Barefoot Investor: Stop the hacks with a three-step guide

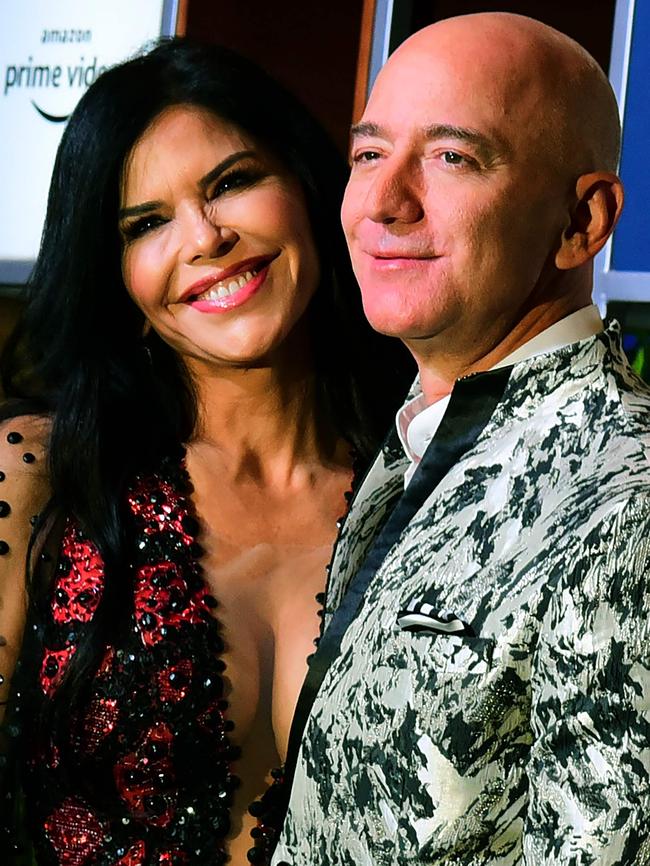

Even the wealthiest people in the world can be hacked. Amazon chief Jeff Bezos has built a trillion-dollar internet business but managed to click a dodgy link, so take precautions, writes the Barefoot Investor.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

Picture this. You wake up one day, flick on Sunrise, and Kochie is in a flap.

“Overnight the internet was hit with the biggest co-ordinated data hack in history. Everyone is exposed,” he warns.

You whip out your phone and check your accounts, but it’s too late — all your secrets have already been flushed out into the world: all your (private) messages, all your (private) photos, all your passwords, all your credit card and bank details … everything is out there.

Here’s you: “Yeah … nah. That is not gonna happen.”

Here’s me: “I have three words for you: Jeff. Freaking. Bezos.”

Word has it that the wealthiest person on the planet clicked a dodgy WhatsApp link that hacked his phone.

The result?

The internet got to see a pic of a very different type of “package” that Jeff had delivered to his girlfriend.

(Suffice to say the old boy was Amazon “Primed”.)

Here’s the point: Bezos has built a trillion-dollar internet business. Yet even he got hacked.

Right now your kids are swiping at your phone with their grubby, jam-stained fingers, poking around at one of the hundred apps you’ve downloaded and long forgotten about.

So the question is: are you feeling lucky, punk?

I’m not.

And you shouldn’t either. According to the government’s Australian Cyber Security Centre, Australians are reporting cybersecurity incidents every 10 minutes — and in 2018 almost one in three Australian adults was affected by cybercrime.

So here are three things that I do to avoid getting hacked.

DUMPSTER DIVING

I have a rotary phone, a fax machine, a pager on my belt, and a CB radio in my ute.

I’m joking.

(All right, so I do have the CB in my ute, but that’s none of your damn business, Victor Charlie, Charlie.)

While you’d think going to the olden days may save you from being hacked, the truth is it’s even more dangerous: the easiest way to steal your identity is not to hack into your computer — it’s to simply fish through your rubbish bin.

So I do whatever I can to stop receiving snail mail and instead get everything emailed instead. When I went full digital, I scanned all the old mail I had lying around and then destroyed it. (On the farm we have an incinerator, but if you’re in a more urban setting a $40 shredder from Officeworks is fine.)

ALWAYS USE PROTECTION

On all my accounts I’ve turned on two-factor authentication (Google it). I also use Dashlane to securely store my passwords, Malwarebytes to protect my computer, and TunnelBear as a VPN (to keep web browsing secure).

For about $100 a year, it’s cheap insurance.

Also, my social media accounts don’t give away my location. (Unlike Terry the Tosser: “Here we are in Mykonos #richlife” … and back in Melbourne your house is getting robbed, (thuglife.)

