No time to gamble when dealing with a tough hand

Those who have lost their jobs or their small businesses during this coronavirus crisis are being offered a gamble by the government by being allowed to withdraw super. So how do we play our hand, asks the Barefoot Investor.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

Truth be told, Australia was one of the least prepared countries for this crisis.

That’s because the average Aussie household is shouldering some of the highest household debts in the world and has skint savings: half of us have less than $7000 in the bank, according to the Grattan Institute.

So for those people who have lost their jobs or their small businesses, the government is offering you a gamble — they’ll let you take up to $20,000 from your super, tax free, to live on.

Specifically, it kicks off with $10,000 in mid-April, then you can request another $10,000 in the new financial year.

To access the dough, you need to be unemployed, or getting a Centrelink payment like youth allowance, or have had your working hours or business income reduced by at least 20 per cent.

On the upside, you’ll have money to tide you over for the next few months. On the downside, you could be putting your retirement at risk.

So, what should you do?

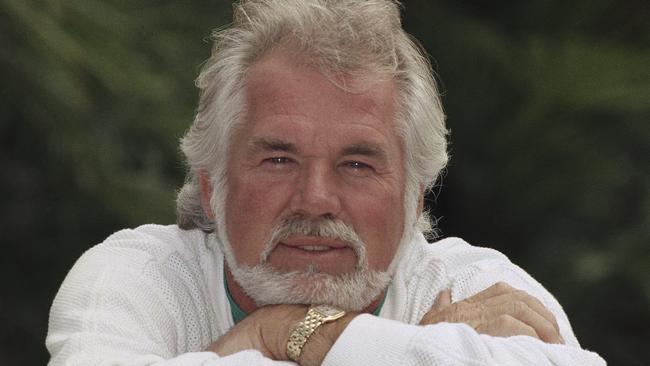

Well, with a hat-tip to the late Kenny Rogers: “If you’re gonna play the game, boy, you gotta learn to play it right”.

There’s a saying in poker: you’re not really playing the cards, you’re playing the other players.

So, let’s see who’s sitting around your table. First, you’ve got your bank. They’ve been dealt a really bad hand. That’s why they’re giving their affected customers up to a six-month “pause” on their home loan (and in reality, all their debts).

Next to them sit your utility providers and telcos, who will offer payment arrangements.

Finally, there’s your landlord, who looks like they’ll be forced to go easy on renters who are in financial difficulty.

In other words, if you’ve lost your income, you can put on your poker face and call their bluffs. All you need to do is contact their hardship department (pro tip: email them, their phone lines will be jammed) and explain your situation, preferably with written evidence.

So, should you still take the $20,000, just in case? Well, the Gambler advises “you never count your money while you’re sitting at the table”.

But I don’t agree. See, you may think you’re cashing in $20,000 of your super money, but you’re really not:

IF you’re 45 years old, that $20,000 would be worth $50,000 by the time you retire.

IF you’re 35 years old, it’s an $80,000 decision.

AND if you’re 25 years old, you’re really gambling with $132,000!

Why? Because you’re cashing out your investments during a share market crash, where the price of stocks are 25 per cent cheaper than they were a few months ago. You’re selling out cheap. And history tells us that over the long-term the stock market always goes up — through panics, pandemics, wars, depressions and recessions.

Always.

Of course, that doesn’t help you if you’re a hospitality worker and you’ve got to put food on the table.

Your kids can’t eat compound interest.

Yet before you cash out part of your retirement savings, make sure you have exhausted every last option available to you (including eating baked beans for a month or two).

Remember, this crisis will likely last a few months, yet your retirement will last decades.

If you do have to access your super, make a pact with your future self that when you get back to work, you’ll increase your repayments to 15 per cent of your gross wages, so you automatically pay it back.

Do whatever you can do now to avoid a royal flush of your financial future.

Tread Your Own Path!

