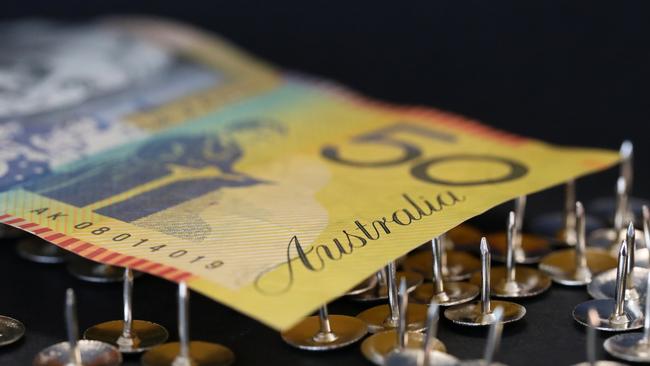

Interest rate rise: mortgage traps that can hurt your household

The Reserve Bank’s latest interest rate rise puts more people in danger of being financially wounded by these four mortgage traps.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Eight straight interest rate rises by the Reserve Bank of Australia leaves many home loan borrowers punch-drunk, putting some at risk of a financial knockout in the months ahead.

Tuesday’s official interest rate rise of 0.25 of a percentage point lifts the RBA cash rate to 3.1 per cent – up from 0.1 per cent at the start of May – and will result in mortgage rates climbing near 6 per cent.

The RBA says it “expects to increase interest rates further over the period ahead”.

When people are dazed or distracted, small money mistakes can multiply into huge financial issues, and the holiday season is a time of distractions.

Here are four interest rate traps threatening to unravel the finances of Australian borrowers.

1. FIXED-RATE CLIFF

A couple of years ago more than 40 per cent of home loans were being fixed at ultra-low interest rates, often under 2 per cent and for two years, as banks battled for customers.

In the next 12 months those fixed-rate terms expire and revert to current interest rates, meaning a massive jump in repayments – potentially $830 a month for a $500,000 mortgage or $1250 a month for a $750,000 loan based on Ratecity.com.au calculations.

Experts call this the mortgage cliff, and the best way to avoid falling off is to know now how much your repayments will rise, and plan strategies to control it.

2. DELAYED ONSET REPAYMENT PAIN

It’s only now that 2022’s barrage of rate rises is starting to hit home.

When the RBA goes up, it can often take a couple of months for the higher repayments to flow through to residential mortgages. Add to that the fact that many households were flush with cash following Covid lockdowns and closures, so did not initially feel the rate rises.

Now, as cash reserves dwindle and borrowers must find around $1000 extra each month, people need to be careful that they have cut spending elsewhere, or risk entering a debt spiral in the new year.

3. FESTIVE FORGETFULNESS

Christmas is one of the easiest times of the year to overspend, whether it’s on presents, parties or travel.

Normally, most debts are repaid when the bills arrive in January, but what if your household budget no longer balances thanks to soaring mortgage repayment costs on homes and investments?

Now is not the time to lose track of money coming in and money going out of your household. Reclaiming control can be as simple as writing down what you spend, and there are free budgeting tools available to download online.

4. INFLATION SURGE

Consumer Price Index data released by the Australian Bureau of Statistics on November 30 suggested the surging inflation of 2022 may be running out of steam, with price rises slipping below a 7 per cent annual rate.

Australia remains in the bottom third of key global economies when it comes to inflation this year, although things could change quickly if there are more supply shocks, a big jump in wages in Australia, or energy bills surging 56 per cent as recently forecast.

Most economists think the RBA rate rise cycle is nearing its end. Borrowers everywhere will be hoping they’re right.

More Coverage

Originally published as Interest rate rise: mortgage traps that can hurt your household