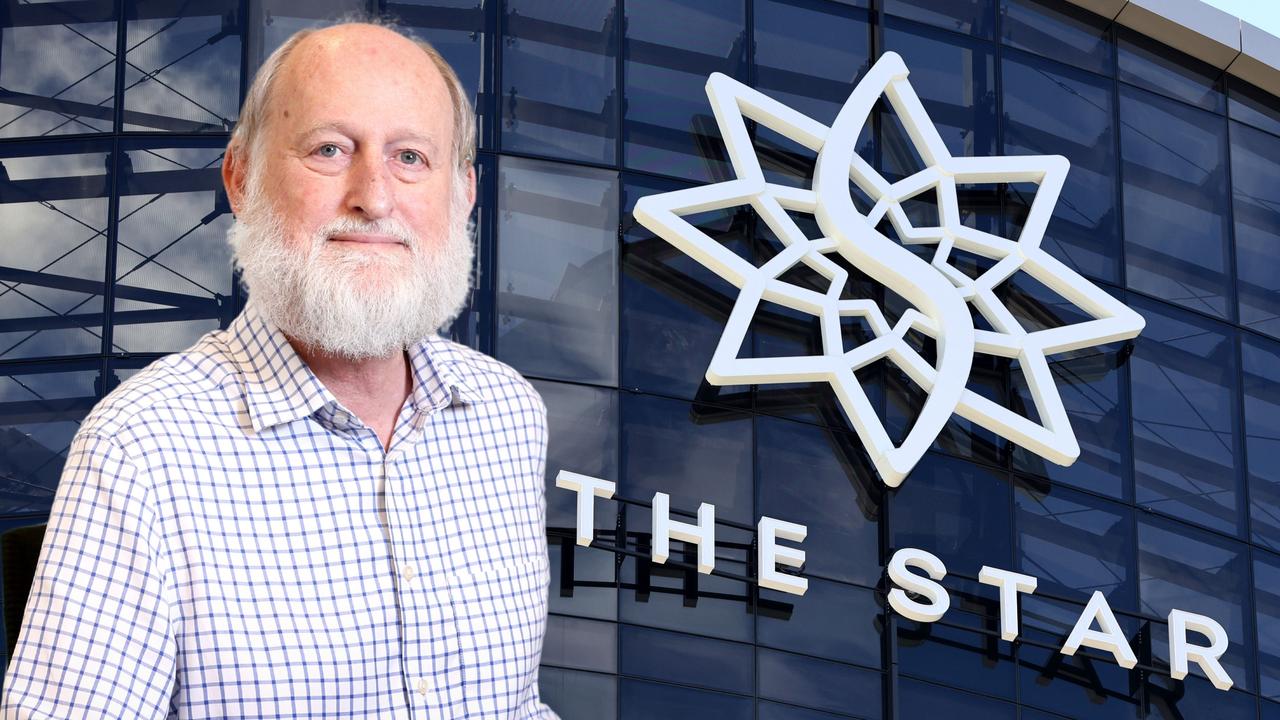

Garry Weaven takes aim at APRA over banks, insurers, super funds boardroom intervention

Major changes proposed by the prudential regulator would cap the term limits of board members, as part of its biggest intervention in corporate governance in decades.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Industry super fund veteran Garry Weaven has warned the prudential regulator’s move to impose term limits on board directors is another unwelcome and unnecessary intervention in Australian corporate governance.

Mr Weaven, who was an architect of Australia’s modern superannuation system and retirement income-backed asset manager IFM Investors, said the Australian Prudential Regulation Authority had to show “a bit of respect” for boards, and its “bureaucrats need to get out of the way”.

On Thursday, APRA unveiled eight key reforms to governance in the banking, superannuation and insurance sectors, which could see up to 200 directors forced out under proposed 10-year term limits.

APRA chair John Lonsdale said 10 years was “the right number” for a director to serve, but in some cases exceptions could be made for directors with longer tenures.

Almost 30 directors have been on boards for more than 20 years.

Mr Weaven said if APRA had a problem with directors being on boards for more than a decade, it should produce evidence to back its concerns.

He said the regulator had been trying to impose term limits for “at least 10 years” and APRA had made “all sorts of proposals about how boards should be structured without any evidence base whatsoever and completely counter (to) any evidence of director performance”.

“They make things up when they want to nail certain individuals, that gives everyone no confidence,” Mr Weaven said.

“I can recall instances where a whole board has said we have almost no experience on the board, we need to retain our 10-year person, but they still keep on with this nonsense.”

Mr Weaven chaired IFM for more than a decade.

AustralianSuper boasts at least two directors who may run foul of APRA’s 10-year term limits: Ai Group boss Innes Willox and investment committee member Russel Maddox, both of whom joined the retirement giant in 2014.

Banks, funds and insurers would be given until 2028 to manage board succession, with APRA proposing to put in place the broader changes after three years of consultation and finalisation of its standards.

Speaking after APRA unveiled its new rules, Mr Lonsdale said the regulator saw good practices across the industry, but there were also “areas of weakness and substandard practice”.

“Organisations need to anticipate risks that might arise from the economic environment, geopolitical risk and globally connected digital economy,” he said.

“So the demands on director skills, experience and time have also increased.”

Under the proposed changes, APRA will require boards to better identify skills and capabilities for directors, as well as run a review every three years of individual directors, the board, and its committees.

APRA will also turn the screws on individuals, putting in place a tougher fit-and-proper test as well as requiring banks, insurers and super funds under “heightened supervision” to engage with the regulator before making any appointments.

The regulator said it had observed several incidents where boards had failed to properly review replacement directors, sometimes only considering potential criminal cases but not any civil or regulatory proceedings.

APRA said it would require boards to consider a number of issues when searching for directors, including reputational risk and the capacity to commit time to the role.

Any bank, super fund or insurer on watch would be required to consult the prudential regulator ahead of any board succession. Mr Lonsdale said companies facing intense supervision often had underlying governance problems.

Mr Lonsdale said APRA was increasingly concerned about conflicts of interest where directors sat on multiple boards or could be compromised by contracts between a regulated entity and a third party.

APRA said it could block appointments if there are adverse findings against directors.

The prudential regulator will also require boards to ensure at least two directors, including the chair, are independent and not a member of any other board within the entity’s group.

APRA will also require bank and insurance boards to have separate risk and audit committees.

The changes come after recent scandals in the banking and super sectors, with APRA intervening at major bank ANZ and industry fund Cbus.

The APRA chair said he didn’t want to talk about any “particular entities” in reference to Cbus, noting APRA had a “range of supervision actions including an investigation under way”.

The Wayne Swan-led fund entered into a court enforceable undertaking with APRA in February, agreeing to an investigation into the governance of the $100bn giant with roots in the building industry.

APRA is exploring potential breaches of the Superannuation Industry (Supervision) Act by Cbus.

“We are being very clear, as in the case of Cbus, but not just Cbus, that we will take action including enforcement action where we think it’s necessary,” Mr Lonsdale said.

The APRA chair said some of the recommendations came out of APRA’s work in the wake of the 2018 banking royal commission.

He said APRA was also looking at scaling back some of its 150-odd requirements for boards, noting that this “looks too many”.

An Australian Banking Association spokesman said APRA’s review was a timely intervention.

Originally published as Garry Weaven takes aim at APRA over banks, insurers, super funds boardroom intervention