Why one generation has been screwed by COVID-19 economy

Fact is, every generation must play the financial hand they’re dealt, and as a result of coronavirus one generation just got handed the Joker. But there are ways they can still fight their way up the money ladder, writes Barefoot Investor.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

My editor emailed me with a request on Thursday: “Can you do a piece on the Treasurer’s economic update to the nation?”

My answer? Sure, and I can do it in one line: “The Treasurer is throwing the kitchen sink at COVID like there’s no tomorrow.”

So today I thought we’d talk about the people who are really getting screwed right now.

People like 17-year-old Louise, who sent me this question:

“Hi Scott, I’ve been reading The Barefoot Investor as I am interested in kickstarting my financial freedom. However, I am only 17, and about to graduate, so I don’t have a strong income. I am slowly working towards setting up the different bank accounts but I am having trouble with the advised percentages for each. Any advice on how to get ahead?”

Yes, Louise is still a kid. She’s not old enough to vote, but she’s young enough to spend the rest of her working life paying off the multibillion-dollar promises our politicians are making today.

Thankfully, the concept of shouldering an unfair amount of future government debt isn’t high on her priority list.

Louise is more focused on the here and now — and with good reason: her age group has been the worst hit in this crisis, with a staggering 44 per cent of the jobs lost this year belonging to 15-to-24-year-olds.

Now, Louise, here’s the thing: our lives are shaped by our experiences, right?

My generation’s experience has been 29 years of non-stop economic growth, falling interest rates, and rising house prices.

Yours will be different.

As you grow up and get the keys to the (err) Uber, you’ll be starting your working life at the bottom rung of the employment ladder, leaning up against the worst economic downturn in a century.

Fact is, every generation must play the hand they’re dealt, and you just got a Joker (Donald Trump).

Contrast this to your parents and grandparents, who’ve enjoyed the greatest economic boom in history. Lucky buggers, right?

Well, maybe. However, the irony is that this long boom has softened people up. It’s allowed them (well, many of them) to paper over their financial mistakes. And, as a result, many older Aussies have never had to learn much about managing their money.

You will, though. You won’t have a choice.

Yet thankfully you’re two steps ahead of most people — you’re asking the right questions while you’re still a teenager.

So don’t fret about the percentages; you’re already on the right track by setting up your savings buckets.

What that tells me is that they’re going to fill up. It’s only a matter of time — and you’ve got plenty of that.

And if all this doom and gloom is getting you down, know this: the last generation that encountered genuinely tough times was that of your great-grandparents, who lived through the Depression.

The tough times hardened them into one of the greatest generations in history.

Tread Your Own Path!

ASK BAREFOOT YOUR QUESTIONS:

ISSUE A RETRACTION NOW!

RUTH WRITES: Firstly, love your work. You’ve changed our financial lives in a significant and very positive manner. But secondly, and more importantly, I hate to tell you but your article about weighted blankets is actually very risky. Weighted blankets are something that typically are only prescribed by occupational therapists and are not to be used while sleeping. There have been many cases of people (particularly children) suffocating when these have been left on. As an occupational therapist myself, I would never recommend using one for sleep (it can be used as an aid to fall asleep but MUST be removed). Additionally, the weight should not be more than 10 per cent of your body weight. So if a small person (or child) is given a 10kg blanket, as suggested last week, the risk of suffocation is much higher. May I kindly suggest retracting your column, or sending an additional disclaimer!

BAREFOOT REPLIES: Strewth, Ruth! It’s bad enough that each week my finance column has to be vetted by lawyers (for disclaimers and defamation).

Now you’re telling me I have to worry about giving blanket statements … on blankets?!

In my defence, I was writing about my own experience as an adult and not suggesting you give them to your kids.

(Then again, with three kids under the age of seven, maybe tying them down a little so they don’t always end up in our bed doesn’t seem like such a bad idea …)

“Strike out that last line!” warned the lawyers.

“It was written in jest!” I pleaded.

Yet point taken, Ruth. You need to be careful with these blankets, especially if you’re a kid (or a supermodel).

Seriously, though, fair suck of the sav: surely no one takes my advice in the bedroom, right?

HELL’S KITCHEN

GARY WRITES: My wife and I are in our early 30s and are both nurses. She has decided she wants to put our money into starting a restaurant. I think it is a terrible idea, considering our lack of experience and the low success rate of restaurants. Please help me change her mind!

