What’s next for ‘Magnificent Seven’?

The ‘Magnificent Seven’ super-stocks have surged on the back of the AI frenzy, but what’s next for America’s tech giants?

The ‘Magnificent Seven’ super-stocks have surged on the back of the AI frenzy, but what’s next for America’s tech giants?

Can Australia survive the Albanese Labor government’s minister for destroying our electricity system Chris Bowen?

Rio Tinto has been talking up the 4 billion tonnes of iron ore it’s shipped to China, but has the miner forgotten about its commitment to saving the planet?

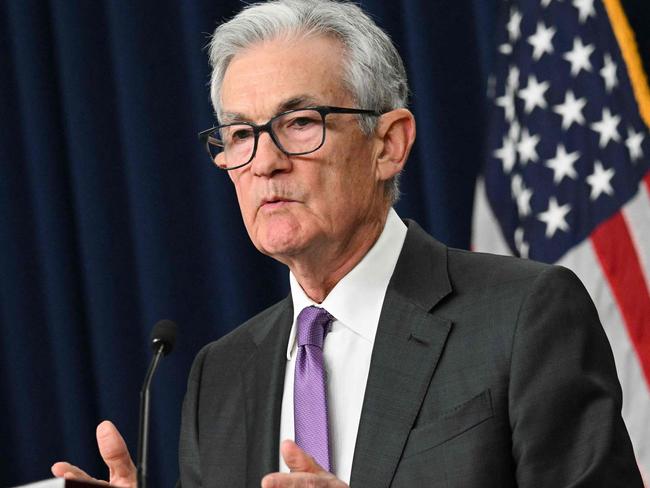

Our financial and economic future does not hang on who lands in the White House but rather by the decisions made by the Federal Reserve.

Jim Chalmers’ speech on Wednesday revealed the sort of insane dystopian future that will be built if the treasurer and his colleagues aren’t stopped.

There is no way that Reserve Bank governor Michele Bullock would lead her board to raise the official cash interest rate with the current abysmal levels of consumer spending.

Central banks in the US and Australia have a fair bit to think about over Easter as they contemplate the question on everyone’s minds – will the rate cuts come?

The one proposed change to the RBA that should be entirely uncontroversial is the ending of the government’s ability to overrule an interest rate decision.

Billionaire Solomon Lew is determined to show there is still life in retail and that much if not indeed most of that future life will still be in real actual bricks and mortar stores.

The Labor Government’s push for a 4 per cent minimum wage increase has effectively set it against RBA governor Michele Bullock’s desire for a wage moderation and productivity increases.

The US Fed’s ‘dot points’, supposedly predicting rate cuts, stirred up the markets bigtime. But they’re well known for their inability to forecast the future.

From destroying the electricity system to overseeing a growing migration crisis, Labor’s ministry of incompetents have proven to be way out of their depth.

All eyes will turn to Thursday’s potentially explosive unemployment numbers after the RBA’s ‘half pivot’ on Tuesday.

For the first time since the 1990s, the RBA is making an interest rate decision the day before the release of the ABS’ quarterly GDP figures.

Original URL: https://www.themercury.com.au/business/terry-mccrann/page/6