders Australia representative Shaun Schmitke at a Friday senate hearing into the country’s rolling cost-of-living crisis, with both warning the union needed to be put into administration in a first step to larger “cultural change” in construction.

Ms Martin said the union had undermined confidence in the sector, acted as a disincentive for companies to enter the industry and so degraded competition, which would ordinarily keep a check on prices, and jeopardised taxpayer dollars by risking cost blowouts on infrastructure projects.

There was “no doubt”, she said, the union had “driven up the cost of construction”.

The federal government has presented a Bill to parliament to force the union into administration, but Mr Schmitke warned that the CFMEU was not cowed by the government’s move and had not altered its behaviour on the ground.

“They are becoming worse and it’s worsening by the day,” he said.

“They are not backing off.”

Earlier in the hearing, the committee heard nearly 1.25 million small businesses were at risk of shutting down as cost-of-living pressures hammer profit margins.

Council of Small Business Organisations Australia director Adele Sutton made the startling claim on Friday morning at the hearing chaired by Liberal senator Jane Hume, warning that 49 per cent of 2.5 million small businesses were not “breaking even or making a profit”.

“When a small business isn’t breaking even, the last person to get paid is the owner themselves,” she said, adding that owners were dipping into their own savings to “keep the lights on”.

Ms Sutton credited the unpredictability of energy costs, excessive red tape and complex changes to industrial relations for the bleak picture.

She also said wage increases had not matched productivity improvements.

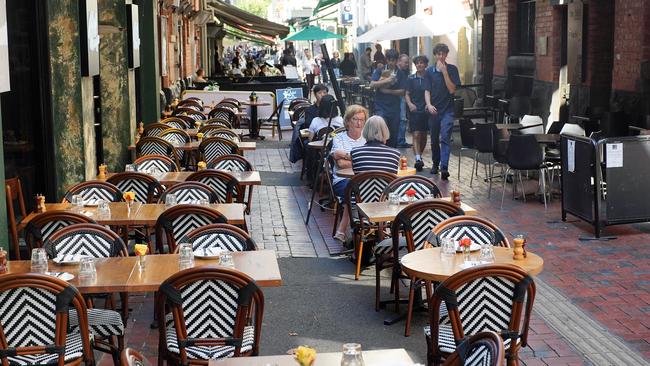

The hearing, which will be held across Friday, is hearing from Australian Restaurant and Cafe Association chief executive Wes Lambert, Restaurant and Catering Australia chief executive Suresh Manickam and Ms Sutton in the morning session.

Mr Manickam said the cost-of-living crisis was rooted in four factors: rising energy prices, interest rates, cost of labour and productivity.

He said cafe and restaurant owners were suffering from “IR fatigue” following the government’s complex changes to industrial relations laws.

“It (the changes) is having a fundamental and deleterious impact,” he said.

He also called for energy stability and assistance from the government to ensure a sustainable energy system.

He said business owners were grateful for the government’s recent energy rebate, but it was not enough.

“It’s not even a sugar hit,” he said.

Mr Lambert warned that owners of small cafes and restaurants would be forced to hire legal counsel to navigate the thicket of new regulation.

“They need to have a lawyer almost on call,” he said, adding the cost was too much for many owners.

“They just don’t have the money to hire solicitors in order to navigate through legislation.”

Labor senator Karen Grogan said in response to Mr Lambert the government had allocated money to the Fair Work Commission to help small businesses secure legal advice.

Labor senator Glenn Sterle asked the witnesses why they struggled to attract young people to the industry, given the global popularity of TV shows such as MasterChef and My Kitchen Rules.

Mr Manickam said the world of high-end restaurants spruiked on TV was only “a very small part of the sector”.

“The reality is there’s a whole chunk of the sector that is the local fish and chip shop … or a hole in the wall for coffee and doughnuts,” he said.

Media stars were “not what the sector is all about”, he said.

ASIC data on insolvencies shows 11,049 businesses went bust in the 2024 financial year, a 39 per cent increase from 2023.

Originally published as CFMEU blamed for driving up costs in building industry