Closing Bell: ASX powers to new 50-day high, up 0.63pc

The ASX jumped 0.63pc to a new 50-day high, driven by strong performances in gold and finance stocks with most sectors in the green.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

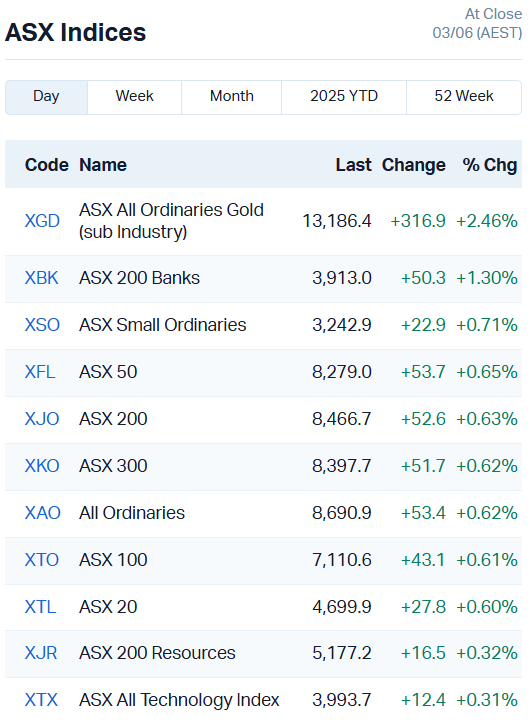

ASX adds 52 points, hitting a new 50-day high at 8,466.70 points

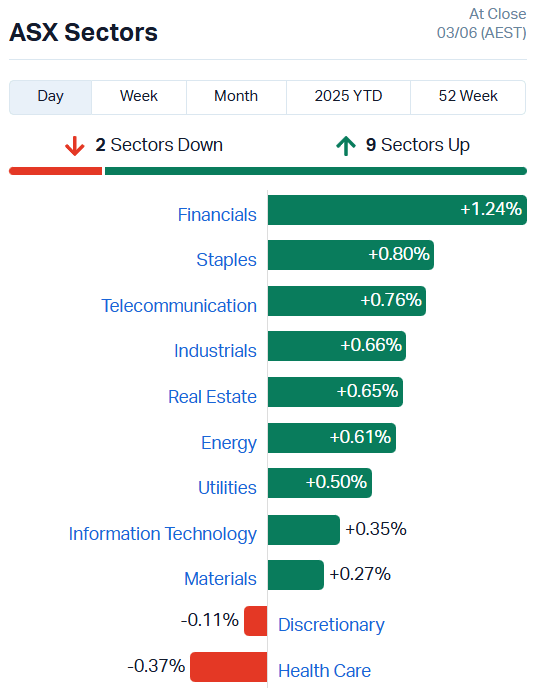

Broad strength with 9 of 11 sectors on the up

Gold and finance stocks outperform

The ASX was on a roll today, climbing swiftly in the first hour of trade and maintaining momentum throughout trade to finish up by 0.63%.

That also marks a new 50-day high for the bourse, which is just 1.72% off the all-time highs reached in February this year.

All but two sectors made convincing gains today, with just Consumer Discretionary (-0.11%) and Health Care (-0.37%) lagging.

The ASX All Ords Gold Index outperformed once again, surging 2.46% on another lift in gold prices, which climbed 2.5% to US$3397.20 an ounce overnight.

The ASX 200 Banks index also stood out, jumping 1.3%. The major four banks gained between 1.19% and 1.37%.

RBA outlines tariff risks for Australian economy

Speaking to the Economic Society of Australia in Brisbane today, RBA assistant governor Sarah Hunter opened with a quote from Lenin.

‘There are decades where nothing happens; and there are weeks where decades happen’.

It certainly feels like we’ve been in the tariff war trenches for years at this point, although in truth this all kicked off just four months ago.

“The broad-based nature of the proposed US tariffs, retaliation from major partners and other policy shifts all have the potential to structurally alter the world economy,” Hunter continued.

