Barefoot Investor’s most common questions answered

BAREFOOT Investor’s book is popular ... even with thieves. And its success means he has received thousands of follow-up questions. Here are the most common queries — and answers.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

EVERY father wants to be a hero to his son. So, a few weeks back, I took my four-year-old to a bookstore to show him my bestseller.

Only problem? I couldn’t find a single copy anywhere (not even in the bargain bin).

“Your book. It isn’t here, is it Daddy?” he said, consolingly.

This wasn’t going well.

Thankfully a shop assistant recognised me and said “follow me”.

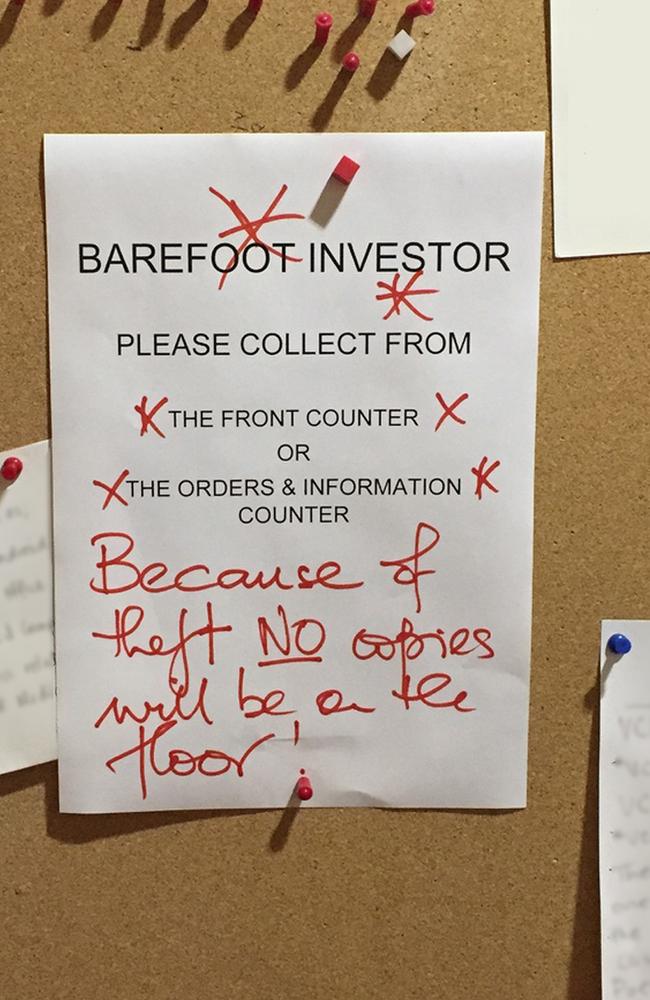

She took us out to the storeroom and showed us a sign pinned to the staff noticeboard (see below).

“Barefoot Investor … Because of theft, NO copies will be kept on the floor.”

True story.

SIX SIMPLE STEPS TO RUIN YOUR FINANCIAL LIFE

I didn’t know how to handle this one with the boy: “Daddy’s book is popular … with thieves.”

Yet I’m taking it as a win — even with the pilfered copies, the book has still sold over 300,000 copies!

And its success has meant that I’ve received thousands of follow-up questions on the book, far too many for me to answer individually (though I try!). With that in mind, here are the top questions people ask me.

Is this really how you manage your money?

Yes it is.

I’ve lived the nine Barefoot Steps; Liz and I have set up our buckets. We have a shared bank account. We do our Barefoot Date Nights.

And that’s why I believe the book has resonated so strongly with people — I know it works.

The steps won’t make you rich overnight, but they will give you a clear path that will keep you and your family safe.

You need more than $250,000 to retire on!

Well, having more money is certainly better.

A financial overhaul can help fathers realise their dream of independence

Socially responsible investing begins at home

Bitcoin-fever fuels flock to digital goldmine

In case you haven’t read my book, my chapter on nailing your retirement sets out my “Donald Bradman Strategy”, which says that to enjoy a comfortable retirement you don’t need $1 million — or $2 million.