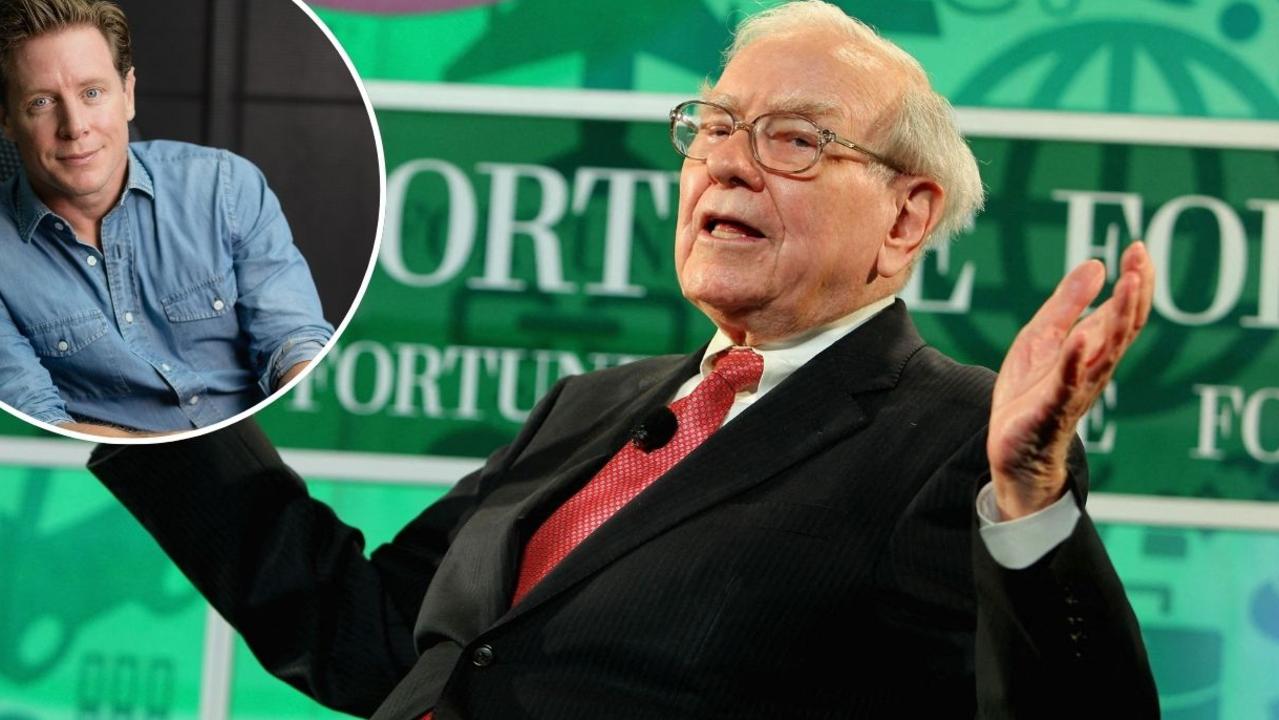

BAREFOOT REPLIES: Order up! I suppose your wife could argue that she’s being “greedy when other people are fearful”, as Warren Buffett says.

Though I couldn’t see Buffett investing his money into a start-up restaurant right now.

After all, figures from Treasury estimate that 441,000 jobs will be lost in the hospitality sector, and the industry’s peak body is warning that 20 per cent of restaurants could go down the gurgler.

In reality, the industry was already struggling before the pandemic, as a result of fair work compliance off the back of high-profile wage theft cases. Most small business people buy themselves a job. Many restaurateurs discover they’ve been served up a shank sandwich.

My thoughts?

You’re both in one of the few pandemic-proof positions — nursing — so I wouldn’t be leaving it.

However, if she’s determined, why not suggest she work evenings in a restaurant for the next 12 months? She can think of it as a paid internship. It’ll give her an entree to the industry, and she’ll get to see just how hot it is in the kitchen.

I’d say it’s the best way to work in a restaurant and come out ahead over the next 12 months.

FROM THE DEPTHS OF DESPAIR

NIKKI WRITES: Not a question. I just want to say THANK YOU!

I know you receive hundreds of messages like this, probably each week if not each day, but I just wanted to share my experience of going Barefoot.

At 31, having been married the year prior, I sat in my GP’s office crying my heart out, feeling suffocated by my $27,000 debt, feeling depressed like there was no way out.

My GP listened to every word I said (in between sobs) and finally said, “I think we need a longer appointment”, and asked me to come back the next day.

Around that time a friend had suggested I read The Barefoot Investor. I had of course scoffed at the suggestion, but that day I decided I needed something, anything, to help.

I read the book cover to cover in a day and felt so empowered that I began to draw my buckets and to have the conversation with my husband.

Two-and-a-half years on, I never did rebook that appointment! My husband and I are completely debt free! We own (outright) two cars, have had a baby, have been on a four-month holiday overseas, have saved $40,000, and are ready to buy our first home.

Thank you, Scott. You will never know what your book did for our family.

BAREFOOT REPLIES: You bloody ripper!

In the sea of doom and gloom and depressing news, I’m craving good news stories, and hope — and that’s exactly what your story offers people. You Got This!

DISCLAIMER: Scott Pape is an independent, community-based financial counsellor. Information and opinions provided in this column are general in nature and have been for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

If you have a money question, go to barefootinvestor.com and #askbarefoot

The Barefoot Investor for Families: The Only Kids’ Money Guide You’ll Ever Need (HarperCollins) RRP $29.99

Originally published as Why one generation has been screwed by COVID-19 economy