Closing Bell: ASX rebounds hard, insurers on edge as Cyclone Alfred closes in

The ASX bounced back on Monday with real estate leading the charge, while insurers sweat over Cyclone Alfred.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX rebounds as real estate, miners rise

NRW Holdings slumps over Whyalla collapse mess

Insurers hit hard as Cyclone Alfred looms

The ASX bounced back by 0.90% on Monday, shaking off the losses from last week even as the threat of looming tariffs keep traders on edge.

Buyers stepped back in to snap up the market’s most beaten-down stocks after the chaos sparked by US President Trump last week, where he announced an additional 10% tariff on China.

Miners clawed back some of their losses. Both Rio Tinto (ASX:RIO) and Newmont Corporation (ASX:NEM) gained over 2.5%. Goodman Group (ASX:GMG) lifted real estate stocks with a 2% jump.

Tech stocks also rallied, bouncing back from an 12% dip over the last week.

Insurers, meanwhile, were getting hit after the news that Cyclone Alfred, a category-2 storm, was likely to hit Brisbane and parts of the east coast this week. Traders are bracing for the cyclone to cause damage and push up insurance claims.

Suncorp Group (ASX:SUN) tumbled by 3%, while Insurance Australia (ASX:IAG) dropped 1%.

Severe Weather Update: Tropical Cyclone Alfred likely to move towards south-east #Qld and north-east #NSW from Tuesday.

Video current: 1:00pm AEST 2 March 2025.

Latest forecasts and warnings: https://t.co/4W35o8iFmh or the BOM Weather app. pic.twitter.com/15Pkd2my8U

— Bureau of Meteorology, Australia (@BOM_au) March 2, 2025

In the large caps space, mining services company NRW Holdings (ASX:NWH) took a big hit, falling 10% after it failed so far to recover the $113.3 million owed from the collapse of the Whyalla steelworks.

NRW’s Golding contracting arm Golding was chasing up the fees after the Whyalla steelworks and the nearby iron ore mines, which fed Sanjeev Gupta’s empire, went belly up.

"There has been no financial impact recognised during the period , with no specific allowance associated with amounts due, being recognised for the period," said NRW.

On a brighter note, ProMedicus (ASX:PME) rose 3% after signing a $40 million deal with US radiology provider LucidHealth, which will see the company’s diagnostic imaging tech rolled out across LucidHealth’s network.

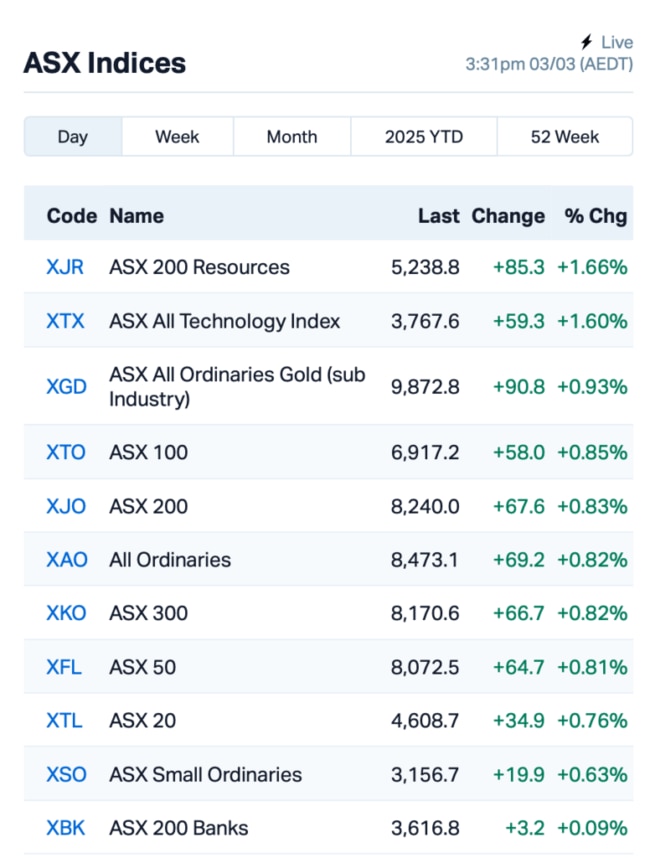

This is where things stood leading up to today’s closing:

Over in Asia, China is apparently preparing to unveil another big stimulus plan. The US’s 10% tariff is set to take effect just as China plans to reveal its growth targets for 2025.