Q&As

THE PAYDAY LENDING PANDEMIC

LINDA WRITES: As you suggested last week, I sent an email to the Honourable Mr Michael Sukkar about putting a muzzle on payday lenders.

I’ve never told anyone this because it’s embarrassing, but I once fell victim to these predators when I was struggling financially. Then I found your book and got back on track. So while I’m worried about getting COVID-19, financially, I’m as healthy as I can be. And for that

I thank you.

BAREFOOT REPLIES: Well done for getting back on your feet, and for sending an email to the Assistant Treasurer, who is the responsible minister for implementing reforms on payday lenders. Right now we’re facing a payday lending pandemic as millions of Aussies stress about their finances. And these predators are marketing their loans heavily on social media: “Need instant cash? Approved in 60 seconds!”

(Fine print: interest rates for a one-month loan, 407.6 per cent per annum.)

Once you sign up, they use sophisticated screen-scraping technology that allows them to time their direct debits to swoop in and take any money that hits your account before it can be spent on food, medicine or school books. Then they offer another loan, and the cycle repeats.

Right now the government is taking bold steps to protect our health and we need them to do the same to protect our most vulnerable families’ financial health.

My view? At the very least, payday lenders should be temporarily put out of business, for

as long as we’re out of business.

Many of my readers agree: this week I’ve received thousands of emails from Barefooters in support, so I can only imagine how many Michael Sukkar got.

Yet sadly, at the time of writing, I haven’t heard from him.

Perhaps the highly paid lobbyists that these payday lenders employ really have won.

ARE THE BANKS GOING TO COLLAPSE?

BRAD WRITES: Do you think any of the banks could collapse? I’ve heard people saying we should remove our savings. Won’t that make their closure more likely? What’s your advice?

BAREFOOT REPLIES: I’ve been getting this question a lot this week.

It’s actually quite understandable in the current environment where people are being tasered for toilet rolls. However, the answer is “no”,

I don’t believe the banks are going to collapse.

And even if one did, the government stands behind them with its $250,000 guarantee on authorised deposit-taking institutions. So there is no need to start stashing your cash alongside your toilet rolls.

THERE’S ALWAYS SOMEONE DOING IT TOUGHER

KAYE WRITES: I’m a flight attendant who has just been laid off.

It’s a bit scary not knowing when or if I’ll get my job back, but thanks to you we’re OK for now — we have Mojo enough to last us for several months.

I also watched your bushfire doco, The Road to Recovery, the other day. It’s a really good dose of perspective that there are a lot of people doing it tougher than me. So I just wanted

to thank you for all the good work you do.

BAREFOOT REPLIES: You’re absolutely right — now is the time for some much-needed perspective.

I got mine last week, before the lockdown came into place, when

I travelled to the fire-affected community where I’ve been volunteering as a financial counsellor.

Think about this for a moment: it’s been three months since the bushfires.

We know from experience in previous disasters that it’s at around this time that mental health issues start to surface — and now these people have to socially isolate and stay home alone.

The locals I met told me they (quite rightfully) felt like Australia had forgotten about them. It’s a disaster in the making.

KINDNESS GOES VIRAL

LESLIE WRITES: After watching the news this week I am feeling stressed about the whole virus thing (though not financial stress, thanks to you).

I was feeling for all those who have lost their jobs this week, and wondered what I could do to pay it forward. I ended up putting all the cash I had in my wallet (a total of $150) in an envelope and writing a note to our local pharmacy.

I asked them to take it to pay for some medication for one person or five — just someone who is doing it tough, the pharmacy’s choice. I hope it will brighten someone’s day. It certainly made me feel better.

BAREFOOT REPLIES:

Thank you for being such a generous, kind person and helping people in your community. And thank you for brightening my day. This too shall pass. You Got This.

If you have a money question, go to barefootinvestor.com and #askbarefoot

The Barefoot Investor for Families: The Only Kids’ Money Guide You’ll Ever Need (HarperCollins, $29.99)

Originally published as No time to gamble when dealing with a tough hand