Barefoot Investor: How to offer immediate help in a crisis

The “once-in-a-century” floods in NSW are an unfolding financial disaster for many families. But a small donation can make a huge difference in someone’s life.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

If you’ve been watching the floods, you’ve probably thought to yourself:

“That’s no good … but at least they’ve got insurance, right?”

Maybe.

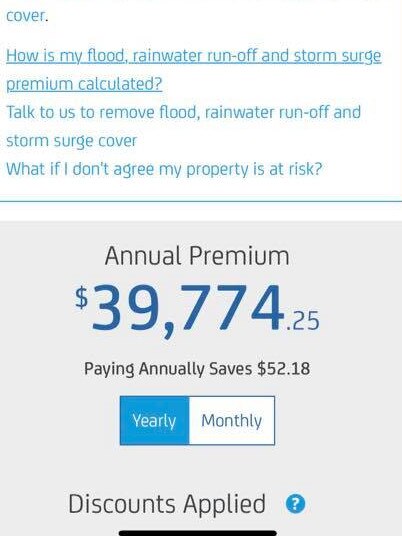

Here’s a quote that was sent to me by a homeowner in a flood-prone area in New South Wales.

That’s something you don’t see every day. Round figures, let’s call it forty big dogs … EVERY YEAR.

Of course, no one can argue that the insurance company is not doing its part: that $52.18 saving for paying annually is a total game-changer.

Seriously, though, a family can’t afford this. So what do they do?

Well, they opt out of flood insurance, which is exactly what the insurance companies want.

Now we could get angry at the insurance companies for doing this.

Or we could get angry at local governments that let developers build on these flood-plain areas.

Yet none of that is worth a squirt when you’re in a “once-in-a-century” natural disaster (which in the Lucky Country comes around roughly once a year).

This is exactly why the floods are an unfolding disaster for many people.

And it’s not just homeowners: three-quarters of renters don’t have any insurance on their contents, according to the Insurance Council of Australia.

Maybe they don’t think they have anything in their house worth insuring … but they do.

The truth is, it’s the battlers who really get screwed when disaster hits — specifically the elderly and those on very low incomes.

Picture someone who counts out their coins each morning. They often go shopping at night when all the unsold meat is marked down.

Then one day water gushes under their door and short-circuits their fridge.

And hundreds of dollars of food — which they can’t afford to replace — starts to rot.

Now that is a disaster.

And right now, as you read this article, there are thousands of Aussies (many elderly, or ill, or young parents) in this situation.

So what can we do?

Thankfully, there are people at Foodbank in NSW and Queensland packing emergency food hampers.

Now during the bushfires, many charities (unfairly) got a bad rap for not spending the money quickly enough for the people who needed it.

Well, it doesn’t get much quicker than providing someone’s next meal. Even better, it’s also a freakishly good return on your money. For every $1 you donate to Foodbank Australia, their scale means they can provide $6 worth of food to battlers.

It’s times like this that we pull together and remember how good we have it.

And it’s times like this that our kids (or grandkids) feel the pride that comes from spending their money on helping others.

To donate, head to foodbankna.org/helpfloods

Tread Your Own Path!

HIT ME BABY ONE MORE TIME?

My four siblings and I have inherited close to $100,000 between us. I am the executor, and am unsure how best to manage the funds. At the moment two of my siblings are unaware of the inheritance as, to be honest, they will most likely spend a good amount of it on drugs. Would it be best to divide it individually, or invest it as a whole, or set up trusts for these two? Even with a trust, I don’t know when the best time to release the money would be. Help!

- Chris

Hi Chris,

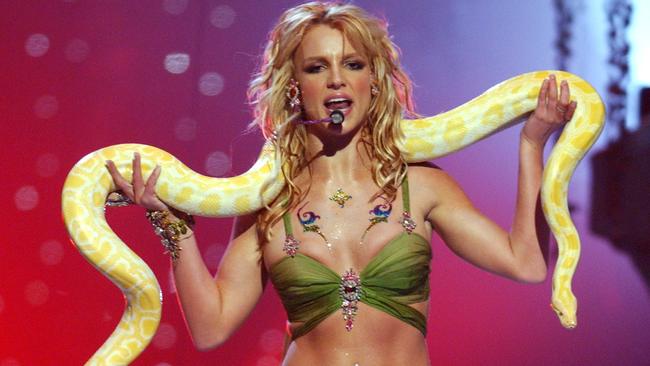

Have you seen the explosive documentary on Britney Spears?

