Six ways into AI for the intelligent investor

The AI boom is taking off and you can take part in it on any investment level you like so long as you’re prepared for a rocky ride.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australian investors have been watching from the sidelines as the artificial intelligence boom has taken off on Wall Street.

For a short time it seemed like investors had little to choose from in our local market, but the current reporting season has changed that dramatically. AI is suddenly on the agenda and stocks which can link their future prospects with the boom are being rerated.

It is no coincidence that Telstra has scrapped a long held ambition to spin off its infrastructure business just as AI fever sweeps the market.

In the blink of an eye the AI theme is broadening across the investment markets, from pure technology opportunities to telcos, data storage stocks and even property management.

There are very strong parallels with another technology boom – the dot.com boom – and just like that fevered period two decades ago, “entrepreneurs” will run wild in this atmosphere and some of them will be go down in flames. But that is still a long way off.

Just now, investors are watching as a de facto megatrend takes wing. Smart investors are making money in an otherwise lukewarm sharemarket on stocks and funds which capture the measurable benefits of AI tools such as ChatGPT, and a swarm of related AI products coming down the line.

Here’s six ways into AI for the Australians investor:

ASX-based specialist exchange traded funds: Standout choice – Betashares Global Robotics and Artificial Intelligence ETF

ETFs offer a very good opportunity to follow a theme without the elevated risk of depending on a fund manager to pick the best stocks. Through specialist algorithms an ETF should capture the best stocks at the best time – and the process appears to work. That’s why top stocks such as chipmaker Nvidia are as likely to be the best performer inside a specialist ETF as they are in an actively managed fund.

There are two ASX-listed ETFs expressly designed for AI – The Betashares Global Robotics and Artificial Intelligence ETF (up around 30 per cent year to date) and the Global X Global Robotics and Automation ETF (up around 20 per cent YTD).

Of course there is no such thing as a sure thing in the investment market and there is strong academic evidence that “thematic” ETFs arrive too late to make the big money from a new market trend. Still, the option is ideal for investors who are not willing to do the research on individual stocks.

US-listed exchange traded funds: Standout – Global X Robotics and AI ETF

There is a wider menu of ETFs focusing on AI available in the US market. With Wall Street-listed funds an investor can find more customised funds such as the Roundhill Generative AI and Technology ETF and others from Ishares (Blackrock) and Wisdom Tree. The best-performing ETF on a three-year annualised return earlier this year was the US version of the Global X Robotics and AI fund. Keep in mind that investing in offshore ETFs involves extra paperwork, different taxes and currency risk.

ASX blue chips in the right place: Standout – Goodman Group

Telstra is not the only market leader being reassessed in the light of the AI boom. A number of key stocks have moved to reshape strategy around the surging demand for AI technology and facilities. A very good example is the Goodman Property Group which already has a strong track record in exploiting the swing to e-commerce over the past decade.

At this week’s result presentation – a surprise 17 per cent lift in profit – chief executive Greg Goodman outlined “significant growth in data storage and AI in particular”. With roughly one third of the entire development workbook at Goodman now being related to data centres, Goodman – despite doubling in price over the past five years – looks to be in a better space than many of its rivals.

US listed blue chips in the right place: Standout – Microsoft

Us shares have lifted at more than twice the pace of the ASX over the year to date thanks largely to a handful of technology blue chips that are getting a second wind from AI. Stocks in this list include Alphabet (Google), Amazon, Apple, Facebook and Microsoft. Both Google and Microsoft have made key advances with AI products as Microsoft added ChatGPT to Bing and Google unleashed its Bard product. All of the big tech companies are going to get a lift from AI but as our sister publication, Barrons, noted recently: “Microsoft is at the heart of enthusiasm about the transformational power of AI.”

ASX AI players: Standout – Wisetech

On the ASX we simply do not have the type of stocks that are at heart of the AI boom such as the chip manufacturer Nvidia or technology majors such as Microsoft.

Nonetheless, there are stocks that are very close to the action. On the technology front the

Wisetech group has an AI subsidiary, Shipamax, which is a key part of why the shares are up 35 per cent year to date. Wisetech’s AI unit is a good example of how AI is going to escalate productivity and cut costs on routine tasks. As The Australian reported last month, Shipamax “uses AI and machine learning to convert unstructured data (eg PDFs, scans, images) direct from various sources, including emails, into machine-readable formats’’.

“The data is then used to automate manual tasks such as creating and managing forwarding and customs brokerage jobs, and processing accounts payable invoices.’’

Alternatively, there is the data storage king, NextDC which is another group that had a very strong year so far and its shares are already up about 45 per cent.

Both companies are linked with very dominant CEOs – Wisetech with Richard White and NextDC with Craig Scroggie – and both have proved to retail investors they can survive periods when tech stocks are out of fashion.

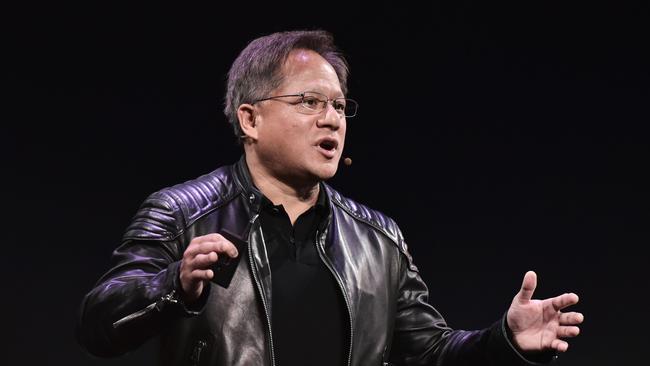

Bet on the big one: Nvidia

Nvidia is the star stock of the AI boom. The US chip company makes AI-focused products that are at the epicentre of demand led by the technology majors. Earlier this week it was reported Nvidia had received an eye popping US$5bn worth of orders from China tech companies alone.

The stock has a sky high valuation, yet it is also getting upgraded this month by brokers who estimate that Nvidia has an 85 per cent share of corporate AI “workloads”.

Nvidia is a one-way ticket; there is no hedging your bets. The stock at US$430 has a $US1 trillion market capitalisation with a price-earnings ratio of 225 times (a p/e of more than 20 is high) yet the price has more than doubled this year to date.

As Bitcoin is to cryptocurrency, Nvidia will perfectly reflect the sentiment around the wider world of AI. Take it or leave it.

Originally published as Six ways into AI for the intelligent investor