Rogetta Mine collapse: Report alleges offences, reveals court case

A report into the collapse of a proposed iron ore mine near Burnie has made several allegations and revealed the existence of a current court case against a bankrupt former director in NSW.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The administrators of two companies associated with a proposed magnetite iron ore mine southwest of Burnie, which collapsed in March with debts of approximately $30m, have recommended the companies be liquidated.

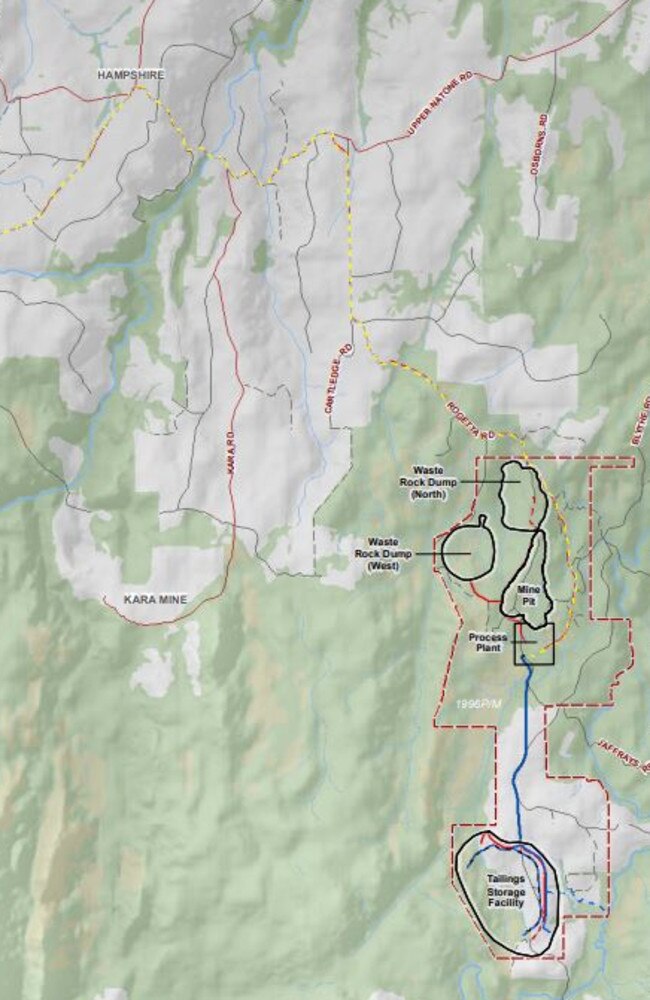

Forward Mining Ltd (FML), which was founded in 2010 and granted a lease at Hampshire, 27km southwest of Burnie, in 2015 to develop the Rogetta Mine project, and its treasury arm, Middle Cove Enterprises (MCE) Pty Ltd, were tipped into external administration on March 9.

According to a report filed by administrators Philip Campbell-Wilson and Said Jahani, the two companies owe $30,997,614, of which $22,669,814 is owed to unsecured creditors.

The report alleged multiple offences against the Corporations Act relating to “insolvent trading, maintaining books and records of the companies and the transfer of shares (in related company Blythe River Iron Pty Ltd (BRI), which holds a number of mining exploration licenses in Tasmania, including at Camena, Hampshire, South Riana and southwest of Penguin) for no consideration”.

According to Justice Brigitte Markovic in a recent Federal Court decision, FML was the sole shareholder of BRI up until August 27 last year.

“However, between August 27, 2021, and January 27, 2022, FML’s shares in BRI were transferred numerous times,” Justice Markovic said.

On April 8, lawyers on behalf of the administrators commenced proceedings in the Supreme Court of New South Wales against Rogetta Resources Pty Ltd, the initial recipient of FML’s BRI shares, and Wenwu Su, a former director of FML who is an undischarged bankrupt, to prevent Mr Su from “lodging further share transfer documents with ASIC for the transfer of BRI shares and also to seek recovery of those shares,” according to the report.

That action is still ongoing.

The report also alleged “potential unreasonable director related transactions in MCE totalling $4,065,600” and estimated FML was trading insolvent from as early as July 2019, with MCE possibly trading insolvent from February 17.

The liquidation of FML would result in an estimated return to creditors of between 45 and 100 cents in the dollar, while that of MCE would be an estimated zero to 95.6 cents in the dollar.

Two proposed deeds of company arrangements have been submitted for consideration, but neither “provide a greater return than on winding up,” the report said.

A second creditors meeting will be held on Wednesday.

Attempts were made to contact the directors of FML and MCE via the administrators.