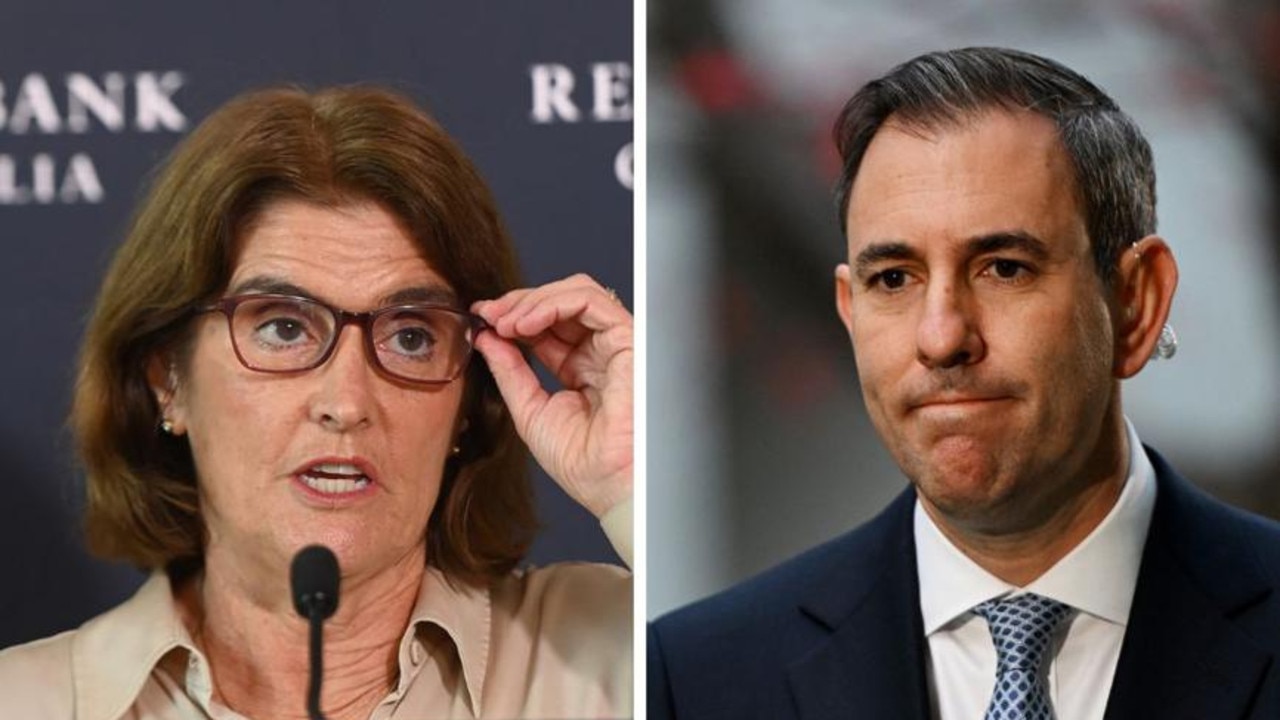

Fit your own safety mask before you help out the kids

It’s natural to want to help your children with money but think twice before you dip into your own pockets to help them buy their first home.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

This is an open letter to parents who are thinking about helping their kids buy their first home.

In my book I was pretty blunt (and a tad dismissive) about hitting up the parentals:

“Should I get my parents to go guarantor? No way, Jose.”

And … no one listened.

In fact, Digital Finance Analytics (DFA) has found that the ‘Bank of Mum and Dad’ has around $34 billion in loans, with parents forking out on average $90,000 to their kids.

So let’s look at it from the parents’ perspective.

It’s natural to want to help your kids. They’re your flesh and blood … and the very people you’re counting on to change your incontinence pads in a few years’ time.

Besides, if you’ve done well, you should help them out, right?

My parents-in-law offer a good working example: they bought their inner city Melbourne family home in the eighties for less than a hundred grand. It’s now worth close to two-and-a-half million bucks.

Yet a decade ago their (then single) daughter would schlep over to “millionaires’ row” for dinner, and complain that she couldn’t afford even a two-bedroom flat this side of Bendigo.

Come on, help out the kid!

Well, here are three things to keep in mind before you sign on the dotted line.

First, if you’re struggling or still have outstanding debt yourself, you’d be mad to go guarantor for anyone. As they say in the airline safety demonstration, always fit your own oxygen mask first.

Second, consider what could go wrong.

The most important one being that it can cause a rift in the family. I know you think that’ll never happen, but what if your princess’s prince turns into a frog and leaps off with half your deposit? Ribbit!

Or rates could rise, the market could cool, and your kids could be left really struggling. In fact, DFA suggests that kids getting a handout from their parents are three times more likely to default on their loan in the first five years.

