‘It’s like they are trying to change the meaning of property ownership’: Landlords threaten to sell up over further reforms

Eighty per cent of Queensland property investors have warned they may sell up if the government continues to hit them with reforms, in what is a troubling outlook for the state’s already strained rental market.

MORE than 80 per cent of property investors have warned they may sell up altogether if the Queensland government continues to hit them with reforms, in what is a troubling outlook for the state’s already strained rental market.

A survey of more than 3300 Queensland property investors, conducted by the Real Estate Institute of Queensland (REIQ), canvassed sentiment towards some of the ‘hot button’ changes proposed in the State Government’s stage two rental law reforms.

Those proposed reforms include making it easier for renters to install safety, security and accessibility modifications, to make minor personalisation changes, balance privacy of tenants with owners’ entry rights and need for information on their investment, changes to the rental bond process and tow hat fees and charges can be passed on to a tenant.

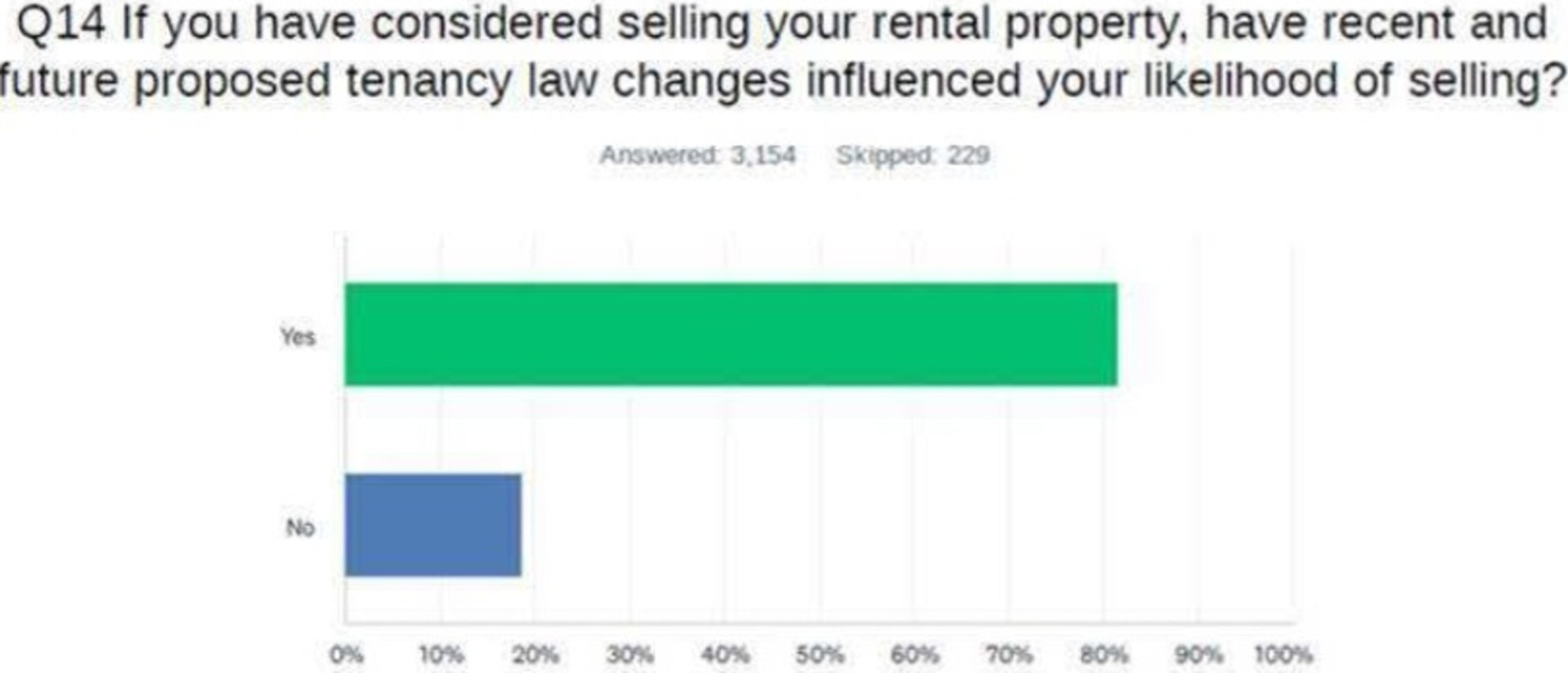

The REIQ survey revealed that 81.4 per cent of respondents said that recent and proposed tenancy law changes had influenced the likelihood that they will sell up.

