Brightstar group resources jump to 2Moz with Montague East acquisition

Brightstar Resources has acquired the gold rights at the Montague East project from Gateway Mining, bumping its group resources to a whopping 2Moz

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Brightstar completes acquisition of gold rights at Montague East Gold Project

Resources now sit at 2Moz with addition of 500,000oz of gold

Company also acquiring Alto Metals to consolidate Sandstone district which is set to push Brightstar’s resources towards and beyond 3Moz Au

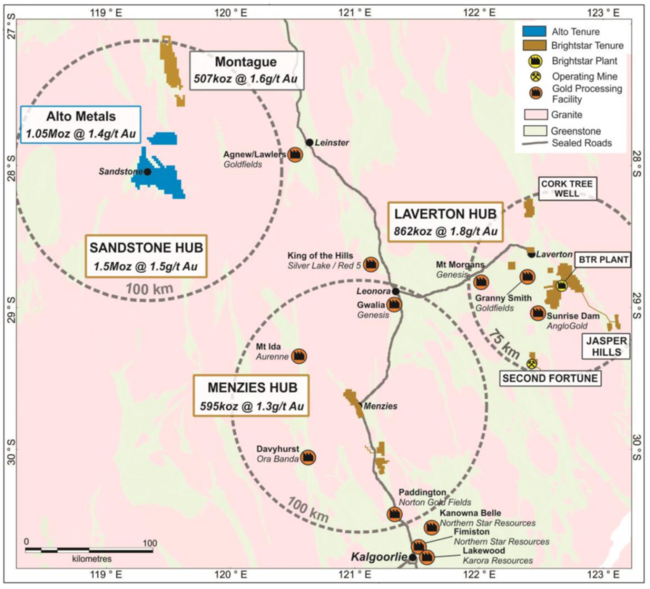

Special Report: Brightstar Resources has pushed into a new category of gold company, completing the acquisition of the gold rights at the Montague East Gold project (MEGP) from Gateway Mining (ASX:GML) in a move that’s bumped up its group resources to a whopping 2Moz.

The total mineral endowment now owned by the company is 38.3Mt at 1.6g/t gold for 2Moz gold.

This is partly due to the fact the MEGP already has a resource of 9.6Mt at 1.6g/t gold for 0.5Moz gold. It’s also just 70km from the Sandstone gold project, owned by Alto Metals (ASX:AME) – which is currently undertaking a merger with Brightstar Resources (ASX:BTR).

The acquisition of Alto Metals and the Montague East gold rights consolidates the Sandstone district of WA, allowing the new assets to act as the foundation for a third production hub, adding to the company’s existing Laverton and Menzies hubs.

It also means that combined, the company will boost its resources further to ~3Moz gold sitting near its own and third-party milling infrastructure.

Strategic acquisition for commercialisation

The company says the strategic addition of shallow ounces is aligned with its strategy of commercialising multiple assets in the near term.

“The completion of the acquisition of the Montague East Gold Project from Gateway achieves the first step in Brightstar’s previously announced consolidation plan of the Sandstone district, adding shallow ounces and a meaningful mineral resource inventory to our portfolio of advanced exploration, development and producing gold assets in Western Australia,” BTR managing director Alex Rovira said.

“With 2Moz of gold mineral resources situated on granted mining leases in the company, combined with our low capex growth plans and near-term development and production expansion, Brightstar is well placed to maximise value of the portfolio in an all-time high gold price environment.

“Recent drilling success across the Lord Byron, Fish and Second Fortune deposits has illustrated the immense upside in the company’s projects, as we seek to grow the mineral resource and de-risk future development through the DFS underway.”

BTR will pay GML $5m in cash, $7m in shares and another $2m worth of shares to be paid out upon the start of commercial mining operations in relation to the gold rights or the delineation of resources in excess of 1Moz.

Drilling planned this month

The company is now planning a drilling program at the MEGP starting late October, targeting infill and extensional targets within and proximal to the resources at the advanced Whistler and Montague-Boulder deposits.

“We are working towards mobilising an RC drill rig to the Montague-Boulder and Whistler deposits in late October, which contain ~280koz gold of shallow, largely oxide material. It is our intent to move the Montague East Gold Project swiftly through resource drill-out and feasibility study workstreams to advance this asset towards development,” Rovira said.

The company is also a hop, skip and jump away from defining maiden ore reserves at its Menzies and Laverton projects, so there’s a solid growth pipeline of existing and near-term production from Laverton and Menzies hubs supporting the expedited exploration and development of the Sandstone Hub.

That puts BTR on track to becoming a significant gold producer within the next four to five years.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Brightstar group resources jump to 2Moz with Montague East acquisition