Warnings of chance of August rate rise, ‘painful’ recession looms

Consumer and business confidence is in the “gutter” yet economists are warning interest rates still could be hiked again.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

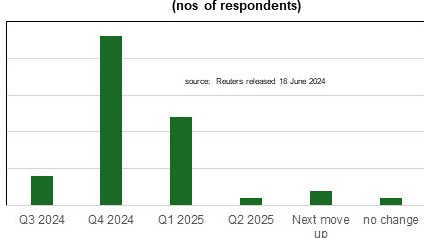

Top economists have put the chance of a rate hike in August as high as 40 per cent, dashing any hopes of relief from high mortgage repayments any time soon amid warnings the economy is on a “knife’s edge” and could be plunged into recession.

As widely anticipated, the Reserve Bank of Australia (RBA) held rates at 4.35 per cent at its June meeting despite discussing a 0.25 per cent hike as a potential move.

But in her follow up press conference RBA Governor Michele Bullock signalled a rate hike was a “live event”, according to Betashares chief economist David Bassanese, especially if the June quarter Consumer Price Index (CPI) result on 31 July is disappointingly high,

“The RBA made note of the higher-than-expected monthly April CPI result and recent revisions to the national accounts that revealed consumer spending last year was stronger than previously thought,” he said.

“This new information highlights the risk of higher for longer inflation, underpinned by higher consumer spending especially given new tax cuts in July.

“Using its most delicate bureaucratic language, the RBA could not help but concede that recent federal and state budget outcomes may have an impact on demand.”

The RBA also seemed somewhat dismissive of new energy rebates, noting they will only “temporarily reduce headline inflation”, with the implication being their impact on underlying inflation over the longer term is less clear, Mr Bassanese added.

Further labour market softening through either a lift in the unemployment rate or a further weakness in corporate hiring intentions would also have an influence, he noted.

“The key issue will be how the balance of data over coming weeks influences the RBA’s updated set of inflation forecasts in early August,” he said.

“If in August the RBA feels the need to upgrade its longer-term forecasts – such as by lifting its trimmed mean annual inflation forecast for December 2025 to 3 per cent or more – from 2.8 per cent at present – it may feel compelled to raise rates at the August policy meeting,” he said.

“That said, at this stage, however, I only attach a 40 per cent chance to an August rate hike. This is because I forecast quarterly gains in headline and trimmed mean inflation of no more than 0.8 per cent in the June quarter, which would be consistent with the RBA May forecast of 3.8 per cent annual growth for both.

“Any further upside surprises to inflation, however, whatever their cause – would be hard for the RBA to ignore.”

‘Unnecessary and painful recession’

But the economy is on a “knife’s edge” and the emphasis should move away from inflation to rebuilding the economy, warned Deloitte Access Economics partner, Stephen Smith.

“An over-exaggerated emphasis on demand management in a weak economy and with inflation trending down will only result in an unnecessary and painful recession,” he said.

“Earlier this month National Accounts data confirmed that the economy is barely crawling along, with economic growth to the March quarter the lowest it’s been since the 1990s recession, outside of the pandemic. On a per capita basis, Australia has been in a recession for over a year.”

While monthly unemployment and inflation results are variable, the trend is clear: inflation is on its way down and unemployment is on its way up, Mr Smith added.

“Meanwhile, consumer confidence and business investment are in the gutter. This is an economy navigating a delicate rebalancing. In that context, trying to force inflation down faster by raising rates even higher would interrupt this rebalancing and push the economy into an official recession,” he warned.

“It would also be an incredibly ineffectual move as factors most heavily contributing to inflation like rent and insurance costs cannot be directly suppressed through rate rises.

Nobody likes the fact that inflation remains just outside of the RBA’s target band. But it is better than a recession.”

The only way to get the economy moving while continuing to bring inflation is to increase productivity in the economy through policy and reform – not interest rate hikes, he added.

Economists split

Bank of Queensland chief economist Peter Munckton was one of the finance experts that noted the RBA had emphasised that inflation is not falling as fast as anticipated and that the economy is operating above capacity.

