‘Billions in forgone revenue’: How NSW could have pocketed $6.2B in coal royalties

A report has revealed how one state could have been $6.2B richer if it had committed to one major system already adopted by another.

NSW could have been up to $6.2B richer last year if it had adopted Queensland’s lucrative coal royalty system, a new report has found.

The newly minted Labor government has not committed to whether they will adopt such a policy, insisting the royalties to be collected this year remain “well-above” the average collected over the past five years.

This is despite progressive think tank The Australia Institute finding such a measure would have generated another $6.2B in coal royalties this financial year alone.

“This is billions in forgone revenue that could be invested in health, education, transport and a wage rise for NSW workers,” research director Rod Campbell said.

In June last year, Queensland Treasurer Cameron Dick announced a raft of new rates for Queensland coal after a 10-year royalty freeze ended that same month.

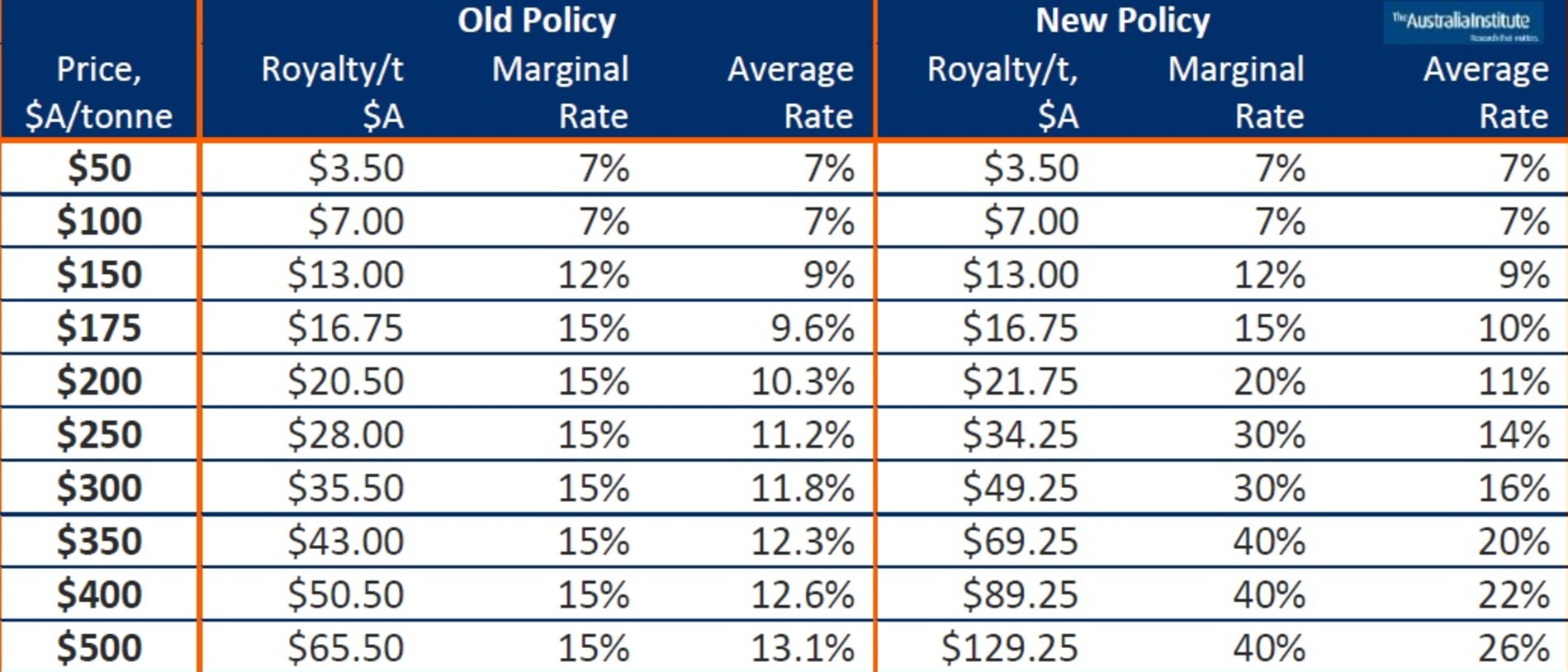

Royalties were initially charged at 15 per cent at prices over $150 per tonne.

New rates are now valued at 20 per cent for prices above $175 per tonne and 30 per cent for prices above $225 per tonne.

A maximum rate of 40 per cent was also announced for prices over $300 per tonne.

