Exclusive book extract from Barefoot Investor for Families by Scott Pape

HE’s an Australian finance phenomenon who has already changed life for thousands of adults. Now he wants to do the same for your kids — with jam jars, jobs and food.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

IN this edited extract from his new book The Barefoot Investor For Families, SCOTT PAPE lays out the basics of making our kids financially secure for life — with jam jars, jobs and food.

OUR GAME PLAN

This book is in three parts, and each of them has some of the ‘big things’ that you should get right as a parent.

Part I: First Steps

The first part is about the fundamentals … getting your kids to take their first financial steps.

I’ve boiled down the basics of teaching your kids about money to a dead-simple strategy:

Three jam jars … to put their pocket money in.

Three jobs … so they can earn that pocket money.

Three minutes a week … where you’ll ‘lock in’ life-changing money lessons with a simple weekly ritual over dinner.

That’s it.

Your kids will pitch in, help get dinner on the table and do some jobs. Then they’ll get paid, and make decisions on how to spend, save and give that money.

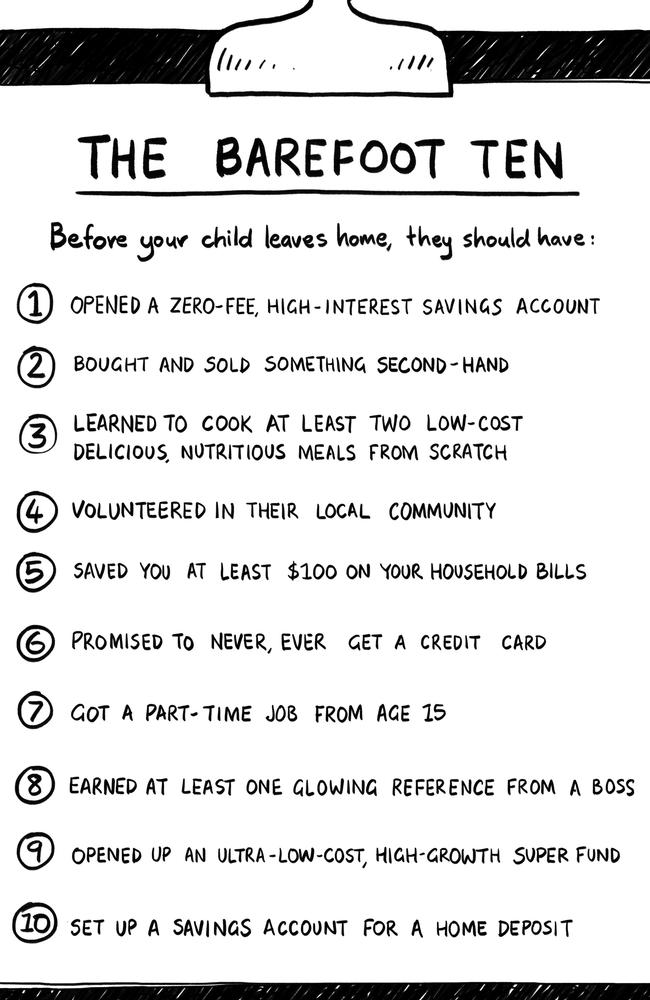

Part II: The Barefoot Ten

The second part of the book will arm your kids with the life-changing money skills that most people don’t learn till they’re in their 40s (if ever!).

Remember, as a parent you can afford to get a lot of things wrong, as long as you get a few big things right.

Well, I’ve stepped out exactly what these big things are, and I’ve put them into a simple checklist that you’ll be able to go through with your kids.

But let me be clear: this is NOT just a list of topics, or a table of contents, or a lesson plan.

In their bestseller The Power of Moments: Why Certain Experiences Have Extraordinary Impact, authors Chip and Dan Heath researched the building blocks of life-changing moments:

“We spend weekend after weekend together with our kids, but in our memories all those times blend together. What’s needed is to rise above the routine. A few minutes can change a life. And the moments that stick with us years later are ones that involve praise, and create an emotionally elevated experience.”

That’s why for each of these “big things”, I’ve created custom-made, real-life experiences that you can do together over the family dinner table.

If you check these experiences off with your kids before they leave home, they’re virtually guaranteed to be financially secure for the rest of their lives.

