Arizona Lithium’s updated Prairie development plan slashes initial production Capex to US$22m

Arizona Lithium has scaled-down Phase 1 operations at its Prairie project to enable entry into production at a drastically lower Capex of US$22m.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Special Report: Arizona Lithium has put into place an updated phased development plan for its Prairie lithium project in Saskatchewan, Canada, that drastically slashes capex required to start production down to just US$22m ($35m).

- Arizona Lithium slashes capex to start Prairie lithium brine production from US$290m to US$22m

- Smaller proof of concept Phase 1 plan will produce 150tpa LCE using a commercial-scale DLE unit

- Phase 2 will ramp up Pad #1 production using additional DLE units while Phase 3 will replicate design at Pads #2 and #3

https://www.youtube.com/watch?v=mUNExsUBjfo

This is an order of magnitude lower than the US$290m that was originally envisioned for the Phase 1 development and will enable the company to be the first company to produce commercial lithium from brines in North America.

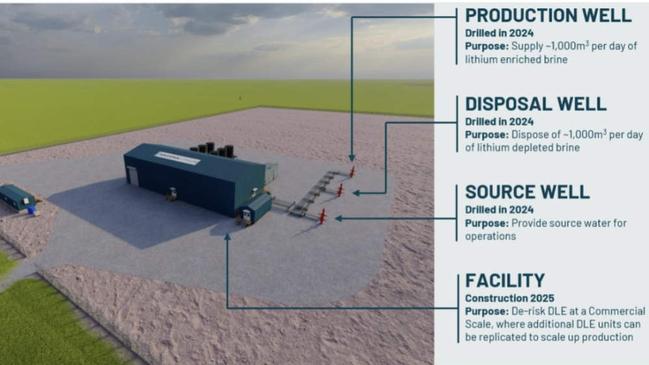

Arizona Lithium (ASX:AZL) will achieve this under the updated Phase 1 development by using a commercial-scale direct lithium extraction unit capable of producing 150tpa of lithium carbonate equivalent at Pad #1 where a production well, a disposal well and a brackish water source well have already been drilled.

Prioritising the low cost of entering production does come with its compromises, chief of which is significant reduction in initial production from the original 6000tpa production from three production pads.

However, this proof of concept does allow production to be quickly ramped up by replicating the process at Pad #1.

This is exactly what AZL plans to do under Phase 2, which will see the expansion of the production facility with additional commercial-scale DLE units at Pad #1 while Phase 3 will replicate the pad design at the already drill and de-risked Pads #2 and #3.

The company is now considering non-dilutive capital initiatives with multiple strategic partners completing extensive due diligence along with existing government grants, loans and traditional debt financing solutions.

Construction work is expected to begin in Q2 2025 with leading Western Canadian oil and gas facilities engineering company Grey Owl Engineering engaged for facility engineering, procurement, and construction.

De-risking Prairie

“We are excited to share additional details about our plans for the Prairie project,” managing director Paul Lloyd said.

“In 2023, a PFS was released that highlighted lithium production across three pad locations from the Prairie project. In 2024, we partnered with three landowners to secure the three pad locations and immediately went to work permitting and clearing the ground for the pads.

“A major drilling program was then executed across those three pads, which significantly de-risked the project and put us in a position to continue development toward production. 2025 will be a year of facility construction and commissioning Phase I at Pad #1.

“Our phased development plan clearly articulates how we will continue to de-risk and develop the project. Modularisation allows rapid and cost-effective scale-up to increase production in Phase II and III.”

The DLE plant will operate 24/7 to process brine at a rate of ~1000m3 per day to de-risk the temperature, pressure and chemical constituents of the brine.

Lithium produced will also be used to de-risk end market opportunities where battery-grade samples are currently being tested by interested groups in Asia.

Phase 1 operations at Prairie will be one of the world’s largest DLE facilities and provide the guidance required to scale-up production cost effectively across the broader project while the Phase 2 expansion will highlight the benefits of modularised scale-up as additional commercial-scale DLE units will be rapidly deployed.

While AZL did not reveal which DLE tech it is using, the company does have a proprietary DLE technology called Prairie Lithium Ion Exchange (PLIX) that selectively extracts lithium from brine.

This tech has been extensively tested at the nearby Lithium Research Centre (LRC) and produced battery-grade lithium carbonate in August 2024 that was verified by Vancouver-based Saltworks Technology, a specialist in treating wastewater and refining lithium.

This article was developed in collaboration with Arizona Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Arizona Lithium’s updated Prairie development plan slashes initial production Capex to US$22m