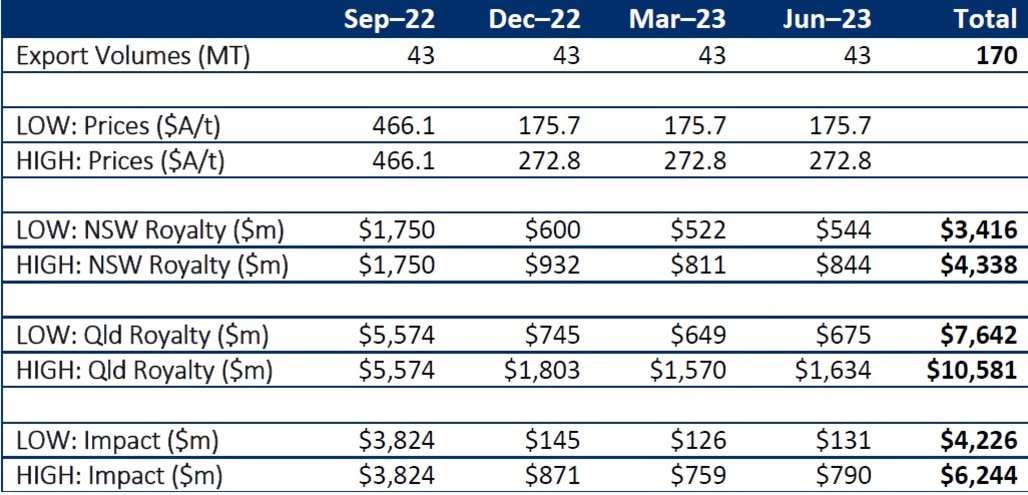

In their report – titled Northern direction: If NSW had the Queensland coal royalty system – authors Matt Saunders and Mr Campbell are forecast to generate up to $4.3B in additional revenue over the 2022-23 financial year.

They found if a similar system was put in place in NSW, it would have raised between $4.2 and $6.2 billion this financial year of extra revenue this financial year.

The report clarified the differences between the high and low price scenarios were “relatively small” because they both shared the same historically high price in the September quarter.

“Even if prices dip back to the low prices forecast in the NSW budget papers the single quarter price spike generates over $3.8B in additional revenue compared to the existing policy,” the report states.

Mr Campbell said both major parties in NSW had avoided the topic throughout their election campaigns.

“This should be a key issue for independents and minor parties in the next NSW parliament,” he said.

“(It’s) an area where the crossbench could push for constructive reform.”

The former Perrottet-led Liberal government in February announced a freeze on mining royalty rates – delaying any promised hike until June next year.

They were defeated by the Labor Party, led by Chris Minns, on March 25.

A NSW Government spokesman said they had begun receiving “departmental briefings” on the topic when asked if there were any plans to adopt a similar royalty system to Queensland.

“Labor did not propose any change to royalty rates during the election campaign,” the spokesman said.

“The NSW Government expects the royalties for the next financial year to be more than $3.7B.

“Although down on the expected record levels of this financial year, the forecast remains well above the average royalties collected during the past five years.”

NSW Mining Council chief executive Stephen Galilee said royalty revenues have grown significantly in recent years, rising from $1.4 billion in 2020-21 to $3.7 billion in 2021-22.

He told ABC Radio that NSW was paying “record royalties”.

Mr Galilee said Queensland’s change was a “shock” to the resources sector as it was “way above” NSW’s current rate of 8 per cent on coal royalties.

“The Australia Institute is calling for increased royalties to be imposed on the coal sector because they want to hurt the coal sector,” Mr Galilee claimed.

“There’s not a coal mine they don’t want to see close … they are a threat to Hunter coal mining jobs.

“They’re hiding behind the facade of the need to transition when what they’re all about is imposing additional cost burdens on the industry to reduce its competitiveness and make it more difficult to operate coal mines in NSW.”

Energy prices over the past few years have skyrocketed from the ongoing Russian invasion of Ukraine.

But previous research by The Australia Institute has found coal companies were collecting windfall profits as the value of coal exports climbed to $112B over 2021-22.

The report From Russia with love: Coal profits from war in Ukraine – published in December 2022 – estimated windfall gains to coal companies over 2021-22 were between $38B and $45B.

Between $13 to $23B of this was “directly attributable” to turmoil in energy markets from the war in Ukraine.

Originally published as ‘Billions in forgone revenue’: How NSW could have pocketed $6.2B in coal royalties