Ian Macfarlane, Peter Costello warn against ‘error’ of removing key power in RBA shake-up

A former RBA governor and a former treasurer have teamed up to slam the government over plans to remove a major design of the RBA in their shake-up.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

A former Reserve Bank governor has slammed the government’s intention to remove a provision that allows the treasurer to override a decision from the central bank.

The government has introduced legislation following last year’s Reserve Bank review to “modernise” the central bank, including a provision to remove section 11 of the original act.

That section allows the treasurer of the day to “overrule” a monetary policy decision in extremely rare circumstances.

The powers have never been used – although former prime minister Paul Keating came close while treasurer in the 1980s.

They were built into the Reserve Bank Act for a “just in case” scenario where the government and central bank were at loggerheads over monetary policy.

In a senate economics committee hearing on Thursday, former RBA governors and treasurers, and economists alike said removing the powers would be an “error” – putting them on a unity ticket with the Greens, Mr Keating and unions.

They said it would remove democratic oversight and would rid the government of accountability when it comes to monetary policy.

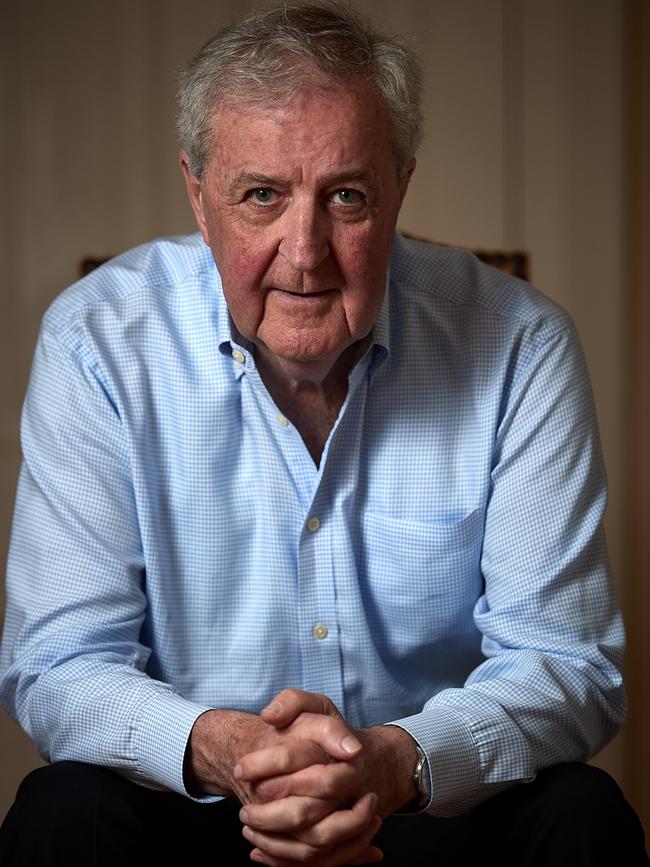

Ian Macfarlane, who served as RBA governor from 1996-2006, told the committee he didn’t understand why removing the power was on the agenda.

“I don’t think there’s any deep thinking gone on behind the decision to get rid of section 11,” he said.

“I think it actually provides independence against the government … (influencing).

“It provides protection against that. But at the end of the day, the elected government has to have priority, if the issue was big enough.”

He said if the power was removed, and later became necessary, the government of the day would have to throw together legislation which could have unintended consequences.

Current governor Michele Bullock said she was “agnostic” to the government’s plans to remove the powers.

“It’s a matter for the government and the parliament,” she said.

The RBA review panel also defended the recommendations, saying the idea came from “best practice” and came based on how the central banks in the United States and United Kingdom operate.

Think tank the Australia Institute the section 11 “should not be removed”.

Executive director Richard Denniss said for the RBA board to be truly independent, that independence could be “enhanced by having a simple mechanism whereby the parliament can overrule their decisions”.

“Ultimately, the RBA is not independent of parliament … It is, I would suggest, ridiculous to suggest that in any sense the RBA will ever be entirely independent of the government.

“And if the independent RBA is overruled by the government, that’s okay, because the RBA, the public will know what the RBA’s view on this was and the public will know what the government’s view was.”

Former treasurer Peter Costello said the only reason to remove section 11 was “if you don’t trust government”.

“You’ll always find economists still say parliament should give up its power because they’re economists. They believe they should have the power,” Mr Costello said.

“I can only think that the parliament would give up its power if it doesn’t trust itself.

“I don’t think that’s a very good principle. So I don’t think we will improve things by getting rid of it.

“And I would recommend strongly against multiplying the bureaucracy inside the bank by having two boards.”

Mr Keating made his thoughts known last year, when the review was released.

“Political power, its management and employment in office, must, in a working democracy, take precedence over any subordinate bureaucratic structure,” he told the ABC.

Greens economics spokesman Nick McKim said the party would move an amendment in parliament to retain the section that gives the treasurer override powers.

Originally published as Ian Macfarlane, Peter Costello warn against ‘error’ of removing key power in RBA shake-up