Resources Top 5: Western Yilgarn well placed in quest for alternate bauxite supplies

One ASX junior well placed to benefit from increasing bauxite demand from non-Guinea sources is Western Yilgarn with its Darling Range properties.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

A suspension of exports from Guinea has seen increasing demand from other supply sources, including Australia

Future Battery Minerals has identified new gold prospects at the recently consolidated Miriam project in WA

Potential hidden extensions of gold breccia pipes have been identified at Colosseum gold and REE project in California

Your standout resources stocks for Tuesday, May 27, 2025

Western Yilgarn (ASX:WYX)

Changing market fundamentals in the past 12 months have seen prices for bauxite, the key raw material for aluminium production, climb and then remain strong.

The primary driver has been the suspension of exports from Guinea, the second largest producer globally and just behind Australia in production volume. In 2023, the West African nation mined around 87.9Mt.

As Guinea attempts to tighten control over its mineral resources, the world’s largest user, China, is being forced to look elsewhere for bauxite supplies, including Australia where bauxite prices are considerably lower than Guinea.

The supply situation was exacerbated this month when Guinea began proceedings to revoke the mining licence of Emirates Global Aluminium (EGA), which operates one of the nation’s largest bauxite mines through its Guinea Alumina Corporation subsidiary and accounts for about 4% of global supply.

EGA has been in a dispute with the government of Guinea since October 2024 when its bauxite exports and mining operations were suspended by authorities, citing concerns over customs duties.

One ASX junior well-placed to benefit from increasing demand from non-Guinea sources is Western Yilgarn (ASX:WYX).

In an interview with Stockhead earlier this year, non-executive director Pedro Kastellorizos said he expected the increase in bauxite prices to continue in 2025 with some Chinese alumina refineries curtailing production on the back of domestic bauxite shortages.

“We have already received interest from the overseas market in our project due to its close proximity to existing bauxite mining operations,” he said.

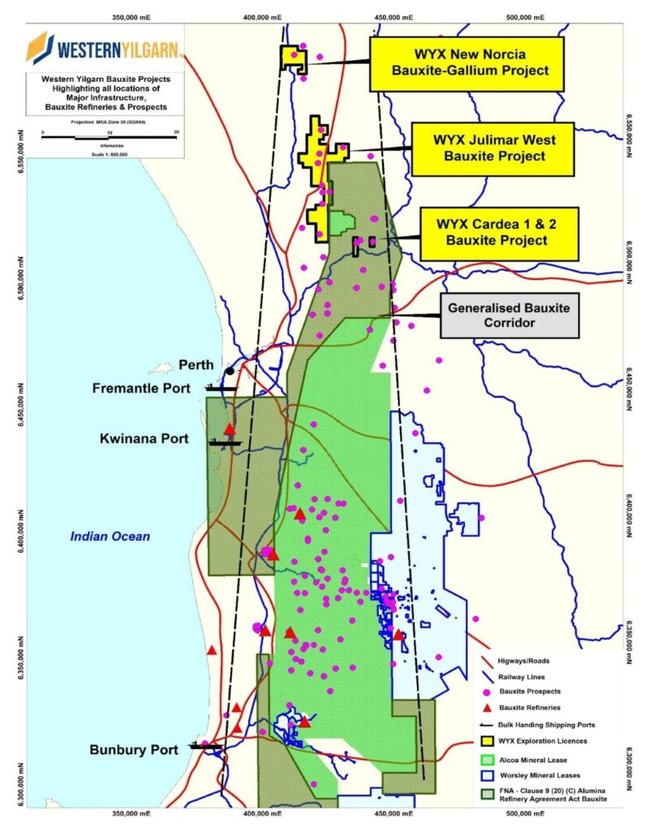

WYX is set to add scalability and tonnage to its portfolio in Western Australia’s Darling Range bauxite mineral field on being granted the Cardea 1 and 2 project areas, about 16.5km southeast of its 168Mt Julimar West project.

Darling Range is a world-leading alumina producing region with bauxite deposits stretching across a north-south corridor roughly 240km-long and 50km-wide.

The company’s projects benefit from nearby major infrastructure, including the Millendon Junction Railway Line.

Kastellorizos said WYX was extremely pleased with securing the Cardea 1 and 2 projects and investors shared his enthusiasm with securities 28.57% higher to 2.7c.

“It provides further scalability and excellent potential to increase the bauxite tonnage and grade through further exploration to the west and northern portion of the exploration licence area,” he said.

“The location of the current resources is within trucking distance of a multi-user railway at a time of record alumina and bauxite prices.

So far, WYX says surface and drilling geochemistry, along with the interpreted geophysics, has highlighted multiple targets proximal to the west and south of the current tenure areas.

Regional mapping and interpretation of the Western Australia Geological Survey has delineated laterite and pisolitic gravels in which the bauxite occurs and these areas will be systematically targeted in first-pass exploration.

Future Battery Minerals (ASX:FBM)

As gold holds above US$3300/oz, it is no surprise that gold stocks remain in the news, including Future Battery Minerals which has identified new gold prospects at the recently consolidated Miriam project in WA following a review of historical data.

The project has some notable gold neighbours including Horizon Minerals’ (ASX:HRZ) Burbanks mine (466,000oz at 2.4g/t gold), Beacon Minerals’ (ASX:BCN) McPhersons Reward mine (132,000oz at 1.2g/t) and Focus Minerals’ (ASX:FML) Coolgardie Operations (2.7Moz at 1.8g/t).

The gold endowment is supported by lithium, another mineral trait of the region.

Miriam was subject to intense gold prospecting following initial discovery in the 1890s and it was within the shafts and workings where spodumene bearing pegmatites were first observed in 2022.

