The five big mistakes inside the Qantas boardroom

A forensic look at Qantas’s failings finds the overriding theme was a dominant, long-term CEO who called all the shots in the face of a weak board.

A forensic look at Qantas’s failings finds the overriding theme was a dominant, long-term CEO who called all the shots in the face of a weak board.

A former bank employee’s life has been “destroyed” by allegations she defrauded multiple banks out of tens of thousands of dollars, a court has been told.

Glencore is reframing the debate on coal’s future. Some of Australia’s biggest investors will be quietly cheering the miner on.

The Australian got a look at Coles’s ultra-high-tech new warehouse that has just given it the edge over rival Woolworths.

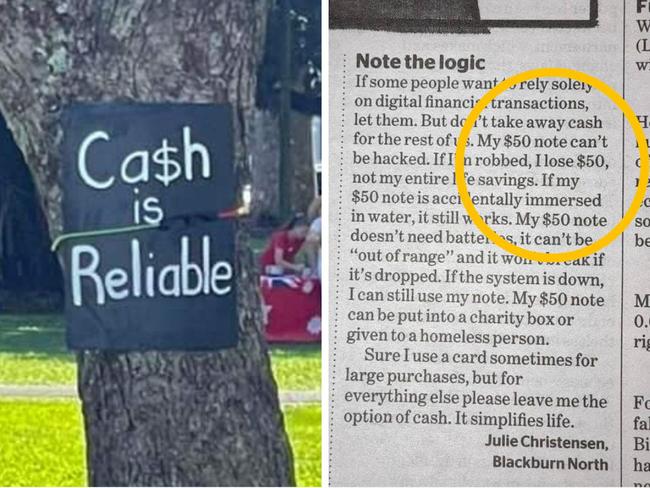

A Melbourne woman’s rant to her local newspaper about the dangers of moving to a cashless society has resonated with thousands of Aussies online.

Six years after the big four banks ‘dropped’ ATM fees for non-customers, experts are warning of a trend that’s hurting Aussies’ pockets more than they may realise.

Private equity senses a big opportunity in the demise of scandal-hit PwC.

The Reserve Bank is now “impotent” and more rate hikes, as foreshadowed in Tuesday’s decision, will do nothing to further tame inflation, an economist says.

A group of protesters have gathered outside the Reserve Bank as Philip Lowe hands down his latest decision on interest rates.

Bucking economists’ predictions, the RBA has kept the official cash rate on hold. Here’s how the banks have reacted.

Australians with a side hustle can make the most out of their upcoming tax returns by following these simple tips.

Some homeowners face a 63 per cent increase in their monthly mortgage repayments as they are hit with much higher rates.

Interest rates on savings accounts are heading for record highs, but there’s usually a catch that Aussies should be aware of.

An Aussie boss accidentally sent more than half a million dollars to the wrong bank account, but the owner hasn’t been found.

Original URL: https://www.themercury.com.au/business/companies/banking/page/77