Silver ore reserve gives Manuka strategic shine

The Wonawinta mine’s silver ore reserve gives Manuka Resources clear production pipeline with potential for dual precious metals revenue stream.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Manuka Resources releases ore reserve of 4.8Mt at 53.8g/t silver, containing 8.4Moz of silver, for its Wonawinta Silver Mine

The asset is the only primary silver reserve in Australia with all mining approvals current and intact, with a fully constructed substantial on-site process plant

The ore reserve gives Manuka a clear production pathway and the potential for revenues from gold and silver, following restart of Mt Boppy gold project

Special Report: Manuka Resources’ Wonawinta Silver Mine has secured its position as a highly strategic asset both for the company and Australia with the release of a maiden ore reserve of 4.8Mt.

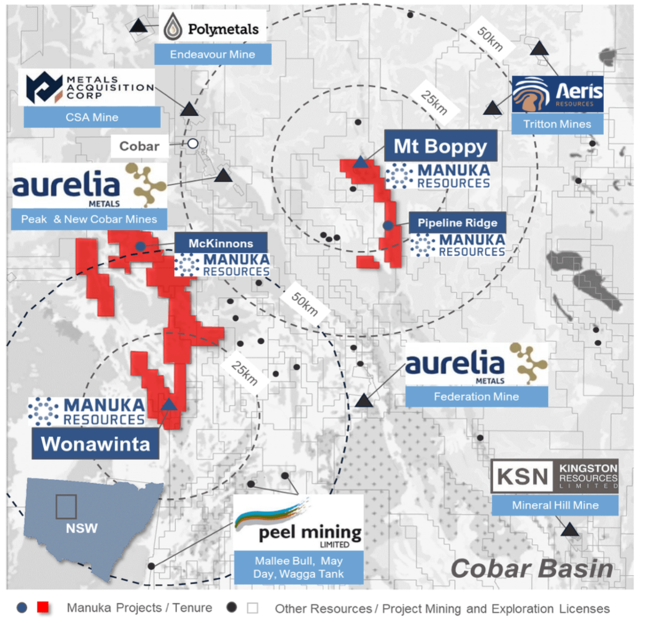

Located in NSW’s prolific Cobar Basin, Wonawinta is the only primary silver reserve in Australia with all mining approvals current and intact, and a process plant fully constructed.

The plant was producing silver from Wonawinta stockpiles for Manuka, as recently as early 2023 and the ore reserve gives Manuka (ASX:MKR) a clear production pipeline, with potential for a dual precious metals revenue stream to follow the restart of the company’s Mt Boppy Gold Mine.

Shallow reserve with excellent exploration potential for future growth

Within the ore reserve of 4.8Mt at 53.8g/t (grams per tonne) silver is 8.4Moz of the metal.

Based only on shallow (less than 40m from surface) oxide material, the ore reserve comprises 0.8Mt at 50.8g/t and probable Ore Reserves of 4.1Mt at 54.3g/t of silver respectively.

The total Wonawinta resource is 38.3Mt at 41.3g/t of silver for 51Moz. Based on the current silver forward price curve, the mine plan would deliver net operating cash flows of ~A$100M based on the ore reserve alone. A 10% increase in the silver price adds an additional A$32M in net operating cashflows to the company.

Manuka is now reviewing its economic model for the Wonawinta mine development, which will include re-entering the two existing pits (Boundary and Manuka) plus the development of two new pits (Belah and Bimble). The company will announce the outcomes from this analysis during the current quarter after it has assessed development scenarios.

Manuka has previously conducted a deeper diamond drill program beneath the existing silver resource investigating the existence of lead-zinc silver mineralisation. As released through the ASX on 1 June 2021, there was confirmation of a mineralised strike length extending over 3km, which will be the target for follow up drilling.

Dual precious metal operation

Manuka is initially focused on the restart of a high-margin operation at its 100% owned Mt Boppy gold project, only 50km east of Cobar and 150km from Wonawinta.

It’s also awaiting fast-tracking approvals for its world-class vanadium-rich iron sands project in New Zealand.

Manuka’s executive chairman, Dennis Karp, said: “Manuka’s maiden silver ore reserve at Wonawinta represents a major milestone for the company and supports potential restarting of silver mining and processing operations in the future.

“Our process plant at Wonawinta has been kept in good working condition and has been on active care and maintenance since the processing of the gold-bearing stockpiles hauled from Mt Boppy ceased in February 2024. It therefore stands ready to come back online at short notice.

The prospect of restarting Wonawinta following Mt Boppy gold production, provides Manuka with excellent optionality on silver and the potential to take advantage of the very buoyant precious metals prices and broader strategic opportunities within the Cobar Basin.

We look forward to providing further updates to the market as our strategy progresses.”

Right time, right place

Manuka’s progress towards production comes as precious metals prices have been on a tear this year. Now also categorised as a critical mineral, silver is facing surging demand thanks to its growing industrial use, particularly solar panels and other clean energy technology.

Traditionally seen as more of a safe haven metal, gold has also experienced a jump in demand for its use in tech, primarily the booming AI sector.

This article was developed in collaboration with Manuka Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Silver ore reserve gives Manuka strategic shine