Rex’s John Sharp says buying Cobham’s FIFO arm strengthens his airline in a Covid world

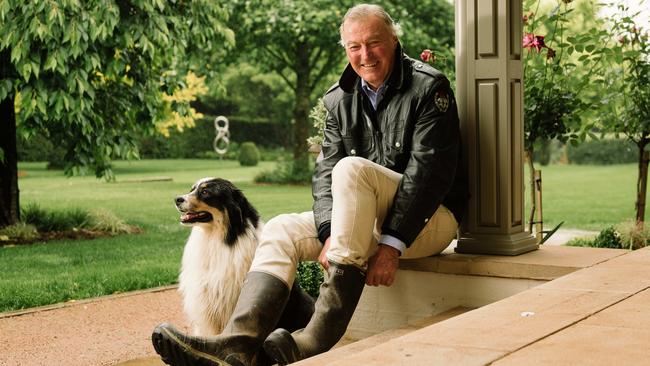

Rex deputy chairman John Sharp isn’t intimidated by Qantas or Virgin — and lets fly with a jab: his company runs on time, doesn’t lose luggage and has hired when the others fired.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

John Sharp curls his lips ever so slightly as he discusses the chaos facing his larger rivals, Qantas and Virgin Australia.

In this post-lockdown, pandemic-affected world it seems to have become increasingly difficult for the country’s two biggest airlines to get people and bags to the places they are booked to go — at all, never mind on time.

Sharp, the deputy chairman of Regional Express, is careful — but not too careful — when talking about the performance of Qantas and its chief executive, Alan Joyce.

“We’ve actually expanded and so we haven’t had the same problems. Alan in particular says, ‘oh this is an industry-wide problem’. It’s a global problem. So really, you know, Qantas is just doing what everybody else is doing. There’s nothing wrong with Qantas,” says Sharp, a former federal transport minister.

“But if you come back to Rex, we’re not operating with huge cancellation rates. Our cancellation rates are around 1 per cent.

“Our on-time performance is good at about 80 per cent, while theirs is bad. We don’t lose thousands and thousands of suitcases.

“Our passengers put a suitcase on wherever they are and it pops out the other end, and they take it home with them.”

Qantas’s on-time performance has been poor — down to 43 per cent last week — and its significant issues with baggage have been widely reported. It was forced to fly an entire aircraft without passengers just to reunite bags with owners over the Easter period.

Still, these are most certainly fighting words from the smaller carrier about the market giant. They come during an interview after Rex announced a deal to buy Australia’s second largest fly-in fly-out carrier, National Jet Express, from Cobham Aviation.

Cobham’s FIFO business accounts for just under 20 per cent of the market for transporting miners and gas workers to sites across Australia.

Sharp’s comments about the two airlines’ relative performance are true but not strictly fair.

The complexities of running an airline with the widest network coverage in Australia, which is also the largest international carrier, are far greater than that of running a smaller regional airline. This means there are more opportunities for logistical errors.

The antagonism between the two airlines seems to run deep.

During the early stages of the Covid-19 pandemic — when Qantas cut 9400 jobs and Virgin Australia, which was placed into bankruptcy and cut 3000 jobs — Rex’s employee numbers increased from 1100 to 1500 and it announced plans to fly into more capital city markets.

Qantas responded, according to Sharp, by moving in on its key regional markets such as Broken Hill.

“What they’ve been trying to do is to squash us, to kill us off by hitting us in these traditional markets and try to undercut us in our basic core marketplace,” says Sharp.

He says Rex is undeterred and has responded by reviewing unprofitable regional routes — for instance cutting Sydney to Lismore, and moving in on Qantas’s Melbourne to Devonport route.

The purchase of Cobham’s FIFO unit, which accounts for about 19 per cent of the FIFO market, is another step in taking it to the market giant, says Sharp.

“This is about not being cowed by the biggest operator in town, and ruining their lunch by moving into these markets that they’ve seen themselves as having complete dominance over, like the domestic market, and like the fly-in-fly-out market,” he says.

Qantas, combined with Alliance Aviation, is the dominant player in the FIFO market. Qantas owns 20 per cent of Alliance and is seeking regulatory permission to purchase the outstanding shares. Together the two account for about 50 per cent of the market.

Virgin Australia accounts for about 20 per cent of the FIFO market through its VARA unit.

For Rex, this purchase gives it a clear scope and direction. Aspirations to seek a bigger share of domestic city routes by directly taking on incumbents Qantas and Virgin were always going to be a challenge.

Cobham’s FIFO business had revenue of $140m last year, which is about half of Rex’s normal revenue in a non-pandemic year.

Rex will pay $48m to purchase that business. On Friday, the airline told the ASX that the acquisition would be half funded by joint venture partners, including its chairman, Singaporean businessman Lim Kim Hai.

“FIFO services are expected to experience strong growth in Australia and this acquisition positions the Rex Group to participate in this booming sector,” says Hai.

“With this acquisition, Rex will have a FIFO arm that is simply unparalleled in Australia. (Cobham subsidiary National Jet Express) has a completely modern fleet comprising eight Bombardier Q400 turboprops and six Embraer E190 jets for FIFO work.”

The Cobham FIFO unit, trading as National Jet Express, operates out of Perth, where it has its own terminal facilities, as well as Adelaide. It also provides freight services in Melbourne, Brisbane, Gold Coast, Sydney and Adelaide.

More Coverage

Originally published as Rex’s John Sharp says buying Cobham’s FIFO arm strengthens his airline in a Covid world