Webull’s zero-fee ETFs and lower trading costs catch traders’ eyes

Webull is attracting attention with its zero-fee ETFs and low trading costs, plus tools like real-time data and advanced charts.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Webull offers $0 fees on US and Australian ETFs trading

Webull charges $4.90 for a $10,000 stock trade, compared to $20 elsewhere.

Webull combines low costs with advanced trading tools

Special Report: Webull is drawing attention with its zero-fee ETFs and low trading costs on single stocks, offering a cost-effective solution for traders. In addition to its competitive pricing, Webull offers a robust suite of trading tools.

For traders, particularly those who are active in the stock market, finding a cost-effective platform can make a substantial difference in their trading experience, and most importantly, their bottom line.

While there are many options available, Webull's trading platform stands out by offering significantly lower fees compared to traditional Australian platforms like CommSec and NABTrade.

For example, a $10,000 trade on Australian stocks done on CommSec and NABTrade would cost around $20 a trade, but on Webull, it costs only $4.90.

For ETFs (exchange-traded funds), Webull’s $0 commission on both US and Australian ETFs also offers a big advantage, making it especially attractive to cost-conscious traders.

For instance, while a $10,000 trade on Australian ETFs would typically incur around $20 in fees with platforms like CommSec or NABTrade, Webull offers this service entirely free of charge.

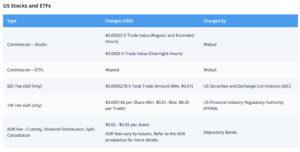

Here’s a summary of Webull’s fee structure:

Images: WeBull

All this can result in considerable savings for day traders or anyone who makes a high volume of transactions. Because for those who frequently engage in buying and selling, those fees can add up pretty quickly.

This cost saving would be even more pronounced when one considers the cumulative cost of trades over a long period of time, especially in a market as active as the one Webull caters to.

Advanced features to help traders

Webull's platform offers more than just competitive pricing.

According to our own experience at Stockhead, the platform has a range of features designed to cater to both novice and experienced traders.

It provides access to advanced trading tools, real-time market data, and comprehensive charting capabilities, which are essential for making informed trading decisions.

Webull's user-friendly interface ensures that traders can execute their strategies efficiently, and their abundance of educational resources help investors to make informed investment decisions.

This article was developed in collaboration with Webull, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Webull’s zero-fee ETFs and lower trading costs catch traders’ eyes