He warned with both inflation and the unemployment rate at around 4 per cent the only move that can take place in the cash rate over the next two to three meetings is up, but this would hinge on what happens next.

“Unless the June quarter CPI figure is well above RBA expectations then I think the weakness of economic growth will be enough to keep the cash rate unchanged,” he said.

“Government subsidies and tax cuts will mean that households will have more money to spend in the second half of this year. This should lead to some pick-up in economic growth. But some of this extra money will be saved or will be needed to fund higher mortgage payments for borrowers still rolling off low fixed rate loans.”

Mr Munckton believes the most likely next move in interest rates is down, although he said they have not completely moved away from the possibility of a rate hike.

“For that to happen the underlying inflation rate over the next couple of quarters will need to move down from its current level of around 4 per cent,” he said.

“That is my forecast, and why I think the cash rate has peaked. The current inflation and unemployment rate though means a rate reduction is looking like a 2025 story.”

Inflation stating to ‘dig in its heels’

Yet the RBA is in the midst of a difficult balancing act and it’s getting trickier by the day, said Moody Analytics’ economist Harry Murphy Cruise.

“To date, the board has been content with slower progress on bringing down inflation if it meant unemployment wouldn’t rocket,” he said.

“The approach has largely been successful; inflation has fallen substantially from its peak in 2022 while unemployment is still well below pre-pandemic levels.

“Now, inflation is starting to dig in its heels — or “proving persistent” as the RBA describes. What’s more, a host of cost-of-living supports are due to hit bank accounts in July. All that is starting to test the board’s slow-and-steady strategy.”

Governments cost of living supports due to start in July risks inflation becoming “stickier”, he added.

“The board has made clear they’ll look past rebates’ mechanical lowering of headline inflation and instead focus on the underlying data. The path of that data all depends on how much of the supports get spent, and how much gets squirrelled away into savings,” he said.

“If they’re spent, it would add to demand at the exact same time the RBA is trying to take it out, adding to underlying inflation even if the headline figure comes down. To be clear, we don’t think the new supports constitute a “break in case of emergency” hike. But they do warrant close attention.

But like the Bank of Queensland chief economist, he was backing the next move as down.

“But we’re less confident the cut will come before Christmas,” he said.

“Still, we put a two-thirds probability of a cut in December. At that time headline inflation should be around 3.3 per cent and returning to the RBA’s 2 per cent to 3 per cent target band by the middle of 2025.”

Cost of living relief measures a real concern

One key issue to recognise is that the cost of living relief policies that have been implemented by state and federal governments are likely to artificially lower the measured rate of inflation, KPMG chief economist Dr Brendan Rynne said.

“The consequence of these novel policy measures is that there is a good chance we will see a sub-3 per cent rate of inflation for a quarter or two, and unless those temporary measures are renewed then it is highly likely that inflation will then kick back up,” he said.

These cost of living policies may provide some temporary relief for households but it is clear they are also going to create more uncertainty about the underlying inflation pressures, he added.

“This muddies the water for the RBA, potentially contributing to a second round of inflation if the RBA loosens the policy rate too soon,” he cautioned.

However, he still backed the first rate cut as potentially occurring around November or December this year.

Rate cuts in 2025

HSBC chief economist for Australia and New Zealand, Paul Bloxham, also believes the RBA is going to remain patient, accepting that the disinflation process will take some time yet, with the trade-off being that they maintain more of the gains in the jobs market.

“We see the RBA on hold in 2024, with its first cut not delivered until quarter two 2025,” he said.

“That said, we see a higher risk of the cash rate being increased further in the second half of 2024, than of it being cut. We ascribe a 30 per cent chance to a 0.25 basis point hike in the second half of 2024.”

Cuts would be a welcome relief as while most borrowers are keeping their mortgage repayments on track, but the latest data from APRA for the March quarter shows mortgage arrears are trending higher, CoreLogic research director Tim Lawless said.

“With interest rates set to hold at their current levels until at least late this year, alongside a gradual loosening in labour market conditions and reduced saving buffers for most borrowers, it’s likely mortgage arrears will rise further,” he said.

Originally published as Warnings of chance of August rate rise, ‘painful’ recession looms