To put that number into perspective, if all of those 81.4 per cent of the 3300 landlords who responded to the survey followed through on their threat, Queensland could lose nearly 2700 rental properties from the market.

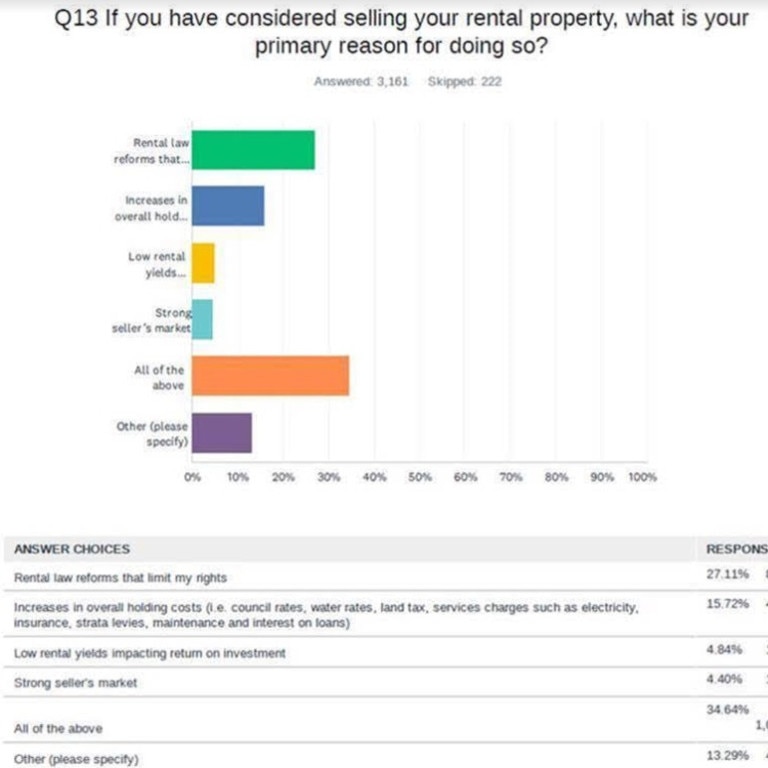

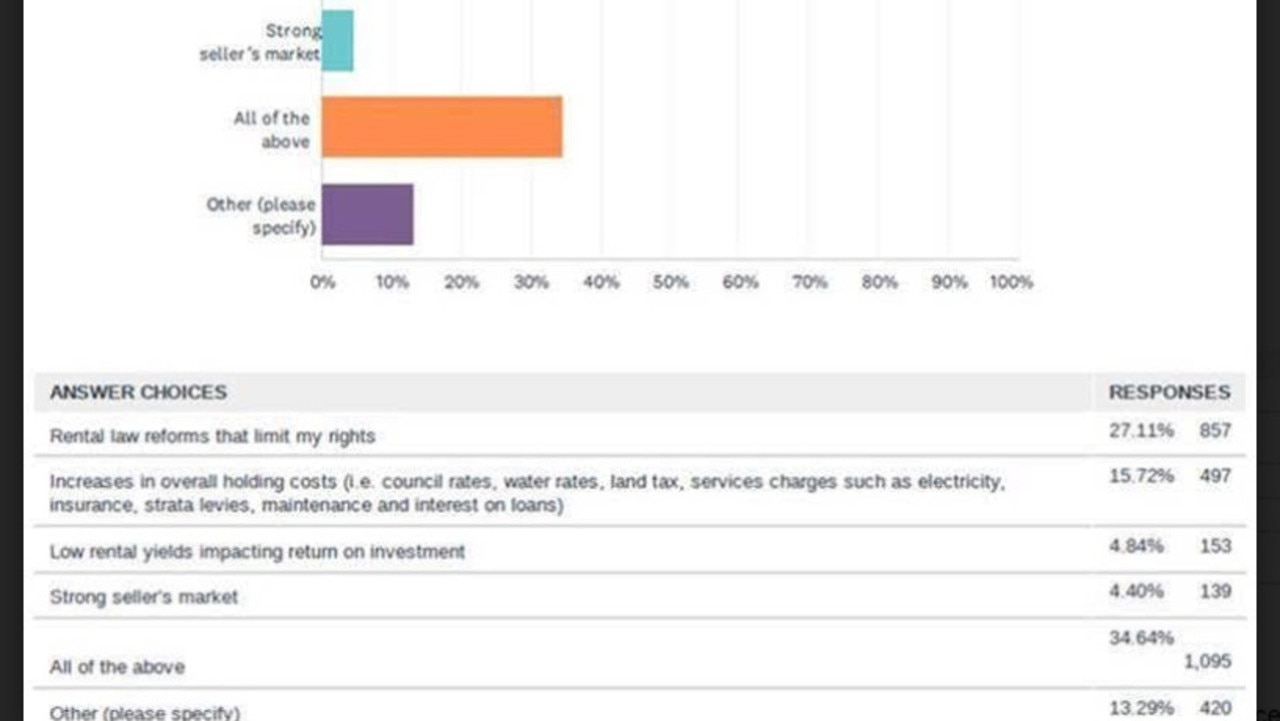

While 62 per cent of respondents said they had considered selling their rental property in the past two years, 27 per cent said the primary reason for doing so was on account of rental law reforms.

REIQ CEO Antonia Mercorella said they had received an overwhelming and passionate response from Queensland rental providers, who may walk away from property investment due to yet another round of rental law reforms.

“The REIQ is concerned with ongoing and consistent rental law reforms in Queensland which are progressively eroding property investor rights along with their confidence,” Ms Mercorella said.

“Further withdrawal of properties from the rental pool amid the critical rental crisis in Queensland will have dire consequences on the market in both the short and long term.

“This wholesale reform of the rental market is in direct contradiction with what all stakeholders seem to be in furious agreement about – the need to boost rental supply.”

The survey revealed that 98.6 per cent of rental providers were opposed to tenants making any property modifications without their consent – citing various concerns regarding property value, safety regulations, unqualified works, costs to rectify or fix damages and insurance implications.

Further, if rental providers could only refuse a property minor modification by going through the Queensland Civil and Administrative Tribunal (QCAT), 83.7 per cent said it would impact their decision to keep the property.

More than half (64.5%) were opposed to minor personalised changes to rental properties without the owner’s consent and were apprehensive about the lack of definition of ‘minor’.

For example, 79.8 per cent of the survey respondents did not consider painting walls of the rental property to be minor.