After Britney went off the rails in 2008, her old man took out a court-approved conservatorship. This order essentially makes him her legal guardian and gives him authority over her finances and personal decisions. The controversy is that many of her fans believe the conservatorship is exploiting rather than helping the 39-year-old superstar mum.

So what does all this have to do with you? Well, you’re acting like Britney’s father … only worse.

I mean, at least he went to court and got an approved order … you’re doing this under your own steam.

Chris, let me be very clear: IT’S NOT YOUR MONEY.

It’s your siblings’ money and, heartbreaking as it is, if they want to blow it on drugs then that’s their business. As an executor you are the servant, not the boss, and you are duty-bound to inform the beneficiaries, and then distribute the money as per the deceased’s wishes.

Now I know you’re a caring brother and you only have your siblings’ best interests at heart.

So you should urge them to see specialist drug counsellors. They can talk through the very serious issue of the money fuelling their drug addiction, and the compounded pain and shame of blowing their inheritance. They may decide to hand over financial power of attorney to you (or someone else they trust). They may not. Either way, it’s their life, and their decision.

If you feel that they are vulnerable and lack the ability to look after their money you can seek an administration order in your State. It’s a legal document that gives a person (called an ‘administrator’) power to make decisions on behalf of another person about financial affairs. This includes money, property and some legal matters. But it is a big responsibility. And it may be opposed.

#FreeBritney.

MY WIFE IS SENDING SELFIES TO RUSSIANS

I am hoping you can solve a disagreement between my wife and myself. I have just read your answer to Lilly, who got herself tangled up with Skyway Investment in Russia. My wife has invested $1,000 with them too. However, they also have a picture of her passport details. Now they are requesting her to take a photograph of herself from various angles so they can confirm who she is. Have you heard of deepfake?! I am concerned they will steal her identity and wipe out our accounts. Thankfully, she has not given them our bank account details, and the credit card number she used for the initial purchase has changed. But I am still concerned. Should I be?

Brad

You’re right, Brad, this smells off like a four-day-old beef stroganoff.

(For those of you playing along at home: never, ever, ever email a digital copy of your ID to anyone.)

The job of clearing your name after your identity is stolen takes the average person 27.5 hours.

So let me help save you 27 hours:

First, kiss the $1000 goodbye. Never communicate with these rogues again in any way, shape or form.

Second, check her credit report and see if anyone has applied for credit in her name.

Third, call the not-for-profit IDCARE on 1800 595 160 and ask their advice on what to do next.

So, Brad, let me raise a glass of vodka to your coming adventure:

Поднимем бокалы за успех!

THE FRIENDLIEST STORE IN TOWN

Last week’s column about the Small Business Debt Helpline was the best one you have ever done! I will be sure to pass this information on to anyone out here in the Kilkivan district who needs it. We need to start looking after small business owners, because no one looks after them, and (as you say) they are our country’s biggest employer. I know — I am one of them. And the constant stress and worry that your family home is directly linked to how many coffees and burgers you sell each day can be crippling.

- Katy

Hi Katy,

Thanks for writing.

Let me give two plugs:

First, for you: Katy runs the Kilkivan General Store, which she reckons is ‘The Friendliest Store in Town’.

Second, for the Small Business Debt Helpline, who do a bloody good job looking after small business owners doing it tough. They’re independent. They’re free. And they’ll fight for you. Call them on 1800 413 828.

The Barefoot Investor for Families: The Only Kids’ Money Guide You’ll Ever Need

(HarperCollins) RRP $29.99

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

Originally published as Barefoot Investor: How to offer immediate help in a crisis