And finally, Bitcoin was holding steady above $US92,000 after Trump hinted that the US government was ramping up plans to create a “crypto strategic reserve.”

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap APC APC Minerals 0.024 60% 1,647,652 $1,757,597 AOK Australian Oil. 0.003 50% 2,193,441 $2,003,566 GUL Gullewa Limited 0.065 35% 70,667 $10,465,064 TKM Trek Metals Ltd 0.028 27% 996,144 $11,477,903 AUK Aumake Limited 0.005 25% 4,196,312 $12,042,769 RDN Raiden Resources Ltd 0.005 25% 12,683,701 $13,803,566 BMR Ballymore Resources 0.130 24% 38,400 $18,556,711 AHF Aust Dairy Limited 0.058 23% 1,194,970 $34,936,125 X2M X2M Connect Limited 0.022 22% 569,498 $6,810,143 PEB Pacific Edge 0.140 22% 287,535 $93,370,337 LNR Lanthanein Resources 0.003 20% 100,000 $6,109,090 PKO Peako Limited 0.003 20% 350,000 $3,719,355 SKK Stakk Limited 0.006 20% 1,667,302 $10,375,398 TOY Toys R Us 0.043 19% 163,331 $5,445,438 MTH Mithril Silver Gold 0.370 19% 928,874 $45,155,692 AAM Aumegametals 0.052 18% 2,152,460 $26,580,974 DCC Digitalx Limited 0.053 18% 12,449,309 $54,119,299 G88 Golden Mile Res Ltd 0.011 17% 4,981,910 $4,898,231 SPA Spacetalk Ltd 0.280 17% 356,118 $15,306,327 FG1 Flynngold 0.028 17% 4,934 $6,271,595 RFT Rectifier Technolog 0.007 17% 7,914,879 $8,291,904 WOA Wide Open Agricultur 0.014 17% 7,125,787 $6,404,239 BLU Blue Energy Limited 0.008 14% 757,470 $12,956,815 CTQ Careteq Limited 0.016 14% 62,500 $3,319,662 TOU Tlou Energy Ltd 0.016 14% 22,743 $18,180,180

Ballymore Resources (ASX:BMR) has kicked off Stage 5 drilling at its Dittmer gold project in North Queensland, with a 100% success rate so far. All 42 holes drilled to date have hit gold, including some stellar intersections like 4.3m at 29.02 g/t Au. The Dittmer project, which includes the historic Dittmer mine, could be a prime spot for mining again, the company said, especially with gold prices soaring.

X2M Connect (ASX:X2M) is set to launch ‘Hive.AI by X2M’, an AI-powered platform designed to optimise renewable energy operations. This new product will combine X2M’s IoT technology with AI and machine learning to improve energy efficiency and boost revenues for renewable energy companies. The product will first roll out in the APAC region, tapping into a market worth $491 billion.

