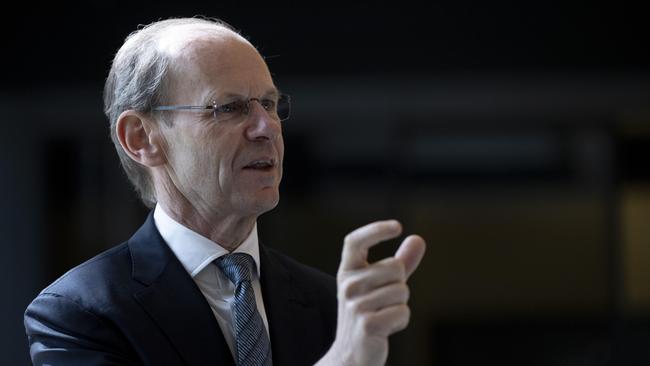

Market too optimistic on rates, ANZ CEO Shayne Elliott warns

The market is expecting the RBA to cut rates this year, but ANZ boss Shayne Elliott still sees potential for the opposite to occur.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

ANZ Bank boss Shayne Elliott believes the market – and his own bank – is too optimistic in its rate cut expectations, warning that a downward move may not come this year.

And while it is not his base case, Mr Elliott also flagged the possibility that the Reserve Bank’s next rate move might be a hike as it battles “hard set” inflation.

“The house view at ANZ is that we’ll probably see rate cuts towards the end of the calendar year. My personal view is that is still optimistic,” Mr Elliott said on Monday.

“I still think that inflation is more hard set in Australia and around the world than people think. Why? Because it’s starting to be built into people’s expectations and what we’re seeing is wages are growing pretty well so people are out spending that little bit more money.

“The economy is a bit more robust than, I think, we give it credit for and I personally think it’s going to be a lot harder to see inflation come down into the target ranges, certainly in Australia, but I think that’s true in other parts of the world as well,” he told Bloomberg TV.

Mr Elliott’s comments come during the Reserve Bank’s rate-setting two-day meeting. The central bank will announce its latest decision Tuesday, where it is widely expected to keep the cash rate on hold.

While ANZ economists are tipping a rate cut at the end of the year, the broader market is expecting the relief to come earlier, pricing in a cut in September and potentially a second before the year is out.

But the RBA board has yet to make any signal of plans to cut interest rates this year, even as inflation tempers to 4.1 per cent, moving closer to its target range of 2-3 per cent.

Mr Elliott warned that a rate hike couldn’t be fully ruled out amid ongoing inflation risks.

“I think the next move is a cut, but you can’t rule out a surprise here. What we’ve learned over the last couple of years is that we should expect to be surprised every now and again,” Mr Elliott said.

“And inflation has been more stubborn than people thought. And so I don’t think it would take a lot for us to see a rate hike.

“It’s not my base case or our house view but you could certainly build a case pretty well, I think, to say that.”

Mr Elliott, who has been at the helm of ANZ for eight years, says from the bank’s perspective cost-of-living pressures are hitting renters rather than mortgage holders, with hardship cases at ANZ sitting at just a fraction of overall home loans.

“The people who have home loans are generally well off. And so that part of the economy, in general, is actually doing quite well. They’re very well employed, their incomes are rising faster than they have for a long time and they’re sitting on quite significant high savings balances, a lot of that to do with Covid,” he said.

“All of the banks have reported this emerging stress in our home loan books, but it’s still much lower than it was pre Covid. So things are getting worse, but from an almost zero base.”

While ANZ has a million home loans on its books, the number of hardship cases at the moment is just “a couple of thousand”, he added.

“People who are renting, they’re the ones who are really doing it tough and really finding it difficult in terms of cost of living.”

But the broader economy is still in good shape, he said.

“Taking a longer perspective, five to 10 years, we’ve got an economy in Australia that actually wants to spend a lot more money in terms of its own infrastructure. There’s still an infrastructure deficit in Australia. There’s big spending plans, quite rightly, around things like defence.

“Then we’ve got a massive housing shortage like many parts of the world, we’ve got to get people out there building homes, apartments, and all the infrastructure that goes with that. And then, of course, the big one out there: the energy transition. The demand on that side is huge. So there’s still a lot of money that needs to be spent in our part of the world and not just in Australia.”

More Coverage

Originally published as Market too optimistic on rates, ANZ CEO Shayne Elliott warns