Tradies say raising pension age “unfair” after a life of hard work takes its toll

Hardworking Aussies fear a decision to lift the pension age to 67 means they will be forced to work even longer in labouring jobs.

At Work

Don't miss out on the headlines from At Work. Followed categories will be added to My News.

Hardworking Aussies fear a decision to lift the pension age to 67 means they will be forced to work even longer in labouring jobs.

From July 1 this year, the pension eligibility age for all Australians to 67 years of age, the final leap after a series of incremental increases to the original 65-year-old “retirement age” – which was introduced for men in 1909.

Researchers even suggest that the retirement age may rise to 70 by 2050.

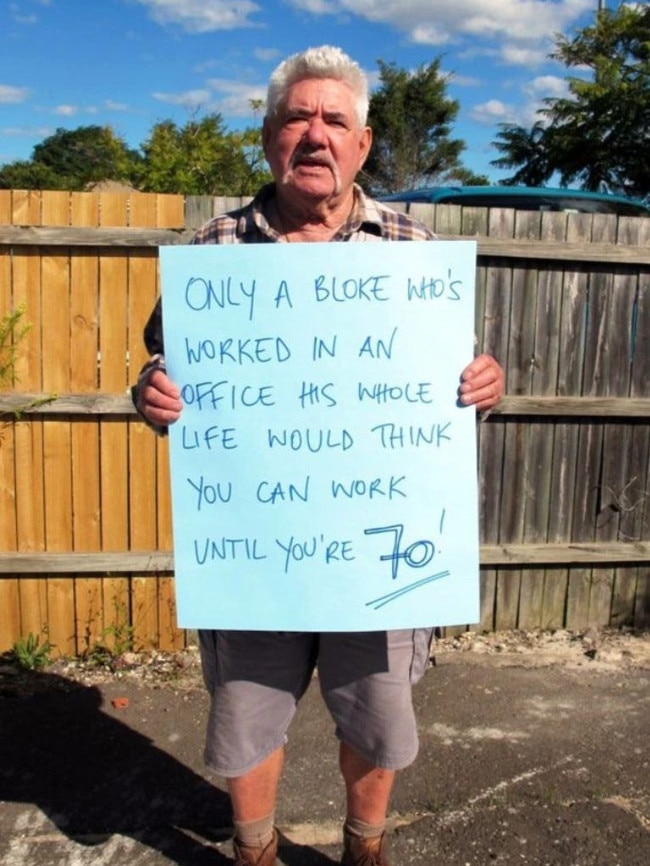

Tradies, in particular, have raised their concerns about raising the retirement age before. In 2018, one man became an instant poster boy when his frank message about the gradually-rising retirement age went viral.

Now, this latest increase has reignited their concerns our tradies will be stuck in backbreaking labour longer than their ageing bodies can handle.

A concreter named Steve told Nine’s A Current Affair he was already feeling the burden of the mid-60s on his body and that new retirement age was “unfair” on those doing hard yakka all their lives.

“Now I’m starting to feel it more in my knees, I’ve got arthritis in my hands, I’ve had two back surgeries,” he said.

“It does seem a little bit unfair that you have to work all your life.”

Meanwhile, Gold Coast tree lopper Peter said the work was only getting harder as the years wore on.

“Everything is going out to 67 and it‘s just like climbing a tree. The injuries are just climbing all the time, it’s getting harder, worse, sorer all the time,” he told the program.

He said it was “very scary” to think the retirement age is only set to keep rising.

Researchers from Macquarie University’s Business School have estimated there may be three more pension age increases between now and 2050.

By 2030, Professor Hanlin Shan and his co-authors estimate, the age will increase to 68, before rising to 69 in 2036 and 70 by 2050.

It is hoped this formula will help working Australians sustain the livelihoods of their elderly unemployed counterparts.

Prof Shan said the pension will also need to keep rising to stop government spending from getting out of control, particularly as the population ages and relies increasingly on support systems and payments.

In the last 100 years, Australians’ life expectancy has increased by 20 years, according to the federal Treasury Department. There are currently 3700 people aged over 100 in Australia. By 2050, the number of centenarians will climb to 50,000.

But Prof Shan told A Current Affair that raising the pension was just one solution of “any possible solutions” including increasing the fertility rate or migration.

As well as increasing the age, the July 1 change also unlocked additional money.

Aussies aged at least 67 years old can earn $204 a fortnight (for single people), or $360 as a couple before losing their full pension,

The disqualifying income threshold – the amount at which individuals or couples no longer qualify for a pension payment – is at $2332 and $3568 per fortnight for singles and couples, respectively.

Significantly, part-rate homeowner couples could receive an increase of up to $97.50 per fortnight while single homeowners could receive an increase of up to $62.25 per fortnight, pending asset tests – for which disqualifying thresholds have also increased.

It means some Australians who did not qualify for the age pension before, due to their assets or income, will now meet the requirements and can receive a pension payment. While some who were receiving partial payments may now receive the full pension payment.

Tree lopper Peter said politicians needed to get out of their cushy offices and do some “physical work” to understand the realities of the age increases.

“It would be nice to be a politician sitting on a nice comfortable chair all day in an airconditioning room or office,” he told A Current Affair.

“They need to come out and see what it’s like to do some physical work. That would make them change their mind in trying to stretch this pension out to 67, 68, 69, 70.”

What do you think about the change? Continue the conversation – georgina.noack@news.com.au

Originally published as Tradies say raising pension age “unfair” after a life of hard work takes its toll