I call them the Barefoot Ten …

Think about the headstart a kid would have if they’d checked off all these things at the start of their life. I’ve worked through the Barefoot Ten with kids of all ages, and I can tell you it boosts their confidence — often dramatically.

Part III: Off and Running

By the time you get to this part, you’ll have already scored the big wins that will ensure your kids never have to worry about money. That’s a feat worth celebrating, and that’s exactly what we’ll do.

So how the hell are we actually going to achieve all this?

With food.

Weekly Barefoot Money Meals

I based my book, The Barefoot Investor: The Only Money Guide You’ll Ever Need, around

the concept of “Barefoot Date Nights” — where couples (and singles) sort their money over garlic bread and wine.

I came up with the idea years ago when I was trying to get my wife, Liz, interested in how we’d manage our money as a couple. I saw how powerful these nights were for us, so I wrote about them.

Turns out they were helpful to other people too. That book went on to become one of the best-selling Australian books of all time, and a big reason for its success was the practicality of the Barefoot Date Nights in getting ‘non-interested parties’ interested in money.

This book follows the same approach, but this time over the family dinner table.

Instead of Barefoot Date Nights, we’re going to have a weekly “Barefoot Money Meal”.

And given we’re already in the business of feeding our kids each night, this is going to be simple.

(A comprehensive 16-year-long study by Michigan State University found that having regular family dinners was the single biggest predictor of academic achievement. It found that a shared family mealtime was more influential than studying, attending religious services or playing sports.)

So all you have to do is have dinner, once a week, and I’ll take care of the rest.

FIRST STEPS

Getting them to do a few chores and paying them a few bucks is only the first step. The main money lesson comes in what they do with their pocket money: the spending … the saving … and the giving.

That’s where the life-changing lessons really happen. You want to take that pocket money and use it to teach your kids things like goal-setting, delayed gratification, kindness and empathy.

Thankfully, I’ve made it unbelievably easy for you. Because what I’m about to lay out for you is the simplest (yet most powerful) pocket money plan you’ve ever seen:

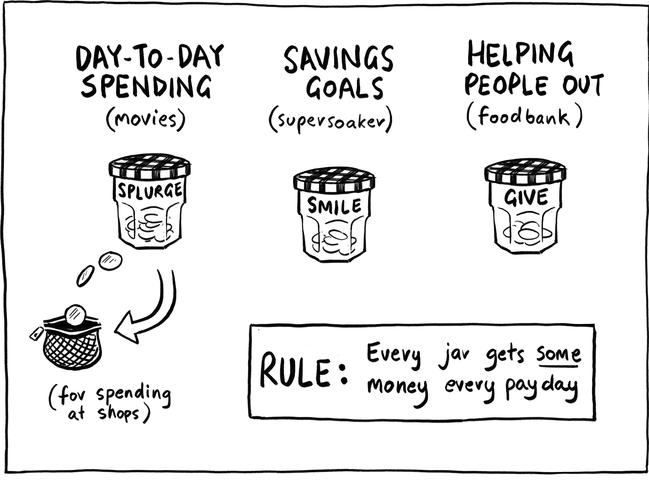

Three jars:

Labelled Splurge, Smile and Give. Every week on “Pay Day” — your Barefoot Money Meal — they get their pocket money and divide it between the three. Later they can transition to bank accounts.

Splurge: for your kids’ day-to-day spending.

Smile: saving up for things that will make your kids smile, remembering the golden rule of wealth is to spend less than you earn.

Give: This jar is what I refer to as “the brat buster”. Not only do studies repeatedly show that we get more pleasure from spending money on other people than on ourselves, it has even been shown to change the mindset of bratty, self-centred teenagers.

Three jobs:

Kids have three jobs to do each week — and they only get paid if they do them. It’s up to you what jobs you want your kids to do, and the payment for each. To help you out, there are some age-appropriate examples in the book.

Done and dusted in three minutes a week:

A simple ritual that’s lazy parenting at its best.

First minute: Check your kid has done their three weekly jobs.

Second minute: Pay them.

Third minute: Watch them divvy it up into the three jars. (The only rule? Every jar must get something.)

Honestly, if this plan is all you take away from this book, your kids will be so far ahead of everyone else it’s scary.

Let’s begin.

* The Barefoot Investor For Families, by Scott Pape, is published by HarperCollins Australia and is in bookstores from tomorrow (Monday, September 24).

Originally published as Exclusive book extract from Barefoot Investor for Families by Scott Pape