Lunch Wrap: ASX rebounds after volatile morning session; CBA releases strong results

The ASX opened lower before finding some momentum with CBA rebounding after a dip following release of its half-yearly results.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX moves up at lunch, as markets mixed on Wall Street overnight

Commowealth Bank reports NPAT of $5.13 billion for H1 FY25

CSL continues to drag after its half-yearly results disappoint

The ASX has had a topsy-turvy morning, opening lower before finding some momentum. By 1.20pm the benchmark S&P/ASX 200 was up 0.31% as the Commonwealth Bank (ASX:CBA) recovered from a fall in its share price after reporting its half-yearly results, helping the market also rebound.

Markets were mixed on Wall Street overnight with the S&P 500 index closing flat, the Dow Jones index up 0.2% and the technology-focused Nasdaq falling 0.3%.

Among commodities, oil continues its upward trajectory with the global benchmark Brent crude near $US77 per barrel and the US WTI ~US$73 per barrel.

After breaking records this year gold has slightly dipped to ~US$2927 per ounce, while Iron ore on the Singapore exchange has is currently flat at $US105.90 per tonne.

Cryptocurrency giant Bitcoin is still trading flat, around US$95,000, while the Aussie dollar is trading ~US63 cents.

Reporting season continues with the Commonwealth Bank revealing a strong H1 FY25 with cash net profit after tax (NPAT) of $5.13 billion, aligning with expectations and up 2% on the previous corresponding period.

Saxo Asia Pacific Senior Sales Trader Junvum Kim said results for CBA, a bellweather for the market, reflected a resilient stance amid economic headwinds.

"Strong performances in home lending and business banking, alongside a net interest margin of 2.08%, showcase effective management in a competitive landscape," Kim said.

"Despite a 6% rise in operating expenses due to inflation and tech investments, the bank's decision to increase the interim dividend to $2.25 per share signals confidence in its financial health.

"While cost of living pressures persist, CBA's solid CET1 ratio of 12.2% and favourable labour market conditions position it well for future growth, with an anticipated interest rate easing cycle in 2025 offering additional optimism."

Blood products giant CSL (ASX:CSL) continued to drag on markets onWednesday after releasing its H1 FY25 yesterday with earnings and guidance missing market expectations.

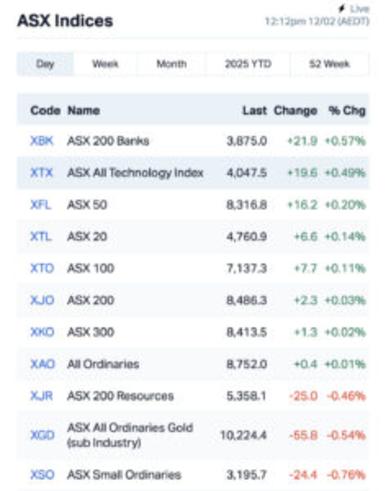

And here’s where things stood on the ASX around lunch time AEDT:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 12 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| CRS | Caprice Resources | 0.057 | 119% | 87,161,270 | $11,518,957 |

| CMO | Cosmo Metals | 0.028 | 65% | 1,305,481 | $2,226,879 |

| 1TT | Thrive Tribe Tech | 0.003 | 50% | 364,999 | $4,063,446 |

| LNU | Linius Tech Limited | 0.0015 | 50% | 1,000,000 | $6,151,216 |

| SLM | Solismineralsltd | 0.14 | 49% | 1,828,542 | $7,237,890 |

| FRS | Forrestania Resources | 0.013 | 30% | 4,753,459 | $2,439,635 |

| DVL | Dorsavi Ltd | 0.009 | 29% | 968,120 | $5,118,665 |

| BXN | Bioxyne Ltd | 0.051 | 28% | 8,071,132 | $81,969,149 |

| TYX | Tyranna Res Ltd | 0.005 | 25% | 200,000 | $13,151,701 |

| GNM | Great Northern | 0.016 | 23% | 1,706,401 | $2,010,178 |

| AZL | Arizona Lithium Ltd | 0.011 | 22% | 875,468 | $41,056,331 |

| FRX | Flexiroam Limited | 0.006 | 20% | 2,000 | $7,586,993 |

| BVS | Bravura Solution Ltd | 2.77 | 20% | 3,135,753 | $1,035,697,745 |

| MTM | MTM Critical Metals | 0.255 | 19% | 6,786,263 | $98,541,577 |

| SGQ | St George Min Ltd | 0.04 | 18% | 8,818,485 | $42,110,375 |

| TKM | Trek Metals Ltd | 0.027 | 17% | 146,318 | $11,962,826 |

| AVR | Anteris Technologies | 12.7 | 17% | 24,298 | $188,995,613 |

| LAT | Latitude 66 Limited | 0.042 | 17% | 152,138 | $5,162,425 |

| JAV | Javelin Minerals Ltd | 0.0035 | 17% | 5,000,000 | $18,135,447 |

| BSX | Blackstone Ltd | 0.047 | 15% | 2,684,993 | $24,394,877 |

| LU7 | Lithium Universe Ltd | 0.008 | 14% | 452,309 | $5,501,857 |

| VKA | Viking Mines Ltd | 0.008 | 14% | 1,563,470 | $9,297,031 |

| ZEU | Zeus Resources Ltd | 0.008 | 14% | 750,000 | $4,484,712 |

| OZM | Ozaurum Resources | 0.17 | 13% | 4,218,327 | $29,581,731 |

| CPU | Computershare Ltd | 40.75 | 13% | 1,208,892 | $21,057,751,025 |

Caprice Resources (ASX:CRS) surged as much as 119% earlier this morning after returning multiple zones of thick, shallow high-grade gold at the Island gold project in the minerals-rich Murchison region of WA.

