Closing Bell: ASX slumps as banks and MinRes buckle; Santos slashes dividend

The ASX dropped on Wednesday with banks and MinRes headlining losses. Gold, however, is the play once more as Trump talks tariffs again.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX takes a hit as banks struggle and MinRes dives

Gold rallies as Trump hints at new tariffs

Aussie wages grow slowest in three years

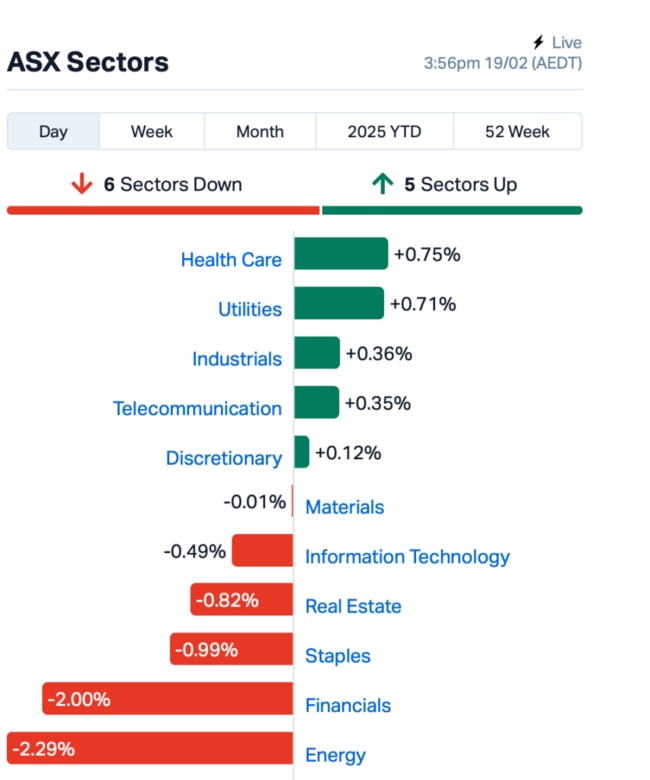

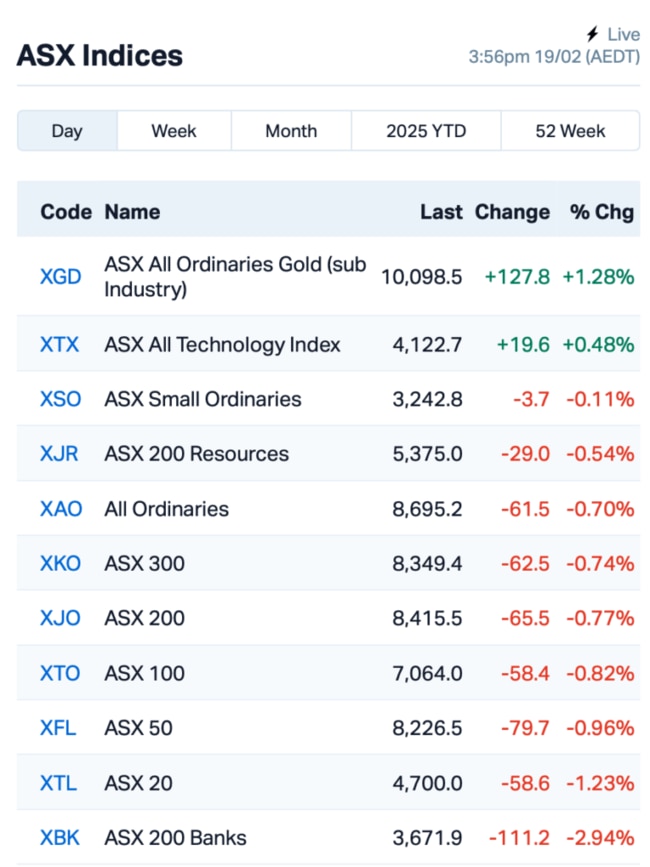

It was a tough day for local investors, with the benchmark ASX200 index slipping lower by 0.73%.

A lot of the damage came courtesy of the banks, which were struggling after National Australia Bank (ASX:NAB) posted a less-than-expected result for the December quarter.

NAB dropped over 7% after getting hammered by higher funding costs and tough competition in the loan and deposit markets in the quarter, even though the stock price was at record levels not long ago.

The rest of the bank sector wasn’t immune to the pain. The other three biggest banks, Commonwealth Bank (ASX:CBA), Australia and New Zealand Banking Group (ASX:ANZ) and Westpac (ASX:WBC) all dropped today.

In the precious metals space, though, gold rallied as investors rushed to the safe haven, driven by Trump’s new tariff threats on car, semiconductor and pharmaceutical imports to the US.

“I probably will tell you that on April 2, but it’ll be in the neighbourhood of 25%,” Trump told reporters at his Mar-a-Lago club when asked for details.

He refused to say for now if the new measures would hit certain countries, or all cars coming into the US.

A few other big names on the ASX also dropped the ball today as they missed market expectations.

