‘Not immune’: Federal budget warns that global ‘uncertainty’, driven by Donald Trump, is threatening Australia

The Treasurer isn’t naming Donald Trump in his warnings about Australia’s economic outlook. But the subtext of his words can’t be missed.

Fed Budget

Don't miss out on the headlines from Fed Budget. Followed categories will be added to My News.

“Heightened global uncertainty” and “subdued global growth” are among the chief underlying concerns outlined in the federal budget papers.

Treasurer Jim Chalmers did not name US President Donald Trump in his speech to parliament on Tuesday night, but the man still loomed over proceedings. How could he not?

“The global economy is volatile and unpredictable,” the Treasurer said.

“The 2020s have already seen a global pandemic, global inflation and the threat of a global trade war. The whole world has changed as a consequence.

“Tariffs and tensions abroad have been accompanied by storms at home.”

The “storms at home” there are both figurative and literal – Dr Chalmers noted that the damage from Cyclone Alfred could “wipe a quarter of a percentage point” off Australia’s quarterly growth figures.

“But storm clouds are gathering in the global economy too,” he said.

“Trade disruptions are rising, China’s growth is slowing, war is still raging in Europe, and a ceasefire in the Middle East is breaking down.”

Some of that obviously has nothing to do with Mr Trump. He doesn’t control economic policy in China, or the war in Ukraine (despite his best efforts), or the fighting in the Gaza Strip.

But global trade disruption? That part is absolutely an allusion to Mr Trump’s policies, specifically his intention to impose sweeping tariffs on the rest of the world.

Australia is already being affected by the American President’s announcement that steel and aluminium imports to the United States will cop significant tariffs.

Prime Minister Anthony Albanese tried to secure an exemption, for Australia, from these tariffs, in the same vein as the exemption we got during Mr Trump’s first term. That effort went nowhere. It seems Mr Trump is determined to grant no exemptions this time, for any country at all.

And the problem doesn’t end there. Starting early next month, the Trump administration intends to impose “reciprocal tariffs” worldwide. Every single product imported to the United States, from any other nation, will endure a tariff rate determined by a range of factors, such as existing tariffs in the other country, and policies from its government that support the relevant industry.

It’s complex. The point is, the United States is going to impose higher costs on pretty much all imports. That has significant ramifications for its trading partners, of course, and also for the global economy in general.

When the world’s biggest trading entity goes rogue, it affects everyone.

The other factor is Mr Trump’s volatility. We have seen this in action already in his dealings with America’s immediate neighbours, Canada and Mexico.

Multiple times, since he took office in January, Mr Trump has announced comprehensive tariffs on those countries only to rescind or tweak them a day or two later. For example he imposed across-the-board tariffs on imports from Canada, only to exempt the car-making industry after lobbying from its biggest companies.

That policy whiplash has consequences.

“This budget is our plan for a new generation of prosperity in a new world of uncertainty,” Dr Chalmers told parliament.

“It is even more important and even more remarkable that Australia’s economy is turning the corner when we know the global economy is taking a turn for the worse.”

That message is reinforced, albeit with a little less political bunting, in the budget papers.

“There is heightened uncertainty in the global economy. Escalating trade tensions risk hindering global growth by disrupting trade and investment flows and driving up costs for businesses and consumers,” the papers note.

“This comes on top of the volatility and uncertainty from two major global conflicts.

“This volatility and uncertainty will weigh on the global outlook. The global economy is expected to grow by 3.25 per cent in each of the next three years. If realised this would be the longest stretch of below-average growth since the early 1990s.

“Australia is not immune from these global pressures but is well placed to navigate them.”

The chart above shows how the American stock market has performed since Mr Trump won last year’s US election, relative to the rest of the world. You can see the sharp drop roughly a month after he took office – it correlates with his tariff rhetoric.

For now, that’s just a stock market downturn. OK. But what happens if America’s broader economy stalls? What happens if Mr Trump’s tariffs raise the cost of trade worldwide? That’s a recipe for lower growth, and higher inflation, not just in the US but everywhere else.

For now, Treasury predicts growth will accelerate in Australia across the forward estimates, reaching 2.75 per cent in 2027, while falling to 2 per cent in the US.

Dr Chalmers argues Australia is about as insulated as it can be from any potential shocks.

The budget papers note that global inflation has “moderated”, to a point, from its peak in the immediate aftermath of Russia’s decision to invade Ukraine. But “the fall in inflation appears to have stalled in many major economies” and the global outlook is “clouded”.

“This has prompted some central banks to adopt a more cautious stance towards further monetary policy easing, which poses a downside risk to the global outlook,” they say.

