Why these two numbers are huge

Two big – and I mean, huge – numbers surfaced Thursday, US inflation and Australian employment figures.

Two big – and I mean, huge – numbers surfaced Thursday, US inflation and Australian employment figures.

It’s another depressing return to an all-too familiar Labor Fiscal Future – high-taxes, big spending, budget deficits and rising debt set to exceed $1 trillion.

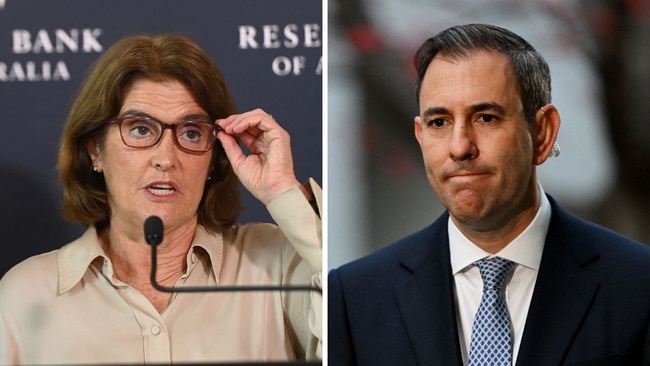

The idea that Reserve Bank governor Michele Bullock is going to rush out an interest rate cut because of the budget’s $300 energy rebate inflation trick is silly.

The one thing you can say with absolute certainty about every budget is that every forecast in it will be wrong — so take claims about controlling inflation with a pinch of salt.

Has Treasurer Jim Chalmers actually got himself – and the rest of us – a more hawkish Reserve Bank governor in Michele Bullock than her predecessor Philip Lowe?

The Optus chief executive had to go. But not for the reasons you probably think.

Borrowers can breathe a sigh of relief, with the latest wages and jobs data all but ruling out another interest rate hike this year.

There are simply no downsides for us from the US reporting lower inflation figures. That doesn’t mean that catastrophe is not looming though.

Poor policy on a number of fronts means there are dark economic times ahead, and the hoped-for surge from increased immigration is not working.

The four big banks made a big headline figure of $49bn in profit – but don’t forget the $13bn in tax paid and $42bn they injected into the economy.

The RBA has delivered the big banks an unparalleled golden period, the likes of which we have never seen before, and which we should hope to never see again.

Next year we’ll be told how the votes have flowed for and against interest rate rises at the RBA, which will pose a challenge for the governor.

This interest rate rise was a surprise to many – but it indicates that Michele Bullock and this board are answerable only to what they see as their one job – to control inflation.

Everyone needs to take a chill pill about the prospect of a Cup Day rate hike. It’s not as significant as ‘they’ are saying, for the economy or for the new RBA governor.

Original URL: https://www.themercury.com.au/business/terry-mccrann/page/12