Hold on for a wild ride into 2023

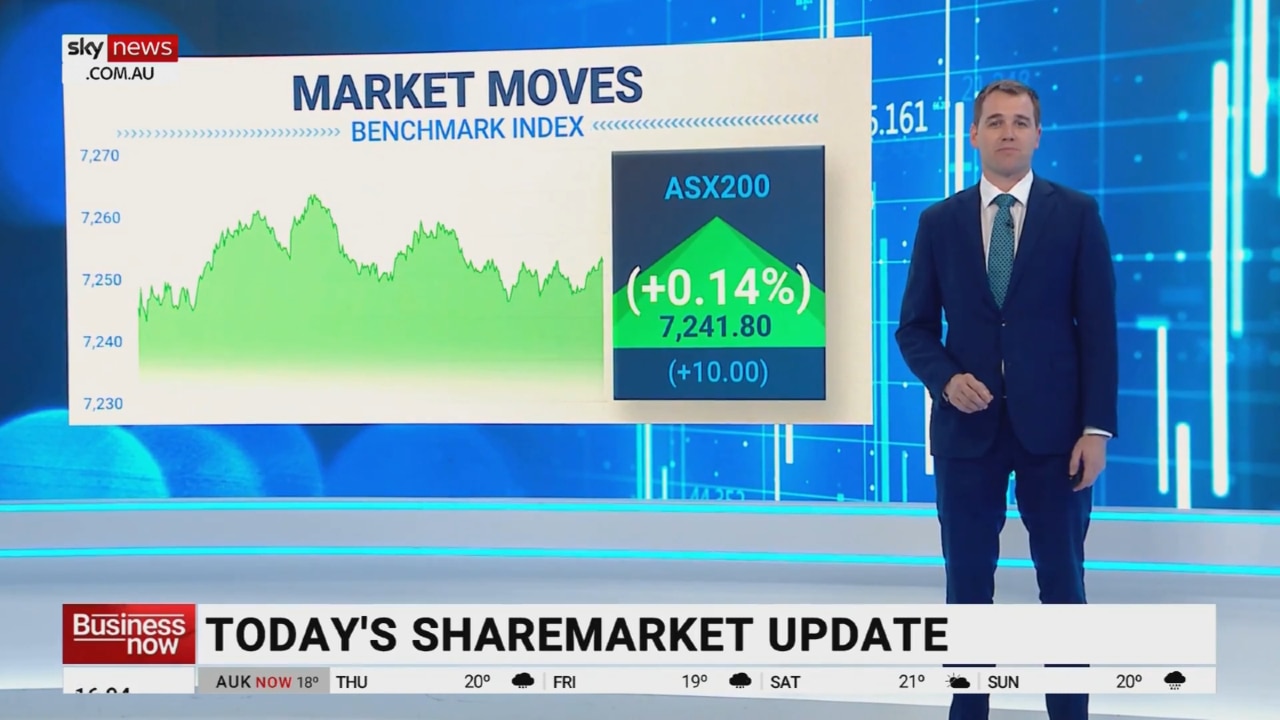

The Australian and Wall St sharemarkets have bounced back over recent months but we won’t know until next year whether investors made the correct call about the economic outlook.

Terry McCrann

Don't miss out on the headlines from Terry McCrann. Followed categories will be added to My News.

Is the share market – here and on Wall St – defying economic reality, or is it accurately predicting, if somewhat early, the ‘good times’ and lower interest rates after whatever bad times come first?

That is clearly the $64,000 question – or, maybe these days, that should be the $64m or even $64bn question – for investors. And indeed not just investors.

The six-week slide on Wall St from mid-August to the end of September which slashed 16 per cent off the Dow Jones index, with our market being dragged down by 10 per cent, is now just a distant and all-but faded away memory.

Cancel whatever that slide was supposed to have been predicting. The Dow has now made back all that drop; and our market indeed is now even a couple of percent higher than its mid-August peak.

This has happened into the face of further rate rises, from the Fed especially but also – if at a more muted pace – from our own Reserve Bank; and into surprisingly tough talking, as I wrote the other day, from Fed head Jerome Powell.

The toughness of that talking was, though, somewhat belied by the minutes of the last Fed meeting which surfaced mid-week. The minutes suggested that while Powell was projecting hairy-chested in public, he and his colleagues were actually preparing to ease off on rates hikes and even turn by early-to-mid next year.

So has Wall St ‘got it right’? That it’s correctly traded into the likely rate peaks and even the consequent rate cuts?

That, more broadly, we could see a Candidean ‘best of all possible worlds’ future for the US economy, developing in early-to-mid 2023 and really blossoming through 2024? A dynamic of low inflation and strong economic growth, lower rates and very strong corporate profits, and some benign mix of good wages growth paid for by strong productivity?

Or have investors, too flush with investible cash, misread either the Fed or the US economy?

That the Fed is not going to blink, as it has always done when Wall St ‘sulks’ or throws a tanti? That with the Dow all-but back to its record high, it would, now have to throw a mega-tantrum?

Or that the path of the US economy through 2023 will be ‘messy’ – whether that means inflation remains sticky, or the hit to activity – and corporate profits – is greater?

Or that, yes, while the Fed does ‘blink’, it’s too soon and inflation bubbles away again, forcing the Fed to take rates higher again in the back-end of 2023?

Questions, questions; we are hostage to the answers and the ongoing and consequent interplay with Wall St and the Fed. Plus the Russia and especially China dynamics, I discussed earlier this week. We also have our own entirely domestic arm-wrestle around wages: will a wages take-off, as RBA governor Lowe warned about, spoil everything? For everyone, including those very workers getting nearer-inflation wage rises?

The next two-to-three months are going to prove exceptionally – and unusually for this time of the year - febrile and determinative. For investments. For the economy.

Normally, up to a point, one could ‘switch off’ into December and through January. Not this year.

As the market of the last few months have demonstrated, conditions and expectations can turn on a dime. Or a Bitcoin.

We have one more – ultra-critical - Fed meeting, mid-December. Then ‘everyone’ (that matters to us) takes a break - until the end of January, the Fed, and a dozen days later for the RBA.

A lot of market action and economic reality will unfold over these next two months; the two central banks will have to take it into their decision-making; what they give us at those opening new year meetings will be extraordinarily significant.

Originally published as Hold on for a wild ride into 2023