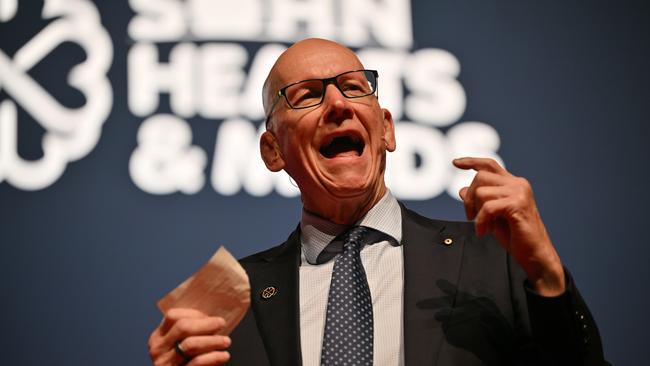

Geoff Wilson is seeking to remove Nicholas Bolton and Antony Catalano from Keybridge Capital

The battle continues to rage as funds manager Geoff Wilson tries to get rid of rival Nicholas Bolton, as well as property investor and media boss Antony Catalano, from Keybridge Capital’s board.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Veteran funds manager Geoff Wilson is trying to get rid of corporate raider Nicholas Bolton from Keybridge Capital’s board as their eight-year feud rages on, as well as media boss Antony Catalano.

Mr Bolton has accused Mr Wilson of “Bolton derangement syndrome” while Mr Wilson has called on Keybridge shareholders to “stand up for their rights” in the face of what he claims is egregious corporate governance failings including allegedly helping to pay for a home for Mr Bolton in Italy’s prestigious Lake Como.

The war between the fundies has been dragged through the ASX, in front of shareholders and before the courts as they make claim and counterclaim over corporate governance issues at Keybridge, and Mr Bolton makes his own accusations against Mr Wilson and what he sees as a personal vendetta funded by his own shareholders’ funds.

Now Mr Wilson’s Wilson Asset Management has written to Keybridge shareholders just before Christmas citing “significant concerns” in relation to the recent actions of Keybridge directors as regards to what it claims is a “total failure of corporate governance for the company”.

WAM Active, which along with Mr Wilson’s Wilson Asset Management owns 45.45 per cent of Keybridge Capital, has written to investors calling for an extraordinary general meeting on February 10 to kick out all directors – Mr Bolton, former Domain boss, entrepreneur and executive chairman of regional group Australian Community Media, Mr Catalano, John Patton and Richard Dukes. He is seeking to replace them with himself, and Wilson Asset Management key staff, chief financial officer Jesse Hamilton and investment specialist Martyn McCathie. Mr Wilson has also nominated financial services executive Sulieman Ravell.

“The convening shareholder (WAM Active) has no confidence in the existing directors remaining in their current roles and is confident the company will be better placed to create shareholder value with the appointment of the proposed directors to oversee the company’s future governance and management,” the WAM Active letter to shareholders stated.

Mr Bolton immediately hit back, telling The Australian on Thursday that Mr Wilson, one of Australia’s most high profile funds managers, had ‘Bolton derangement syndrome’ and was using shareholder funds to pay for “uncommercial personal vendettas”.

“Geoff has a derangement syndrome with me,” Mr Bolton told The Australian.

“It’s gone on for eight years since he wrongly believed I was responsible for an ASIC investigation into him for insider trading. He has wasted a tremendous amount of his shareholders’ funds with nothing to show for it. This meeting is just more of the same.

“It needs to stop.

“I have no respect for (him) and there is no place for him on our board.”

In the latest skirmish in an increasingly bitter and very public war between rival investors, Mr Wilson and Mr Bolton that stretches back to 2016. WAM Active and the Wilson Asset Management funds have built up a 45.45 per cent stake in Keybridge, a small investment play run by Mr Bolton that has a market value of $9.75m.

The duo, at each other’s throats for almost a decade, are some of the best known fundies in Australia due to their corporate activism and investment strategies.

Mr Wilson has almost 40 years experience in investment markets and founded Wilson Asset Management in 1997 which now oversees a range of listed funds including WAM Active which has a market value of around $63m.

Mr Bolton made a name for himself 16 years ago when at the age of only 26 he went to war against banking giant Macquarie Bank and Leighton Holdings over struggling Queensland toll road operator BrisConnections. That deal saw him make $4.5m from an $800,000 investment as he took advantage of BrisConnections shares which slumped to 0.001c and threatened to wind up the company.

Last year, Mr Bolton repeated that play by notching up a $17.6m payday from embattled funds management Magellan Financial Group by scooping up options in its Magellan Global Fund to then engineer a payout to shareholders.

Now that payday from the Magellan play seems to have sparked the latest round of fighting words between Mr Wilson and Mr Bolton.

Mr Wilson’s letter to Keybridge shareholders says his concerns were raised when the Keybridge board decided to pay Mr Bolton a $4.95m bonus or fee relating to the Magellan options deal, a payment representing around 39 per cent of Keybridge’s assets at the time. The payment was accelerated and paid to Mr Bolton in July to help pay for a property Mr Bolton had bought in Lake Como, Italy, the letter claims.

In his own letter to shareholders, Mr Bolton hit out at the actions of Mr Wilson.

“After successfully defending nine months of vexatious litigation from WAM Active including an order for costs in Keybridge Capital Limited’s favour, Keybridge notes that WAM Active have now purported to send a notice under section 249F of the Corporations Act to shareholders to consider resolutions to remove all of the Keybridge directors.

“Keybridge continues to be disappointed in WAM Active’s ongoing conduct to frustrate the operation of the company for what appear to be uncommercial purposes.”

The Magellan options deal profits and subsequent payments to Mr Bolton has triggered its own running court case battle between the funds managers.

Originally published as Geoff Wilson is seeking to remove Nicholas Bolton and Antony Catalano from Keybridge Capital