The RBA has identified the key transmission channels these structural changes will flow through:

- Realigning trade flows between countries, production shifting to new countries over time

- Tariffs are likely to change consumption habits as some products become more expensive

- Business and consumers will become more cautious in the face of flipflopping policy, delaying major decisions involving capital investment

Hunter points out that both fiscal and monetary policy can be adjusted to help offset adverse effects, and that financial markets will simply reprice assets.

You can read her full speech (with sourcing and data analysis) on the RBA website, but in short Hunter concludes that we’re in for a period of slower economic growth and a slightly weaker labour market.

“We also anticipate that, overall, the price of tradable goods will be slightly dampened,” Hunter said.

“Together, these two outcomes mean that inflation is forecast to be a little lower than at the February SMP, settling around the midpoint of the 2–3% target range.”

While that’s not good news, it’s not cataclysmic either.

The RBA says it will be watching its transmission channels closely from here on out, ready to adjust policy accordingly.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EPM | Eclipse Metals | 0.015 | 200% | 65692044 | $14,329,095 |

| VAR | Variscan Mines Ltd | 0.007 | 40% | 92864 | $3,914,289 |

| G88 | Golden Mile Res Ltd | 0.018 | 38% | 10828150 | $7,075,222 |

| BYH | Bryah Resources Ltd | 0.015 | 36% | 42903096 | $9,569,489 |

| BMO | Bastion Minerals | 0.002 | 33% | 1803250 | $1,355,441 |

| TYX | Tyranna Res Ltd | 0.004 | 33% | 2483000 | $9,865,276 |

| BCA | Black Canyon Limited | 0.079 | 30% | 630241 | $7,908,692 |

| NC1 | Nicoresourceslimited | 0.093 | 27% | 412715 | $8,008,142 |

| WCE | Westcoastsilver Ltd | 0.078 | 26% | 5130855 | $16,127,501 |

| CAV | Carnavale Resources | 0.005 | 25% | 1133878 | $16,360,874 |

| EVR | Ev Resources Ltd | 0.005 | 25% | 729920 | $7,943,347 |

| GLA | Gladiator Resources | 0.01 | 25% | 884127 | $6,066,375 |

| MEM | Memphasys Ltd | 0.005 | 25% | 499000 | $7,934,392 |

| UNT | Unith Ltd | 0.01 | 25% | 2621527 | $9,830,283 |

| WMG | Western Mines | 0.195 | 22% | 65152 | $14,456,535 |

| FTL | Firetail Resources | 0.091 | 21% | 4345928 | $28,502,098 |

| BTM | Breakthrough Minsltd | 0.12 | 20% | 348895 | $4,785,950 |

| ALY | Alchemy Resource Ltd | 0.006 | 20% | 909133 | $5,890,381 |

| AN1 | Anagenics Limited | 0.006 | 20% | 100000 | $2,481,602 |

| BIT | Biotron Limited | 0.003 | 20% | 2444305 | $3,318,115 |

| GGE | Grand Gulf Energy | 0.003 | 20% | 439921 | $7,051,062 |

| GLL | Galilee Energy Ltd | 0.006 | 20% | 416 | $3,535,964 |

| ION | Iondrive Limited | 0.024 | 20% | 15264360 | $23,656,727 |

| NES | Nelson Resources. | 0.003 | 20% | 2700000 | $5,429,819 |

| PRX | Prodigy Gold NL | 0.003 | 20% | 5693864 | $7,937,639 |

Making news…

Eclipse Metals (ASX:EPM) unveiled a massive 89 million tonne rare earths resource at its Grønnedal project in southwest Greenland. The updated estimate shows grades averaging over 6,300ppm TREO, including high-value magnet metals like neodymium, praseodymium, dysprosium and terbium – key ingredients for EVs and wind turbines.