Santos (ASX:STO), the mammoth gas producer, tumbled by 5% and dragged down the sector after its full-year profit slumped 14%, largely because of lower oil and gas prices. And it had to slash its dividend.

Santos posted $1.22bn profit for the year, missing expectations of $1.32bn, and dropped the final dividend to 10.3c, down from last year’s 17.5c.

Mineral Resources (ASX:MIN) was another big casualty today, plunging by 17% after it posted a massive $800 million loss for the half and axed its interim dividend.

The miner also slashed production forecasts for its Onslow Iron project, blaming severe weather and haul road upgrades. Even though the balance sheet’s got a bit of cushion with $1.52bn in available liquidity, the $5bn in net debt is a worry.

Read more here: Lithium and iron ore prices push MinRes to half-year loss

There was also some action in the travel sector. Corporate Travel Management (ASX:CTD) leapt 10% despite its first-half profit dropping by a third, mainly due to issues with its European travel business.

This is how things stood leading up to Wednesday’s close:

Meanwhile, ABS data today shows Australian wages grew at their slowest pace in three years, up just 0.7% in the December quarter.

“Yesterday’s rate cut will be welcome news to both employers and employees seeking some relief, however, the economy will not improve overnight,” said Ben Thompson, CEO, Employment Hero.

And turning to Asia, things weren’t looking great after Trump proposed the new wave of tariffs, which weighed on stock markets in Japan and Hong Kong.

But investors have been buying into Chinese IT stocks, with a massive US$2.9 billion flowing into Hong Kong stocks just yesterday.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.003 | 50% | 1,458,688 | $3,224,671 |

| ICU | Investor Centre Ltd | 0.002 | 50% | 2,713,108 | $609,023 |

| VML | Vital Metals Limited | 0.024 | 50% | 8,864,342 | $5,895,067 |

| WC1 | West Cobar Metals | 0.130 | 41% | 2,237,101 | $2,814,599 |

| CSS | Clean Seas Ltd | 0.120 | 41% | 886,822 | $18,520,822 |

| C1X | Cosmosexploration | 0.037 | 28% | 3,661,439 | $8,794,661 |

| EXL | Elixinol Wellness | 0.175 | 25% | 33,263 | $6,403,784 |

| RGT | Argent Biopharma Ltd | 0.003 | 25% | 60,498 | $8,298,118 |

| ASR | Asra Minerals Ltd | 0.018 | 20% | 100,000 | $4,625,260 |

| PEC | Perpetual Res Ltd | 0.006 | 20% | 7,074,105 | $12,395,218 |

| EPM | Eclipse Metals | 0.026 | 18% | 972,333 | $14,299,095 |

| PFT | Pure Foods Tas Ltd | 0.027 | 17% | 550,507 | $2,979,364 |

| ION | Iondrive Limited | 0.035 | 17% | 4,084,829 | $20,503,654 |

| FTZ | Fertoz Ltd | 0.007 | 17% | 116,275 | $8,893,816 |

| IXR | Ionic Rare Earths | 0.007 | 17% | 6,174,764 | $31,430,570 |

| KGD | Kula Gold Limited | 0.014 | 17% | 285,421 | $4,257,922 |

| PNT | Panthermetalsltd | 0.007 | 17% | 9,977,389 | $2,978,049 |

| STM | Sunstone Metals Ltd | 0.007 | 17% | 3,257,195 | $30,900,022 |

| TON | Triton Min Ltd | 0.080 | 16% | 284,709 | $9,410,332 |

| PHO | Phosco Ltd | 0.283 | 15% | 456,244 | $19,733,457 |

| RXL | Rox Resources | 1.890 | 15% | 2,817,067 | $148,931,420 |

| NGI | Navigator Global Ltd | 0.070 | 15% | 1,640,269 | $806,180,659 |

| NNL | Nordicresourcesltd | 0.086 | 15% | 36,893 | $8,990,415 |

| CVR | Cavalier Resources | 0.008 | 14% | 45,000 | $4,338,166 |

West Cobar Metals (ASX:WC1) said it has had success with leaching tests at its Bulla Park copper-antimony-silver project in NSW. After strong flotation results with up to 94% copper, 90% antimony, and 88% silver recovery, a leach test was done to extract antimony. The first test recovered 75% of the antimony, showing it can be separated from the copper and silver. This is a big step in optimising the process, it said, and further tests are now underway.

Clean Seas Seafood (ASX:CSS) revealed that it has received a non-binding proposal from Yumbah Aquaculture to merge by acquiring 100% of Clean Seas’ shares. Yumbah is offering $0.14 per share in cash, or a scrip alternative, which would allow Clean Seas shareholders to maintain exposure to the combined business. The offer is a 52.2% premium on Clean Seas’ current share price.

Cosmos Exploration (ASX:C1X) told the ASX there’s no hidden info that could explain today’s stock price hike. However, the company did mention a news article about China restricting the export of a key lithium extraction technology, which could impact global lithium projects. But C1X isn’t concerned, as its exclusive option agreement with EAU Lithium gives it access to Vulcan Energy’s A-DLE technology, which is unaffected by China’s moves.