As a minimum, I argue you need three things to have a comfortable retirement where the money doesn’t run out:

A paid-off home, around $250,000 in super combined (or $170,000 if you’re single), and the ability to continue working a few days a month (which you should do, no matter how much dough you’ve got, to keep the grey matter ticking over and to get you out of the house).

Some people got all “Tony Abbott” about the fact that I advised people to rely on getting the age pension.

Let me defend myself:

First, the average Aussie approaching retirement has around $200,000 in super, so my strategy is giving them something realistic to aim at — rather than just throwing up their hands in the air.

Second, let me be very clear: I do not encourage planning to rely on a government handout. In fact, I wrote the rest of the book so you can set yourself up to not need the Donald Bradman Strategy!

Can’t I just use my offset account for my Mojo account?

Sure you can.

(I have received literally hundreds of emails from people who tell me they could be $48.50 a year better off by using their offset account for their “Mojo” — my word for savings.) It’s just not how I do it but the most important thing is that you have Mojo!

Again, the power of this book is that it’s what I’ve actually done in my life.

And, personally, one of the things that really helped me was giving each of my accounts a name.

There’s power in being intentional about things, and you tend not to dip into an account that has a name on it (the more emotional the better). When my house burned down, I went to my Mojo account and drained it.

Should I keep my credit card — just in case?

You could do that … but it’s like a drunk keeping a beer in the fridge just in case a “mate” comes around.

The truth is that credit card “rewards” for all but the highest spenders are a gimmick and their value gets eroded with every passing year (some points are worth as little as 0.5c each).

TIME TO TEACH YOUNG PEOPLE ABOUT MONEY

Yet, showing your kids mum and dad can get through life without relying on someone else’s money? In the words of the MasterCard ad — priceless.

The super fund you recommend is too expensive!

(Closely followed by “The super fund you recommend is too cheap — what’s the catch?”).

Many people tell me that the Hostplus super fund I recommend in the book is too expensive.

When they say that, they’re mistakenly looking at the Hostplus Balanced Fund, which charges 1.2 per cent per year (plus a $78.50 admin fee).

Though it has in fact just been crowned the #1-performing fund in the country, with a ripping 13.2 per cent return.

But let me be clear — that is not the fund I invest in or recommend in my book.

The fund I recommend is the Hostplus Indexed Balanced Fund. It charges 0.02 per cent per year (plus a $78.50 admin fee). And for the record, it returned 10.3 per cent this year.

So, you may ask, why not invest in the higher-fee, higher-return fund?

Because the only thing I can control as an investor is the fees I pay. And, over decades, investing in what is arguably the lowest-cost fund in the world will save me hundreds of thousands of dollars.

How do I get my partner on board?

Right now people all over the country are going out for their “Barefoot date nights”.

If you can’t rope your partner in with the promise of booze and good food, what else can I do?!

Will you be updating the book?

Yes. I’ll be updating it every year. In fact I’ve just finished the 2017/18 update, which will be released for Father’s Day.

There’s also an audio book version that I’ve laid down.

And finally ...

What happened to your alpacas?

I’m pleased to announce that Frank and Alberto, my two highly protective alpacas, are still alive and spitting!

Tread Your Own Path!

SUPERSIZED SUNDAYS!

Over the past 12 years, I have by my calculations written over one million words across my two weekend columns.

My dear old mum obviously didn’t think I’d have much of a shelf life — she made a pact to keep a copy of every column I’d written — and now her house is officially a fire hazard!

However, if you’ve been reading this column in the Saturday newspaper — or online at the start of the weekend — you won’t see it anymore.

I’ve made the decision to merge it with my Sunday Herald Sun Q&A column.

Why? Well, because I’m embarking on a new project that’s going to take a lot of my time.

But get this: I’ll not only continue doing my Q&As, but I’ll be expanding my page in the Sunday paper, starting this weekend when I’ve got an announcement to make (one that left my poor old editor scratching his head).

Originally published as Barefoot Investor’s most common questions answered