That puts it among the highest-grade rare earth deposits in the world. This new figure is more than 70 times bigger than the previous estimate, and the mineralisation still looks to extend in every direction, said EPM.

Western Yilgarn (ASX:WYX) has snapped up the Cardea 3 Bauxite Project in WA’s Darling Range, just 17km from its big Julimar West deposit. It paid a modest $5k upfront, and will tip in more cash and shares once the exploration licence is granted.

Previous drilling at Cardea 3 shows high-grade bauxite, with standout results like 7.5m at over 48% total alumina and low reactive silica.

Nico Resources (ASX:NC1) has received firm commitments for a $1.1m placement at an 11.4% premium to its 20-day VWAP. The funding will go to exploration and development of the Wingellina nickel-cobalt project, host to 40,000t of nickel and 3000t of cobalt.

Sunshine Metals (ASX:SHN) has hit bonanza-grade gold mineralisation at the Liontown prospect, with results up to 10 metres at 31.91g/t gold from 41 metres of depth.

With a smaller hit of 2 metres at 121.5g/t gold in hand, SHN says the results demonstrate the historical gold mine still hosts high-grade gold mineralisation, reinforcing the company’s plans to pursue shallow oxide gold production.

Alchemy Resources (ASX:ALY) has taken full ownership of the Bryah iron ore project, acquiring the remaining 50% interest from Carey Mining Pty Ltd for $75,000 cash and a royalty.

The gradational royalty is based on iron ore prices sold FOB from the project, ranging from $0.80 per tonne at under US$100/t of iron ore and up to $1.22 should iron prices rise above US$125/t.

The gold signal is coming in loud and clear from Solstice Minerals’ (ASX:SLS) Bluetooth gold prospect, part of the Yarri gold project in WA. The company has hit multiple broad intersections from less than 50 metres below surface, grading up to 20m at 2.18g/t gold.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BMH | Baumart Holdings Ltd | 0.011 | -67% | 674614 | $5,419,086 |

| ADD | Adavale Resource Ltd | 0.001 | -50% | 400000 | $4,574,558 |

| OB1 | Orbminco Limited | 0.001 | -50% | 81733 | $4,795,136 |

| MGU | Magnum Mining & Exp | 0.005 | -33% | 4155608 | $8,412,381 |

| OVT | Ovanti Limited | 0.002 | -33% | 8085945 | $8,380,545 |

| RCM | Rapid Critical | 0.002 | -33% | 7719243 | $3,734,834 |

| VML | Vital Metals Limited | 0.002 | -33% | 2815666 | $17,685,201 |

| BNL | Blue Star Helium Ltd | 0.006 | -25% | 12656652 | $21,559,082 |

| MTB | Mount Burgess Mining | 0.003 | -25% | 492539 | $1,406,811 |

| NAE | New Age Exploration | 0.003 | -25% | 4402993 | $10,637,596 |

| RAN | Range International | 0.0015 | -25% | 98459 | $1,878,581 |

| UBI | Universal Biosensors | 0.032 | -24% | 841535 | $12,518,832 |

| EVEDA | EVE Health Group Ltd | 0.023 | -23% | 889655 | $3,955,862 |

| OSLDA | Oncosil Medical | 0.95 | -21% | 14356 | $13,819,740 |

| CYQ | Cycliq Group Ltd | 0.002 | -20% | 336928 | $1,151,292 |

| EV1 | Evolutionenergy | 0.008 | -20% | 2240267 | $3,626,505 |

| IMI | Infinitymining | 0.008 | -20% | 180000 | $4,230,158 |

| IS3 | I Synergy Group Ltd | 0.004 | -20% | 10000 | $2,503,651 |

| MML | Mclaren Minerals | 0.026 | -19% | 300161 | $4,528,561 |

| EXT | Excite Technology | 0.009 | -18% | 3170658 | $22,799,061 |

| HT8 | Harris Technology Gl | 0.009 | -18% | 202841 | $3,618,617 |

| CRI | Criticalim | 0.019 | -17% | 47468447 | $62,041,318 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 10842256 | $8,384,917 |

| AJL | AJ Lucas Group | 0.005 | -17% | 7861 | $8,254,378 |

| ARV | Artemis Resources | 0.005 | -17% | 3120042 | $15,171,176 |

LAST ORDERS

Titanium Sands (ASX:TSL) has finalised a corporate funding solution for the Mannar heavy mineral project, whereby CPS Capital Group will provide up to $600,000 in loan funding in two tranches.