Finally, and crucially, you may be inadvertently robbing your kids of one of life’s great financial achievements.

Case in point: all my wife could afford was a tiny studio apartment. She painted it herself and even got her brother to install a discarded oven she found on the side of the road. It wasn’t much, but it was all hers.

Whatever you do, I’m sure it’ll be the right thing for your kids. Just go into it with your eyes wide open.

Tread Your Own Path!

I’m 19 and Have Already Blown My Credit Rating

Dear Scott,

I am 19 years old. When I turned 18, I applied for multiple loans, not knowing that doing so would affect my future. I have recently tried to get a phone plan through Optus in my own name but they rejected me because of my history. Now I am starting to save for a home loan. I have checked my credit rating on Credit Savvy and it’s 631, and I want to bring it up to the highest it can be. But how do I do this? I have been googling for days but nothing useful has come up.

Eryn

Hi Eryn,

True story: when I was 18 years old, my mates and I thought it would be a fun idea to buy a bottle of Jim Beam and mix it with home-brand cola. And then …

Bingo, bango!

I don’t remember much about the night, though I do remember the next morning … violently.

Here’s the killer: since that day I’ve never drunk bourbon (or any spirit for that matter).

Yes, that’s right: all these years later, and I still can’t bring myself to do it.

Which is actually not a bad outcome!

Eryn, that’s how I’d frame your bad credit rating: you messed up when you were still a teenager (like we all do). However, you’ve shown me that you’ve learnt from it. Seriously, how many 19-year-olds are saving for a house deposit, and writing to the Barefoot Investor?!

Think of it as a good thing — you got it out of your system early.

So here’s my advice: aggressively pay down your debts, and then commit to saving for a deposit. Don’t worry about your credit score; it’s a vanity marketing metric from credit agencies, not banks, and therefore about as important as your Uber passenger rating.

What really matters to a lender is having a history of savings and a clean credit report. And there’s the rub … there are things you do as a teenager that stick with you for life … like, say, getting a tattoo. However, a bad credit report will legally drop off in five to seven years, which coincidentally will be about the time you’ll be hunting for your first home.

Bottoms up!

Pressing Problems

Hi Scott,

I am a single mum of five children and I started my own ironing business one year ago. I would like your advice on how to stay on top of things, as all the money I make goes towards paying bills or buying groceries. I don’t have any credit cards, because I hate the idea of buying things with money that doesn’t belong to me. I’m trying to work out how to be financially healthy and become a good role model to my children. Can you help?

Jane

Hi Jane,

Let me iron out the wrinkles that you seem to have in your self-confidence:

You’re not a good role model for your kids, you’re an excellent one.

Let me count the ways.

First, you don’t spend money you don’t have.

Second, raising five kids on your own is a full-time job: many people in your situation wouldn’t work at all.

Third, you’re not only working, you’ve been smart enough to build a little business that allows you to parent and earn an income from home.

The only thing you need to do is to tell your kids what you’re doing. The old advertising rule of thumb is that people need to be exposed to a message 20 times before they’ll remember it. Same goes for you and your kids. You want to tell the humble legend of Jane, working hard for her family against the odds.

In time they’ll appreciate what you’re doing for them. One day they’ll be really proud of what you’ve done.

I’m going to send you a free audio version of my book so you can listen to it while you iron. Work your way through the Barefoot Steps and you’ll never look back.

You Got This!

The Best $5 I Ever Spent

Mr Pape,

We do not know each other, yet you are the one who has single-handedly turned my life around. Last year I was stuck in $13,000 of debt on top of a large mortgage and was living pay cheque to pay cheque. I was headed towards a financial breakdown. Then I picked up your book at an op-shop, and it was the best $5 I ever spent. Reading it kept me up all night, but finally I could see how to start changing my life. Fast forward 12 months and all debts (other than the mortgage) have been paid off and I have a modest $10,000 in Mojo. You don’t know how relieving it feels to go to bed not worrying about money!

Monica

Hey Monica,

As I was reading your story, it made me think of an interview I was doing the other day.

Journo: “What are your top five tips for saving money?”

Barefoot: “Tips are the fairy floss of finance … they look good, but they evaporate in your mouth.”

The journo was not amused.

My guess is that it wasn’t the finance tips in my book that made the difference for you. Rather it was taking the time to reframe your situation and develop a different mindset about what you could achieve.

Your story also made me think about how cool op-shops are. My three-year-old daughter loves our local one. The other day, she used her ‘Smile’ money to buy a princess dress for the bargain price of $3.

Good stuff! (Oh, and there’s nothing modest about having 10 grand in Mojo.)

Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions

If you’ve got a money question or a story to share, go to barefootinvestor.com and #askbarefoot

Originally published as Fit your own safety mask before you help out the kids