Perpetual Resources (ASX:PEC) has secured a landholding in Brazil’s “Lithium Valley”, just 3km from its existing Isabella lithium project. The new licenses expand its land by 3x and feature highly prospective ground with rock assays up to 7.6% Li2O. The project includes spodumene-rich pegmatites and numerous targets ready for drilling, with plans for a maiden drill program in mid-2025.

Iondrive's (ASX:ION) Deep Eutectic Solvent (DES) battery recycling process has passed a big milestone, with independent economic modelling confirming its strong financial potential. The project shows a post-tax NPV of $249m and an IRR of 17.4%. The DES process is designed to process 21,000 tonnes of raw black mass annually, producing high-value battery minerals.

And, Clarity Pharmaceuticals (ASX:CU6) had a win with its prostate cancer treatment. The company received fast-track approval from the US FDA for its Cu-SAR-bisPSMA drug, which will help treat metastatic castration-resistant prostate cancer.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ADD | Adavale Resource Ltd | 0.002 | -33% | 2,061,682 | $6,819,838 |

| ERA | Energy Resources | 0.002 | -33% | 4,155,297 | $1,216,188,722 |

| STP | Step One Limited | 1.030 | -28% | 2,835,604 | $264,109,915 |

| HLX | Helix Resources | 0.003 | -25% | 20,575,997 | $13,456,775 |

| RLL | Rapid Lithium Ltd | 0.003 | -25% | 140,000 | $4,129,779 |

| SRJ | SRJ Technologies | 0.025 | -24% | 205,000 | $19,971,341 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 5,485,362 | $15,392,639 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 76,500 | $7,937,639 |

| VEN | Vintage Energy | 0.004 | -20% | 573,258 | $8,347,656 |

| TGH | Terragen | 0.031 | -18% | 9,368 | $19,190,653 |

| AU1 | The Agency Group Aus | 0.018 | -18% | 158,804 | $9,670,685 |

| PPG | Pro-Pac Packaging | 0.018 | -18% | 470,004 | $3,997,130 |

| PSL | Paterson Resources | 0.009 | -18% | 830,523 | $5,016,417 |

| NMR | Native Mineral Res | 0.068 | -18% | 3,889,319 | $48,818,660 |

| EV1 | Evolutionenergy | 0.014 | -18% | 220,000 | $6,165,058 |

| MIN | Mineral Resources. | 25.260 | -17% | 7,286,820 | $5,993,817,422 |

| AKN | Auking Mining Ltd | 0.005 | -17% | 435,638 | $3,448,673 |

| BEL | Bentley Capital Ltd | 0.010 | -17% | 11,269 | $913,535 |

| CDT | Castle Minerals | 0.003 | -17% | 18,500,000 | $5,690,442 |

| MTB | Mount Burgess Mining | 0.005 | -17% | 7,773 | $2,037,225 |

| TYX | Tyranna Res Ltd | 0.005 | -17% | 404,225 | $19,727,552 |

| NSX | NSX Limited | 0.017 | -15% | 120,000 | $9,155,619 |

| DDB | Dynamic Group | 0.235 | -15% | 4,009 | $39,369,489 |

| FFF | Forbidden Foods | 0.006 | -14% | 1,084,323 | $4,005,564 |

IN CASE YOU MISSED IT

Shareholders have overwhelmingly approved St George Mining’s (ASX:SGQ) acquisition of the Araxá niobium and rare earth project in Brazil. The company now aims to unlock the project's world-class potential with a 5000m diamond-drilling campaign and a maiden resource estimate.

Chariot Corporation (ASX:CC9) has secured seven exploration licences in Western Australia's renowned Southern Cross Greenstone Belt. The company has engaged ERM Sustainable Mining Services for a geological review of the applications and, once granted, plans to commence exploration, including mapping and geochemical surveys.

Moab Minerals (ASX:MOM) has reported uranium intersections in all 51 of the initial drill holes at its Manyoni project, with 49 returning assays exceeding 1m at 100ppm U₃O₈. While awaiting results for the remaining 59 holes, the company has confirmed Manyoni as a consistently mineralised, flat-lying system with just 1m of overburden.

Koonenberry Gold (ASX: KNB) has intersected visible gold in multiple zones from its first diamond drill hole targeting the Sunnyside prospect within the Enmore gold project in NSW. Gold was observed from 172.8m to 191.25m, with drilling ongoing to test for extensions to mineralisation.

Vertex Minerals (ASX:VTX)has completed the commissioning of the ore-sorting module at the Reward gold mine ahead of schedule, with gravity plant commissioning still ongoing. The sorter has significantly improved ore quality, and the company is addressing fine material buildup while preparing to commence underground mining.

At Stockhead, we tell it like it is. While St George Mining, Chariot Corporation, Moab Minerals, Koonenberry Gold and Vertex Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX slumps as banks and MinRes buckle; Santos slashes dividend