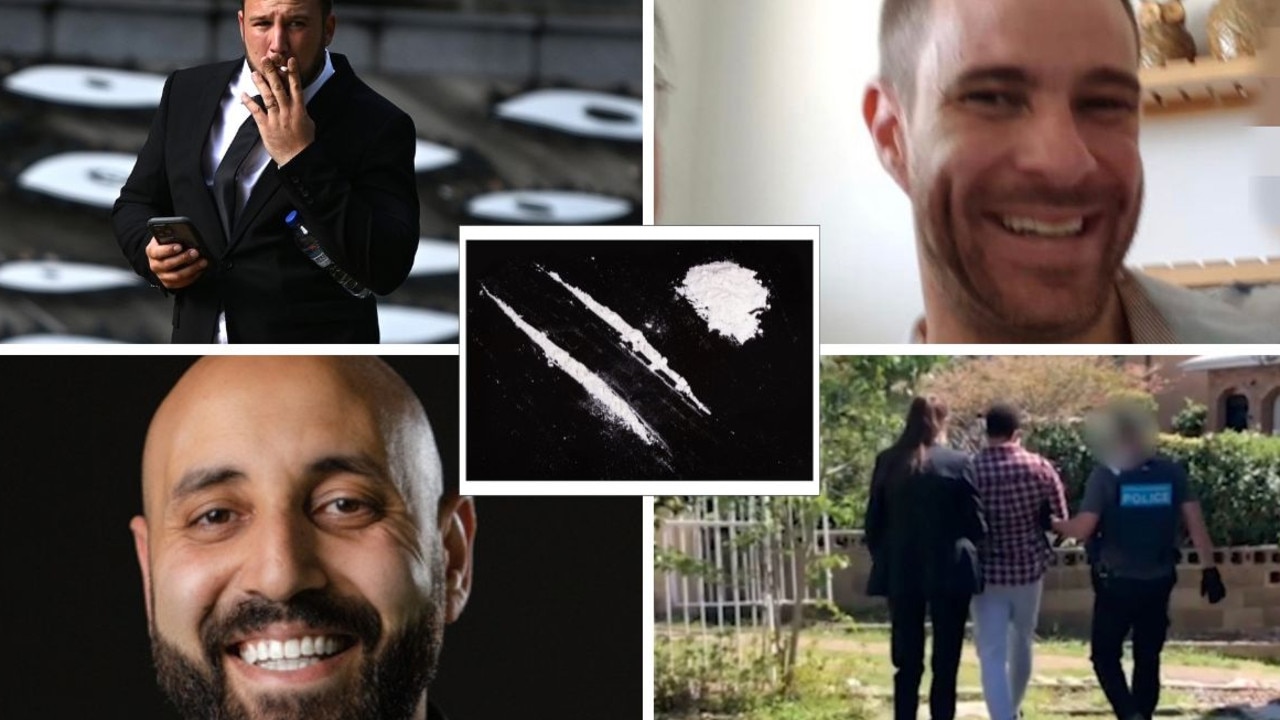

Cocaine Inc: Barristers don’t want to dob in drug dealers

Aussie barristers who earn up to $25,000 a day don’t want to dob in their drug dealing clients for one key reason.

Cocaine Inc

Don't miss out on the headlines from Cocaine Inc. Followed categories will be added to My News.

Barristers paid up to $25,000 a day have rejected proposed money laundering laws that would require them to dob in drug dealer clients.

The new laws, which would also capture real estate agents, accountants and diamond dealers, would be a tool to stop the flow of $60 billion of illegal cash through Australia’s economy.

But barristers claim they must be exempt because it would impinge on their “relationship with their client”.

Independent finance watchdog Transparency International, top tier consultants KordaMentha, and NAB have demanded that the crackdown, which was first floated 17 years ago, be put into law.

Attorney-General Mark Dreyfus has already set aside $160 million to allow financial watchdog Austrac operate the proposed laws.

Watch the video above to see more in our Cocaine Inc. investigation.

Do you know more? Contact us at cocaineinc@news.com.au

“Criminals are constantly looking for new ways to exploit our systems, and Australia needs to remain vigilant and harden our businesses against exploitation,” Mr Dreyfus said.

“Services provided by real estate agents, lawyers, accountants and dealers in precious metals and stones (known as ‘tranche two’ sectors) are particularly vulnerable to misuse and exploitation. These entities are increasingly exploited by criminal networks to disguise and launder illicit wealth.”

Submissions on the proposed laws close at 5pm on Thursday, June 13.

Only China, Haiti, Madagascar, the United States and Australia have not put in place the new laws out of 200 countries signed up to the international Financial Action Task Force.

It comes as a new podcast, Cocaine Inc. a joint investigation between True Crime Australia and the UK’s The Times, and The Sunday Times, revealed how Australian criminals were laundering money through an Irish crime clan using the Islamic Hawala banking system.

But despite the concerns about money laundering, the New South Wales Bar Association has demanded silks be exempt in a submission about the proposed laws.

“Contact between barristers and clients is limited, which would make compliance … unduly burdensome and costly,” the submission said.

Real estate agents have also pushed back on the laws, claiming it would cost them an extra $100,000 a year in red tape to put them into practice.

“A blanket compliance approach … should not be introduced,” the Real Estate Institute of Australia said in its submission.

Listen to the Cocaine Inc. podcast below:

They also hit back against having to check if they were leasing to criminals.

Convicted murderer George Marrogi was accused of running a syndicate from his jail cell in Victoria’s Barwon Prison that owned 60 properties, a luxury yacht, motorcycles, and jewellery.

The properties were among $47 million of assets seized in an AFP and Victoria Police investigation last year.

Transparency International chief executive Clancy Moore said Australia’s “real-estate market is a go-to destination for organised crime gangs, corrupt officials and petty criminals.”

Alice Saveneh-Murray, a financial crime expert at KordaMentha said: “Dirty funds globally are estimated to be 3-5 per cent of GDP and Australia is the 12th largest economy in the world. KordaMentha is very supportive of these changes, they are international best practices. Without tightening these laws it’s like working with one hand tied behind your back.”

NAB’s chief of financial risk Paul Jevtovic said the proposed new laws were long overdue.

Mr Jevtovic previously ran Austrac, was a former boss at the Australian Criminal Intelligence Commission and spent almost 30 years at the Australian Federal Police.

He said tougher rules and oversight needed to be in place for the use of property as a money laundering vehicle.

“Through my experience of 40 years it is without doubt that property has remained one of the key money laundering vehicles,” he said.

More Coverage

Originally published as Cocaine Inc: Barristers don’t want to dob in drug dealers