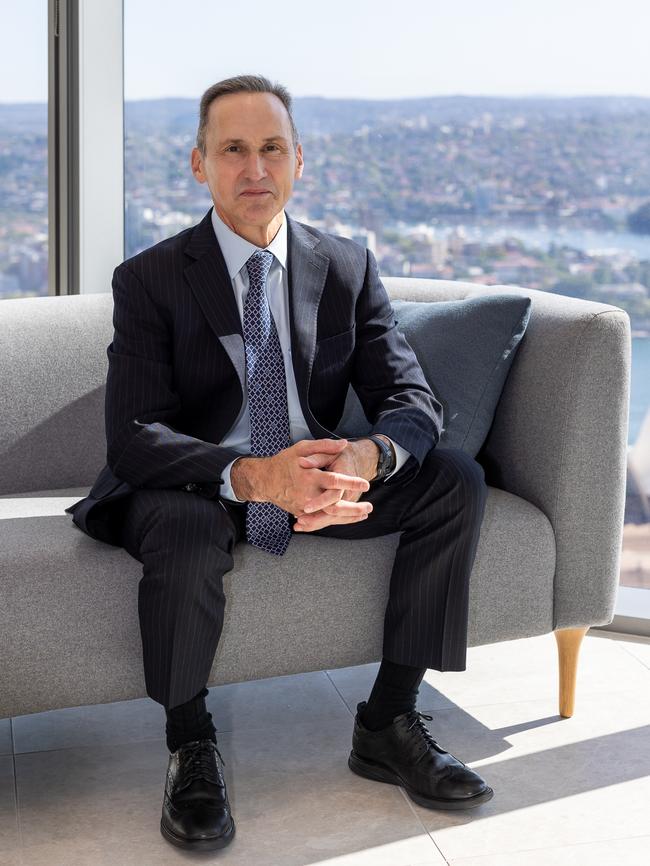

PGIM bonds chief Robert Tipp sees opportunities for investors in US Treasury market

A brutal sell-off in bonds has pushed yields up sharply in recent weeks, but the US Treasury market is now giving a decent buying opportunity for investors.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Bonds have endured a brutal sell-off in recent weeks but the higher yields now on offer in the US Treasury market are giving a decent buying opportunity for investors according to Robert Tipp.

With US inflation coming down and US monetary policy still restrictive according to the Federal Reserve, the managing director and global head of bonds at PGIM Fixed Income expects bonds to benefit from a sharp fall in funding costs in the coming years.

“It’s been a violent market in the short term and a difficult market to trade, but I think it’s a great market for investors,” Mr Tipp told The Australian while visiting clients this week.

In an unusual move, the global benchmark 10-year Treasury yield has soared over 60 basis points from a 17-month low of 3.60 per cent in the space of seven weeks, despite the Federal Reserve cutting interest rates by 50 basis points as expected last month.

Stronger than expected US economic data has raised doubts about the outlook for inflation and US interest rate policy. There have also been jitters about the outlook for US fiscal policy as former president Donald Trump continues to rebound in opinion polls and betting markets.

The sell-off continued for a different reason in Asia-Pacific trading on Monday. Geopolitical tension eased after Israel limited its weekend attacks on Iran to military targets while leaving its oil and nuclear infrastructure unscathed. The 10-year Treasury yield rose as much as 4 basis points to a fresh three-month high of 4.28 per cent. Oil and gold prices fell while US stock index futures soared.

But with soaring tech stocks having compressed the earnings yield on the S&P 500 to about 3.39 per cent, the yield available from “safe” US Treasuries is more than 80 basis points higher.

Of course Treasuries may continue to sell off and the S&P 500 could hit new highs as more tech giants report this week. Strong results from Tesla last week may be a taste of what’s in store.

But while the Treasury market has been volatile in recent months Mr Tipp says the 10-year Treasury yield is more likely to resume its downtrend than retest last year’s highs around 5 per cent.

“The range for the market, I don’t think you can narrow it in quite that finely (as 4-5 per cent), but if I was going to pick a range for it, you know, it would be kind of in the, you know, 3.3 to 4.6 per cent,” he said.

Mr Tipp is also a co-head of the multi-sector team at PGIM Fixed Income, which oversees about $US846bn ($1.24 trillion), making it one of the biggest bond funds globally.

His positive view of bonds comes despite the possibility of Trump winning the election, with risks on tariffs and the budget deficit.

“I think one of the anchors for the market these days that is incredibly powerful and almost non-market, non-economic related, is central bank policy,” he said.

“The Fed is so opinionated on what the neutral rate is that that anchors the market.

“And they are convinced to say in the United States that anything between four and five (per cent) is restrictive.”

Last year, even when the economy was quite strong and inflation was quite high, Fed officials moved decisively to cap the 10-year yield as it approached 5 per cent in September last year.

In the absence of threatening inflation data, he thinks the Fed will continue rapidly cutting rates from the current target range of 4.75-5.00 per cent to below 4 per cent on economic weakness.

“So I think that’s one powerful source of support for Treasuries,” he said.

“I think the other one is the technical backdrop, which is that we’re in a world where there are huge pots of capital, where I think equity allocations have been pushed up by market appreciation, and although non-interest bearing cash balances sure are coming down with QT (quantitative tightening) and as people have spent stimulus, the fact of the matter is the economically oriented interest-bearing money market balances relative to GDP in absolute terms, are incredibly high.

“And so that money is going to bleed into bond funds, and I think that has been the driver of inverted yield curves for a couple years running.”

US inflation is largely under control apart from housing-related inflation which lags.

“There’s the lagging element of the rents and the rolling over of contracts, and there’s also uncertainty as to how much unsold supply in the residential area will come on the market,” Mr Tipp said. “So there have been signs recently, though, that that is really crashing down.

“If that’s the case, we could very well end up a little bit below target on inflation.”

On the other hand, if US immigration continues unabated and housing inflation is 0.4 per cent per month, US inflation could stay above target for longer than expected.

As for why the Fed sees 4.75-5.0 per cent as “restrictive” when the Atlanta Fed’s GDPNow “nowcast” of growth is 3.3 per cent annualised for the September quarter, Mr Tipp says it’s a question of “potential”.

“If we look at the unemployment rate, it’s gone up, even though job growth is strong, there appears to be slack building up in the system and the Fed’s mandate is maximum employment,” he said.

As for the prospect of a slightly higher budget deficit under Trump, Mr Tipp sees only “episodic disturbances” in the bond market as a result.

“So we saw that in 2016 we did sell off on the Trump victory and then in 2017 everything moderated, and the yields came back down. Then in 2018 the fiscal stimulus passed at the end of 2017 and again, early in 2018 and the Fed was hiking rates.

“If you’re in a bearish environment and the budget deficit goes up, people get very concerned.

“We saw that last August (2023) when the Treasury refunding announcement was higher than expected and people were concerned about a hawkish Fed and yields soared to 5 per cent.”

In his view, if the current expansion was debt driven, higher budget deficits might be a problem.

But the corporate sector is in “fantastic shape”.

“The percentage of people buying cars and buying houses all cash is historically very high,” he said.

“It’s just not a debt-driven cycle for the private sector.

“So that leaves a lot of room for the government to come and push in and borrow a lot of money with seemingly very little impact, except inside of the market.”

Originally published as PGIM bonds chief Robert Tipp sees opportunities for investors in US Treasury market