The funding will be used to finalise environmental studies, advance an industrial mining licence for the project, and for general working capital.

ADX Energy (ASX:ADX) has tapped David Gilbert as non-executive director, replacing John Begg as he steps down from the board of directors.

Gilbert has held senior positions in companies based in Austria and Romania, locations highly relevant to ADX’s operations as the company holds projects in both countries.

IN CASE YOU MISSED IT

MTM Critical Metals’ (ASX:MTM) has achieved 98% recovery of antimony from US e-waste using its proprietary Flash Joule Heating technology.

Antares Metals (ASX:AM5) has uncovered a potentially large-scale copper prospect called Marvel with an 80m-wide intercept of disseminated sulphide and chalcopyrite mineralisation.

Maronan Metals (ASX:MMA) has increased the resource estimates for its namesake silver-lead and copper-gold deposit.

EMvision Medical Devices (ASX:EMV) have increased the sites for its pivotal trial for the emu bedside brain scanner, a device designed to rapidly diagnose stroke.

Lumos Diagnostics (ASX:LDX) has enrolled 61 of required 120 bacterial positive patients in US CLIA waiver clinical study for its point-of-care respiratory test FebriDx, designed to differentiate between bacterial and non-bacterial acute respiratory infections.

Sampling at Perpetual Resources’ (ASX:PEC) Igrejinha lithium project has uncovered more mineralisation ahead of RC drilling starting on June 5.

Real estate private credit specialist Zagga is filling the financing gap in Australia's housing crisis, investing in essential projects unfulfilled by banks and government.

Leeuwin Metals (ASX:LM1) has started phase 2 drilling at its Marda gold project to follow-up on high-grade gold intersected in the phase 1 program.

Lithium Universe (ASX:LU7) is pursuing a non-binding MoU to cover full annual SC6 spodumene supply of 140,000 tonnes for its Bécancour lithium refinery in Canada.

Health technology company Cardiex (ASX:CDX) has achieved an important milestone, receiving Therapeutic Goods Administration (TGA) approval for its CONNEQT Pulse arterial health monitor.

Exploration is underway at Core Energy Minerals’ (ASX:CR3) Grande Project in Rio Grande do Sul, Brazil, where broad uranium anomalism has been identified at surface.

With gold on a bull run, Codrus Minerals (ASX:CDR) has mobilised a diamond drilling rig to investigate five targets at its Bull Run gold project in the US.

Cannindah Resources’ (ASX:CAE) rock chip sampling has identified two untested copper-gold porphyry targets at Mt Cannindah, with assays up to 12.28% copper and 9.94g/t gold.

Everest Metals’ (ASX:EMC) has delivered an engineering scoping study for rubidium extraction through a partnership with Edith Cowan University.

With gold prices booming, Artemis (ASX:ARV) is lining up the drills to grow its 374,000oz gold, 64,000t copper Carlow project, with 5000 metres planned in total.

Western Yilgarn (ASX:WYX) has acquired the Cardea 3 bauxite project in WA’s Darling Range, which has strong potential to further increase bauxite tonnage and grade through exploration.

TRADING HALTS

Brazilian Critical Minerals (ASX:BCM) – cap raise

Caprice Resources (ASX:CPR) – cap raise

Lanthanein Resources (ASX:LNR) – cap raise

PointsBet Holdings (ASX:PBH) – update on MIXI takeover

At Stockhead, we tell it like it is. While Titanium Sands and ADX Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX powers to new 50-day high, up 0.63pc