How a trip to the pub can refresh your financial life

Believe it or not, but a trip to the pub is the best way to start sorting out your financial goals, writes the Barefoot Investor.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

Happy New Year!

I’m often asked what is the single best thing someone can do, to refresh their financial life.

My answer is always the same: go to the pub.

No, seriously.

The cornerstone of my entire plane is to schedule a monthly date night.

Making a regular ritual of getting on the same financial page as your partner is the most powerful thing you can do.

(And it goes even better when you have a wine or taco in your hand).

Once you’re there, it’s time to go on to step 2.

Step 2: Set up your buckets

A decade ago I sketched out the plan you’re about to read on the back of a serviette for my Barefoot bride.

Today I’ve had literally millions of people who’ve road-tested it, so I know it works.

(The banks know it too, which is why some of them have built savings and spending buckets into their own apps … and advertising).

Let’s call a spade a shovel: the interest you earn on your so-called high-interest savings account ain’t anything to write home about, but that’s not the point.

The benefit of the buckets is that it puts your day-to-day money on autopilot, and gives you a super simple way to spend more of your money on things that really make you smile.

Let’s get into it …

Let me start off the New Year with a candid confession: the biggest risk I’m facing for 2021 is whether I’m still relevant.

After all, my entire Barefoot philosophy is based around saving … at a time when cash is trash.

To be clear: any money you have saved in a bank — even in a high-interest account or a term deposit — will almost certainly lose you money over the next few years, after you take into account inflation and taxes.

Here’s my take: when it comes to Mojo, it’s not about the interest you earn (which is pitiful), it’s the sleep-easy factor of knowing you’ve got a backstop.

That’s worth more to me and my mental health than any gain I could make by investing in the stock market.

Introducing the Serviette Strategy

Before the parma came, but after the calamari rings, we’d agreed on the three things we really wanted from our money.

Top of our list?

To be totally financially secure.

Which made sense. After all, we were about to get hitched and we were already pregnant (scandal!).

And, according to Relationships Australia, the biggest cause of relationship breakdowns is fights about money (and monogamy, but mainly money).

The second thing we valued was the freedom to travel at least once a year, and to enjoy nice dinners out with family and friends.

The third thing was to build our wealth over the long term, so we could wind down working sooner rather than later.

(Okay, if I’m being really honest, Liz was kind of like ‘meh’ about the exciting world of

long-term investing … but she understood it came with the territory when she married the Barefoot Investor.)

It was my time to shine.

With one final swig of Carlton Draught for courage, I pulled out a pen and drew our new financial plan on the back of a pub serviette.

Here’s what I drew:

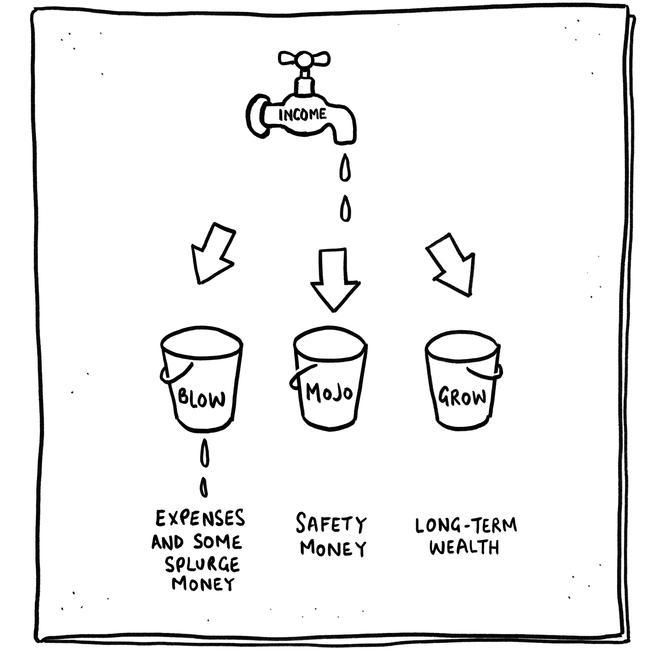

Yes, our entire money management plan consists of dividing our income into three ‘buckets’:

• A Blow Bucket for daily expenses, the occasional splurge and some extra cash to fight financial fires.

• A Mojo Bucket to provide some ‘safety money’, and

• A Grow Bucket to build long-term wealth and total security.

Don’t for a moment be fooled by the simplicity of the picture.

Liz and I have used this plan to manage our investment property, save for our honeymoon, pay off our mortgage, manage a business that earns income in inconsistent lumps, create a solid-as-a-rock emergency account and compound our wealth.

Even better: thousands of people of all ages and income levels have used my Serviette Strategy with stunning success.

Here’s how it works …

The Blow Bucket

Most people only have one money bucket.

If you’re renting, it’s your transaction account.

If you own a home, it might be your mortgage.

Either way, your pay comes in, money goes out, and you ‘hope’ some is left over to put towards investing and saving.

And then old Fido finally catches that car. D’oh! Vet bills.

And then an unexpected emergency: Christmas. Ho! Ho! D’oh!

There’s nothing systematic about it.

Even worse?

Your Blow Bucket has a hole in it: every dollar of income you pour into it leaks out the bottom.

This is just as true for a uni student blowing their Austudy on a pub crawl as it is for 90s rapper

MC Hammer, who squandered his $30 million fortune on fancy (leased) cars, a thirsty

entourage and (my personal favourite) gold-plated ‘Hammertime’ gates for his home. (‘U can’t

touch this’ — apparently his creditors could.)