Mithril Resources (ASX:MTH) ’s drilling at La Soledad in Mexico is delivering solid results, with high-grade gold and silver hits, including 4.95m at 20.5g/t gold and 1,833g/t silver. The drill program is expanding, and the company is set to drill 35,000m this year across multiple target areas to grow its resource footprint in the silver and gold-rich Copalquin district. Mithril is progressing towards completing the Target 1 resource drilling by March 2025, with plans to move to the Target 2 area soon after.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap FTC Fintech Chain Ltd 0.005 -38% 14,000 $5,206,157 PHL Propell Holdings Ltd 0.010 -33% 396,989 $4,175,072 AXP AXP Energy Ltd 0.001 -33% 20,399 $9,862,021 CDT Castle Minerals 0.002 -33% 40,585,119 $5,690,442 LNU Linius Tech Limited 0.001 -33% 65,500 $9,226,824 NRZ Neurizer Ltd 0.002 -33% 51,935 $10,074,012 PAB Patrys Limited 0.002 -33% 455,657 $6,172,342 WEL Winchester Energy 0.001 -33% 182 $2,044,528 BRX Belararoxlimited 0.098 -30% 2,565,991 $20,154,976 MPR Mpower Group Limited 0.008 -27% 687,715 $3,780,736 88E 88 Energy Ltd 0.002 -25% 1,840,024 $57,867,624 BYH Bryah Resources Ltd 0.003 -25% 200,000 $2,507,203 CT1 Constellation Tech 0.002 -25% 540,467 $2,949,467 MEL Metgasco Ltd 0.003 -25% 48,100 $5,830,347 OB1 Orbminco Limited 0.002 -25% 200,000 $4,333,180 KPO Kalina Power Limited 0.007 -22% 1,626,963 $24,659,944 RR1 Reach Resources Ltd 0.011 -21% 11,462,551 $12,242,039 PLN Pioneer Lithium 0.150 -21% 10,000 $7,279,220 PFT Pure Foods Tas Ltd 0.034 -21% 534,664 $5,823,302 1TT Thrive Tribe Tech 0.002 -20% 3,195,353 $5,079,308 BUY Bounty Oil & Gas NL 0.002 -20% 50,000 $3,903,680 CRR Critical Resources 0.004 -20% 56,255 $12,321,106 WMG Western Mines 0.100 -17% 281,016 $10,842,401 1AI Algorae Pharma 0.005 -17% 139,665 $10,124,368

IN CASE YOU MISSED IT

CSE-listed American Salars Lithium (CSE:USLI) is expanding its flagship Pocitos project in Argentina, boosting its landholding by 1635% to 13,880 hectares. The new acquisition comes with existing exploration data and sets the stage for resource upgrades and future production.

Blue Star Helium (ASX:BNL) has completed drilling of its Jackson 31 well in Colorado, intersecting 57 feet of gas-saturated Lyons Sandstone with natural gas flows and no water encountered. Gas samples are being analysed, and flow testing is next as the company advances toward helium production at its Galactica project.

Copper explorer Belararox (ASX:BRX) is seeing promising indications of porphyry systems at both the Tambo South and Malambo prospects within its TMT project in Argentina’s San Juan Province. Drilling is progressing at both, with the company fully funded and targeting completion by April.

Canadian lithium developer Green Technology Metals (ASX:GT1) has appointed Han Seung Cho as a non-executive director. Cho is the general manager of EcoPro Innovation’s Strategic Business team, where he has played a key role for more than five years. Most important for GT1 is Cho’s experience in managing North American OEM relationships and exposure to strategic business development. Prior to working with EcoPro, Cho worked at an automotive interior parts manufacturing specialist where he managed projects and oversaw sales operations across several North American OEMs.

Gold explorer OzAurum Resources (ASX:OZM) has received firm commitments to raise $1.74m via a share placement to professional and sophisticated investors, which will see the company issue 29,100,00 shares at 6c apiece. The money will be spent on exploration at OZM’s Mulgabbie and Patricia projects as well as its niobium project in Brazil.

Moab Minerals (ASX:MOM) has secured a $500k investment from European Lithium (ASX:EUR) via a placement to advance exploration at its Manyoni uranium project in Tanzania. The placement is priced at 0.3 cents per share, with EUR also receiving one free-attaching option for every two placement shares.

At Stockhead, we tell it like it is. While American Salars Lithium, Blue Star Helium, Belararox, Green Technology Metals, OzAurum Resources, and Moab Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX rebounds hard, insurers on edge as Cyclone Alfred closes in