STAY ALERT

I have a premium alert service set up on my credit file (and given I have no credit, it shouldn’t be dinging too much). However, if you get scammed, your credit file is one of the first places it will show up as scammers apply for credit in your name.

Here’s the deal: you don’t have to be mega-rich to be scammed — in this interconnected world, we’re all targets.

So don’t wait for the big hack to come to realise you weren’t covered.

Because, as the Amazon founder himself will tell you: There’s no returns policy once your junk is on the internet.

Tread Your Own Path!

Q&As

HOW TO BLOW $50,000

EMMA WRITES: My fiance and I work in hospitality, earning about $55,000 each.

We love the industry we work in, but unfortunately it does not pay well.

We are saving to go to Vietnam next year, but after that we need to save for our wedding and honeymoon, which will be about $50,000 in total. After that we need to save for a house deposit.

We have a baby, and my fiance works days and I work nights so childcare costs are minimal. But getting a second job is out of the question. What is a good way to save as quickly as possible?

BAREFOOT REPLIES: Emma! Are you on drugs?

Or are you planning on supplying drugs at your wedding?

You can’t be seriously considering spending an entire year’s wages on one day!

Fair dinkum, I’m tapping the keyboard so bloody vigorously right now that I’ve woken up the dog, and she’s moving gingerly to the back door.

(She knows the score.)

You wrote to me for my advice, so I’ll give it:

I think you’ve got your priorities completely out of whack.

There is zero correlation between how much you spend on your wedding and how long your marriage will last.

There is, however, a high correlation between money worries and divorce.

If I were in your shoes I’d first use that money to build up your Mojo, then put the rest towards a deposit on a home.

What about the wedding?

Well, you’re in hospitality, so why not ask your workmates to help you plan a rustic, authentic backyard wedding?

Years from now it’ll become your family legend: you started with nothing, and created something amazing.

LIVING THE ING LIFE

STEPHANIE WRITES: Long time reader, first time asker! I know you mention ING in your book, so I would love your thoughts on their latest superannuation offering — “Living Super”.

BAREFOOT REPLIES: Thanks for your question. Some people assume that because my book recommends the ING saver accounts that must mean I think all ING products are great. They would be wrong.

As a customer myself, I get hit by their automated marketing database with offers for credit cards and super accounts (the financial equivalent of “Would you like fries with that?”).

So, what do I think of ING’s Living Super?

Not much.

It’s kind of like walking into your local pub and choosing between the 35 craft beers they have on tap. They all have flashy logos and pompous names, but they all taste pretty much the same.

Yes, ING allows you to buy individual shares, but industry funds offer the same thing.

And, while their portfolios are made up of sensible index funds, they’re really not that cheap.

(When you’re buying index funds, cost is one of the major factors.)

Bottom line: there are cheaper, and better, products out there in my opinion.

Case in point: arguably the best fund manager in the world is the not-for-profit Vanguard, and they’ll be coming out with their own super offering later in the year.

Hold my beer!

CASHIER KINDNESS

MELANIE WRITES: How fantastic that you shouted that guy his meal!

I was myself behind a lady in the queue at Coles recently and saw she had her groceries scanned and bagged, and for good measure her son had started tucking into some snacks from the bags.

She then realised that her card was not in her wallet and started fretfully taking the bags back out of the trolley.

Without hesitation I handed my card over to the cashier to pay for the lady’s shopping, and I would not allow her to pay me back either. Best $70 I’ve ever spent, helping out a fellow mum during a crappy part.

BAREFOOT REPLIES: One night I went to a chew-and-spew and found that I’d forgotten my wallet.

It was chopsticks at midnight over an $18 pad thai — I seriously thought the restaurant owner was going to call the cops on me.

(And it would have been much worse if my little tacker was tucking into some san choy bau!)

So I can completely understand how that woman was feeling.

Today we rush around so much that occasionally you forget your wallet … and isn’t it nice that for that woman, at that moment, you were there as a smiling face?

The truth that all givers know is that the giver always gets the most out of it.

Hopefully she went home and explained to her kid that even in this day and age of division, isn’t it good to know that there are good people who can help?

(Unlike the owner of that restaurant — a big chop-suey to you sir!)

If you have a money question, go to barefootinvestor.com and #askbarefoot

The Barefoot Investor for Families: The Only Kids’ Money Guide You’ll Ever Need (HarperCollins) RRP $29.99

The Barefoot Investor holds an Australian Financial Services Licence (302081). This is general advice only. It should not replace individual, independent, personal financial advice.

Originally published as Barefoot Investor: Stop the hacks with a three-step guide