While modern exploration is limited within the project tenure, multiple gold occurrences – including Forest, Goroke and Burbanks Monarch – have been recorded.

FBM’s review of historical geological and drilling data was completed following the company’s acquisition of the gold and base metal rights plus residual lithium rights.

It has highlighted consistent and continuous gold mineralisation previously intersected over a strike of more than 600m at the Forrest prospect, with best intercepts of:

- 12m at 2.09g/t gold from 60m;

- 10m at 2.51g/t from 30m; and

- 10m at 2.09g/t from 30m and 4m at 4.86g/t from 73m;

The review also flagged further gold at Forrest South (16m at 0.94g/t gold from 44m) and Jungle (4m at 3.37g/t from 97m).

Future Battery Minerals (ASX:FBM) says the gold mineralisation at Forrest remains open at depth and to the northeast and southwest – representing priority targets for initial follow-up drilling.

FBM says any future gold discoveries at the project will benefit from commercialisation optionality with several operating gold mills in proximity, including the Burbanks mine, 1km away, which contains a mill and processing plant owned by Auric Mining.

There’s also the Greenfields Mill, owned and operated by FMR Investments, and the Three Mile Hill Mill, owned and operated by Focus Minerals.

The company is completing a litho-geophysics and geochemistry review, aiming to better define key structural gold targets that have been identified. Initial RC drilling is set to begin in July.

“The project is an undeniably attractive exploration opportunity, offering structurally controlled gold prospectivity (along with lithium opportunity) matched with multiple potential commercialisation pathways given its proximity to established process facilities for both gold and lithium,” managing director and CEO Nick Rathjen said.

Shares reached a daily top of 2c, a 25% increase on the previous close.

Dateline Resources (ASX:DTR)

Also riding on gold’s strength is Dateline Resources, which climbed 56.4% to 8.6c, a new high of more than two years on volume of more than 352m, after identifying potential hidden extensions of gold breccia pipes at the Colosseum gold and rare earths project in California, USA.

Recent field mapping and geochemical sampling of felsite (rhyolite) outcrops west and southwest of the Colosseum open pits returned encouraging geochemical anomalies, potentially confirming an extension of the mineralised footprint.

This work points to the potential for hidden gold zones beyond historical workings with substantial exploration upside emerging.

All 641 historic drill holes targeted only the breccia pipes with surface exposure and large areas of the property remain effectively untested.

The new geochemical and structural evidence markedly expands the exploration potential at Colosseum.

Planned next steps include extending surface geochemical sampling coverage along the projected trend of the felsite dykes and developing targets for a maiden drill program outside the pit area.

With the REE project now bolstered by a potentially larger gold deposit, DTR is on-track to complete a review of the REE exploration plan in early June.

Importantly, the existence of a viable gold system at Colosseum provides a strong foundation to pursue REE exploration with greater confidence.

In June 2024, the company announced that Colosseum has a JORC-2012 compliant mineral resource of 27.1Mt at 1.26g/t Au for 1.1Moz.

African Gold (ASX:A1G)

(Up on no news)

ASX junior African Gold is banking on Côte d’Ivoire delivering more gold success and has been up as much as 26% to 17c, a new high of more than three years.

After closing at 5.9c on March 11, the company has climbed steadily on the back of positive newsflow, and the bullish trend has continued since the last strong news on May 6 when a third gold discovery was confirmed at the Didevi project, highlighting the potential for another multi-million-ounce gold system in the country.

Pranoi prospect, which is only 11km north of the Blaffo Guetto resource of 450,000oz at 2.9g/t, hosts similar shallow, high-grade, open-pittable gold mineralisation.

Results included:

- 25m at 1.6g/t gold from 83m including 10m at 2.4g/t and 10m at 1.0g/t from 145m;

- 15m at 1.7g/t from 51m including 9m at 2.4g/t; and

- 9m at 3.8g/t from 109m.

The mineralisation closely mirrors the shallow, high-grade, open-pittable style seen at Blaffo Guetto, reinforcing the project's regional prospectivity.

African Gold is progressing a resource update for Blaffo Guetto, scheduled for H2 2025.

“These results continue to validate our belief that Didievi hosts a large, fertile gold system with multiple high-quality targets,” CEO Adam Oehlman said.

“With only two of 10 regional prospects drilled to date, the scale of the opportunity is exceptional.

“The satellite deposits we are uncovering would be considered standalone targets for many companies, this level of optionality adds tremendous value to the Blaffo Guetto MRE.”

Antilles Gold (ASX:AAU)

The signing of offtake agreements by Antilles Gold for the gold and copper/gold concentrates to be produced by the Nueva Sabana mine in Cuba, have seen the share price double to 0.6c.

Antilles’ 50%-owned Cuban joint venture mining company, Minera La Victoria SA, and a major global commodities trading house have signed two offtake agreements.

Compared to the Nueva Sabana pre-feasibility study (PFS), the proposed payables are 12% higher for the gold concentrate and the same for the copper/gold concentrate.

“Finalisation of the concentrate offtake agreements is a major step forward in arranging financing for the Nueva Sabana project, and positive negotiations are progressing with potential lenders for the construction of the mine,” Antilles Gold chairman Brian Johnson said.

"The mine is fully permitted, and the aim is to finalise the financing within the next three months to allow construction commencement, with commissioning 12 months later.”

The company currently estimates the initial life of the Nueva Sabana Mine to be ~4.5 years and this could be further extended.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions.

While Future Battery Minerals and Western Yilgarn are Stockhead advertisers, they did not sponsor this article.

Originally published as Resources Top 5: Western Yilgarn well placed in quest for alternate bauxite supplies