Initial Phase 1 drilling carried out in December 2024 returned gold assays of up to 28m at 6.4g/t from a down-hole depth of 114m including 4m at 16.4g/t from 130m at the Vadrians Hill target and 12m at 3.9g/t from 90m including 6m at 5.9g/t from 94m at the Baxter target.

Both holes also intersected shallower gold intersections of 27m at 3g/t from 48m including 5m at 6.9g/t from 69m, and 9m at 2.8g/t from 27m including 3m at 5.8g/t from 30m.

The multiple thick, stacked gold lodes intersected at depth and down-plunge from surface workings remain open in all directions with drilling constrained to less than 100m vertical depth.

Cosmo Metals (ASX:CMO) , a WA-based gold and base metals explorer, was up 65% earlier after releasing info to the ASX regarding its option to buy high grade NSW gold, antimony and copper projects.

The company noted it has entered into a Binding Heads of Agreement to acquire 100% of the Bingara and Nundle gold-antimony and copper projects in the New England Orogen geological region of northern NSW, subject to shareholder approval.

Solis Minerals (ASX:SLM) was up near 49% a short time ago. The South American-focused critical minerals hunter has made some boardroom moves, bringing in Mitch Thomas (former CFO at Latin Resources and CFO Battery Materials at Rio Tinto) to the CEO role, and Mike Parker to transition to technical director.

This comes a day after the company revealed it had identified extensive copper porphyry mineralisation in rock and channel sampling at its Cinto Project, Peru.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 12 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Innovations | 0.001 | -33% | 800,000 | $6,164,822 |

| 88E | 88 Energy Ltd | 0.0015 | -25% | 42,666 | $57,867,624 |

| NRZ | Neurizer Ltd | 0.0015 | -25% | 510,000 | $6,449,341 |

| CRR | Critical Resources | 0.004 | -20% | 680,414 | $12,159,816 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 3,787 | $7,929,526 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 180,857 | $15,392,639 |

| GMN | Gold Mountain Ltd | 0.002 | -20% | 41,876 | $11,448,058 |

| ICR | Intelicare Holdings | 0.008 | -20% | 1,514,762 | $4,861,881 |

| PSL | Paterson Resources | 0.009 | -18% | 941,608 | $5,016,417 |

| ERA | Energy Resources | 0.0025 | -17% | 70,600 | $1,216,188,722 |

| TEG | Triangle Energy Ltd | 0.005 | -17% | 4,909,718 | $12,535,404 |

| S66 | Star Combo | 0.135 | -16% | 1,195 | $21,613,277 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | 76,197 | $24,001,094 |

| AS2 | Askari Metals | 0.012 | -14% | 3,850,893 | $3,727,226 |

| DTM | Dart Mining NL | 0.006 | -14% | 1,009,803 | $4,186,389 |

| MKL | Mighty Kingdom Ltd | 0.006 | -14% | 14,795 | $1,512,444 |

| ARI | Arika Resources | 0.034 | -13% | 3,876,644 | $24,706,837 |

| NTM | Nt Minerals Limited | 0.0035 | -13% | 124,534 | $4,843,612 |

| QXR | Qx Resources Limited | 0.0035 | -13% | 350,000 | $5,240,311 |

| RTG | RTG Mining Inc | 0.021 | -13% | 1,050,911 | $26,010,684 |

| GCM | Green Critical Minerals | 0.015 | -12% | 46,972,993 | $32,762,031 |

| HTG | Harvest Tech Group | 0.015 | -12% | 1,000,000 | $15,062,832 |

| NRX | Noronex Limited | 0.015 | -12% | 1,049,400 | $8,494,686 |

| AHK | Ark Mines Limited | 0.155 | -11% | 53,016 | $9,703,122 |

| EV1 | Evolution Energy | 0.016 | -11% | 283,250 | $6,527,709 |

In case you missed it

Trigg Minerals (ASX:TMG) started trading on the US OTCQB market under the symbol TMGLF from February 11, 2025, making it easier for local investors to buy in. Trigg said the dual listing also supports talks with US partners on critical funding to advance its high-grade WCC deposit and large scale exploration portfolio.

Koba Resources (ASX:KOB) has agreed to sell its Goodsprings project in Nevada to TSXV-listed Fairchild Gold Corp in exchange for 3 million shares, making it Fairchild’s second-largest shareholder. Koba will also retain a 1% royalty on the project, allowing it to focus on its flagship Yarramba uranium project in South Australia.

Sri Lanka-based Titanium Sands (ASX:TSL) has raised $500,000 through a placement to sophisticated and professional investors to support regulatory approvals for an IML at its Mannar Island heavy mineral project. The company is issuing 125 million shares at 0.4 cents each, with one free attaching unlisted option per share.

At Stockhead, we tell it like it is. While Trigg Minerals, Koba Resources and Titanium Sands are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Disclosure: The journalist held shares in CSL at the time of writing this article.

Originally published as Lunch Wrap: ASX rebounds after volatile morning session; CBA releases strong results