Popular pub collapses owing more than $1m, just 63c left in bank account

The 135-year-old pub had just 63c left in its bank account when it went bust.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

A popular pub that collapsed earlier this month owed more than $1 million to creditors and had just 63c in its bank account at the time of its liquidation, according to a leaked report.

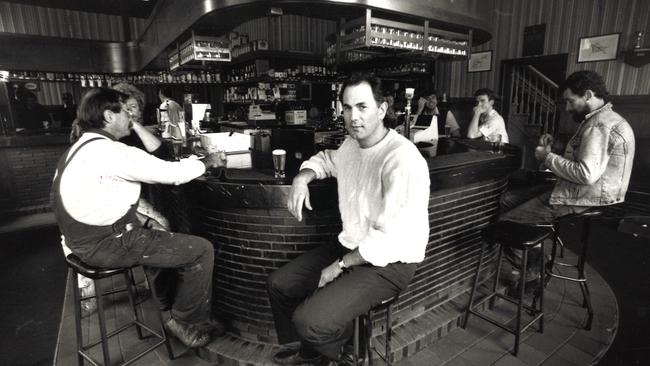

The iconic Carringbush Hotel, in the inner Melbourne suburb of Abbotsford, stopped trading at the start of June before being placed into liquidation just two days later.

The pub group’s owners had cited “horrendous” expenses as the reason behind its closure, adding they would need to charge a whopping $20 for a single beer to survive.

They had also been locked in a bitter legal battle with the building’s landlords before its demise.

Now an initial report to creditors from insolvency firm CJG Advisory, which was leaked to news.com.au, has revealed the extent of The Carringbush Hotel’s financial woes.

It had sunk $1.05 million into debt with employees owed tens of thousands of dollars, the report from liquidator Mathew Golant showed.

“The directors have advised that there are employee entitlements of $39,363 owing at the time of my appointment,” Mr Golant wrote in his report.

Carringbush Hotel operator Liam Matthews told news.com.au the owners have personally undertaken the staff entitlements, this was always going to be the case and was explained to them.

“Some are now working for us at another venue so I am not sure that would be the case if we separated on poor terms,” he said.

“We, the owners, are one of the biggest creditors on the list with our other company with a debt of $324,000. This was from money used for the initial renovation and was something that just sat on our reporting system.”

Restaurant equipment from a fit out five years ago was worth $60,500, the report said, but the landlord had taken possession of them due to debts owed.

One of the biggest creditors was the Australian Taxation Office with a debt of $460,000 accumulated.

Other suppliers listed as creditors included seven breweries with combined debts of more than $20,000, alcohol suppliers owed amounts between $1135 and $1848 and Origin Energy with an unpaid bill of $4000. There are also food suppliers owed amounts up to $2000.

Mr Golant added the pub had ceased trading due “to ongoing business trading losses” in his report.

The 135-year-old pub had announced on Facebook on May 27 it was closing its doors for good after five and a half “amazing years”.

“Like most, we are feeling the current financial pinch and instead of running the gauntlet we have decided to go out on a high,” its post read.

“We have the best group of staff, locals and regulars and to all of you, thanks for everything. We would love to see as many of you as possible this week for one hell of a huge party, then again on Sunday for a few bloody Marys for our last day of trade.

“From today we will not be taking any more bookings. Walk-ins only. Our menu will slowly wind down and the taps are running dry.”

The pub had offered a vegan menu with burgers costing $28.

It comes at a time when a growing number of pubs and breweries struggle during the cost of living crunch.

On Monday, Melbourne-based Alchemy Brewing Co posted on social media to say they’d “had a rough ride” and that “it’s time to call it quits”.

The embattled business revealed to its several thousand followers that its last day of trading will be the end of this week, on Friday.

Earlier this month, popular Sydney outfit Malt Shovel Brewery announced it would be shuttering at the end of August.

A number of other independent breweries have gone into administration in the past year including Brisbane-based Ballistic Beer Company, Adelaide business Big Shed Brewing, Melbourne-based breweries Hawkers Brewery and Deeds Brewing, and the Wayward brand and Akasha Brewery, both from Sydney.

Originally published as Popular pub collapses owing more than $1m, just 63c left in bank account