The deal with the Blow Bucket is spending more money on the stuff you love and less on the

stuff you don’t.

Better yet, with this plan you’ll actually allocate some of your pay packet to guilt-free splurges for stuff that’ll put a smile on your dial.

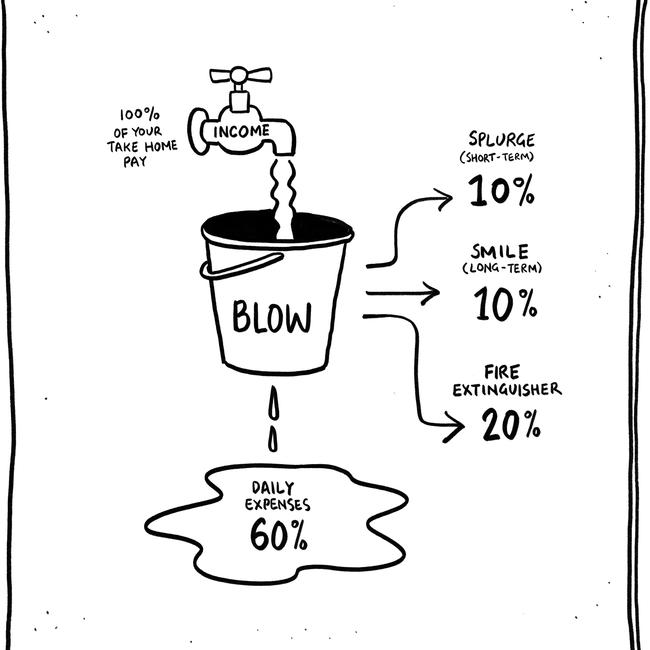

The Barefoot benchmark: live off 60 per cent of your income

So how much does it cost you to keep the lights running and the kids from drinking out of the dog’s bowl?

In other words, how much does it cost to run ‘You, Inc.’?

Well, a good yardstick is allocating 60 per cent of your take home pay (i.e. your after-tax

household income) to food, shelter and Netflix — all the things you need to live safely in the

suburbs.

I want you to try and live off the Barefoot Benchmark of 60 per cent of your pay.

Leave that 60 per cent in your ‘Daily Expenses’ account for, well, daily expenses.

What about the other 40 per cent?

10 per cent Splurge: You are hereby directed to go out and blow 10 per cent of your take

home pay on anything that makes you feel good (shoes, booze, lattes, whatever).

Set up a regular direct transfer to a separate, linked, account and make it automatic.

Then you can spend it how you like.

But remember, when your Splurge money for the month is gone, it’s gone — you can’t cut into your other accounts.

10 per cent Smile: Another 10 per cent of your take home pay should be automatically

transferred to an online savings account.

This is not for splurging when you feel like it; it’s for big goals that will take longer to save up for.

Overseas holidays, weddings, divorces — anything that is going to cost more than a few weeks’ wages.

I call it the ‘Smile’ account because every time you think of what you’re saving up for, you smile.

20 per cent Fire Extinguisher: Finally, allocate 20 per cent of your take home pay to your ‘Fire Extinguisher’ account (online saver). Again, make it automatic with a direct transfer every time you get paid.

You see, you’re going to use it to put out financial fires.

What’s a financial fire?

It could be your crushing credit card debt.

It could be the home deposit you’re saving up for.

It could be paying off your mortgage.

And that’s the point — your Fire Extinguisher account will be used for different financial fires at different times in your life.

The 20 per cent amount won’t change, but what you use it for will.

The Mojo Bucket

The aim of the Mojo Bucket is to get your Mojo back, baby.

You know the feeling — it’s a spring in your step that says, ‘I don’t stress about money’.

Now, you shouldn’t keep your Mojo in an offset account or a redraw facility attached to your

mortgage, and you shouldn’t link it to your everyday transaction account.

This is a totally separate, high-interest online savings account that I want you to open up with $2000 to start with.

You only touch it in emergencies, like losing your job or getting sick … or your house burning down. Or a pandemic.

Sadly, most people never experience the feeling of Mojo.

A survey by comparison site finder.com.au found that 30 per cent of Aussies have less than

$1000 available to deal with an emergency.

Stressful? You don’t know the half of it.

If you don’t have a spare $2000 to put into your brand new Mojo account, do whatever you can to find this money.

Flog stuff on Gumtree, put in overtime at work, sell your kidney.

The Grow Bucket

The third and final bucket I drew for Liz was the Grow Bucket.

The aim of the Grow Bucket is to get a little wealthier every day.

Every dollar you pour into the Grow Bucket should double every seven to ten years (in boom

times it’ll be quicker; in bad times it’ll be slower).

It’s not exactly quick, but over your life it can make you incredibly wealthy.

Your Grow Bucket includes your super fund and any other investments you own (like shares,

investment property, or education savings for your kids).

As we work our way through the Barefoot Steps, the Grow Bucket will take centre stage, but right now it’s more than enough just to have your super sorted.

So that’s what I drew for Liz.

She sat there, surveying the serviette.

‘I like it, Mister Pape.’

Success!

[This is an edited extract from The Barefoot Investor: The only money guide you’ll ever need, Step 2: Set Up Your Buckets, pages 62-70].

Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

If you have a money question, go to barefootinvestor.com and #askbarefoot.

Originally published as How a trip to the pub can refresh your financial life