“Inflation is expected to continue to moderate across major advanced economies in 2025, but more gradually.

“Outside of Australia, very few advanced economies have managed to reduce inflation while sustaining a robust labour market and recording continuing economic growth.”

Ultimately though, the Australian government cannot control what the Trump administration does. We’re at the mercy of decisions over which we have vanishingly little influence.

Nobody wins

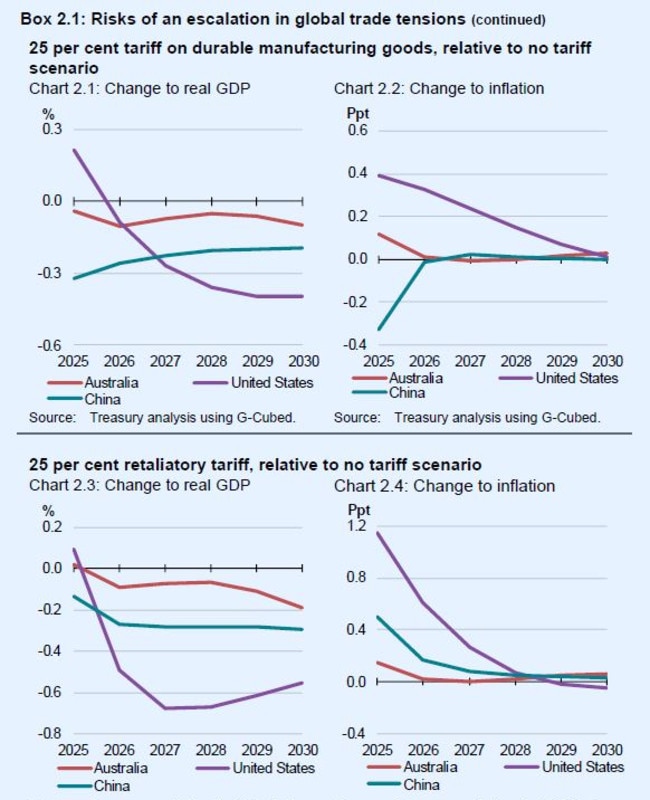

Treasury has modelled a couple of scenarios to demonstrate the impact Mr Trump’s tariffs could have on both the US economy and our own.

“Tariffs generally raise prices for businesses and consumers by increasing the cost of imported goods, which lowers growth,” it explains in the budget papers.

“Tariffs directly imposed on Australian exports lower demand by making them more expensive to purchase in the country imposing the tariffs. This effect could be offset to some extent by a depreciation of the Australian dollar, which would make Australian exports less expensive in foreign currency terms.

“The Australian economy will also be affected indirectly when tariffs are placed on the exports of countries that use Australian exports as inputs. This indirect trade effect can be larger than the direct effect, given Australia exports large volumes of raw materials that are often used to produce goods that are then exported.”

In essence, tariffs tend to be bad for everyone involved. Though in this case, Mr Trump would likely end up doing the most damage to his own country.

Something else to keep in mind: if Australia were to retaliate against America’s tariffs by imposing its own equivalent tariffs in return, the pain would be worse.

“The loss in real GDP is amplified for all countries” in that scenario, Treasury warns, “as is the increase in inflationary pressures”.

‘Five seismic changes’

In his speech to parliament, Dr Chalmers identified five “seismic changes” that are currently “shaping this new world of uncertainty”.

• The shift from globalisation to fragmentation;

• From hydrocarbons to renewables;

• From information technology to AI;

• From a younger population to an older one;

• And changes to Australia’s industrial base.

The Treasurer argued these factors – these shifts in the nature of the global economy – put “a premium on resilience”. The government’s answer to that challenge is what it calls its “Future Made in Australia agenda”, which is a nice, bland governmenty name for an umbrella of policies largely aimed at transitioning Australia to cleaner energy.

“In this budget, we are investing more than $3 billion to support the production of Australian-made green metals like aluminium and iron,” Dr Chalmers said.

“We’re also backing clean technologies through our Future Made in Australia Innovation Fund and by recapitalising the Clean Energy Finance Corporation.

“This will help develop new industries in clean energy manufacturing, green metals and low carbon liquid fuels, and unlock private investment.

“This agenda is about recognising that our future growth prospects lie at the intersection of our industrial, resources, skills and energy bases and our attractiveness as an investment destination, so we can grasp the jobs and opportunities of the net zero transformation.”

The idea is to give potential investors a degree of certainty, at a time when it’s in short supply overseas. That might be difficult, of course, with an election looming in the very near future.

Originally published as ‘Not immune’: Federal budget warns that global ‘uncertainty’, driven by Donald Trump, is threatening Australia