Other concerns surrounding minor personalisation changes related to the risk of costly damages and repairs falling back onto property owners to rectify.

The potential cost burden of the various changes were frequently referenced in the respondent’s commentary, with the survey revealing that 75.6 per cent said that the current rent they charge does not cover all of their outgoings to hold the property.

The REIQ said that private investors were doing the majority of the heavy lifting when it came to the provision of rental housing in this state, and is cautioning against further reforms.

Ray White AKG CEO Avi Khan, who has over 2000 rental properties on his books, said the survey reflected what his team were hearing on the ground.

“It is like they are trying to change the meaning of property ownership,” he said.

“I had one landlord saying he felt like he was losing control of his own asset.

“Landlords are feeling like they no longer have 100 per cent ownership of their own properties as reforms move in favour of the tenant and it is causing huge confidence issues for investors in Queensland.

“It is like the people making these proposals don't own investment properties.”

Mr Khan said the number of investors seeking appraisals was “through the roof”, adding that the vast majority were interstate investors who perceived that the government was taking control of their own assets away from them.

“And if that continues, it will only make the rental crisis worse,” Mr Khan warned.

“We have to keep in mind that with interest rates rising as fast as they have, and borrowing capacity crashing, it is not like it will be tenants who will be buying these properties if an investor decides to cash out.

“In terms of trying to address the housing crisis, they (the government) are just shooting themselves in the foot.”

The survey comes after the latest PropTrack Market Insight Report found that only one in 10 rental properties in Brisbane cost less than $400 a week now – a new record low – with just 7 per cent of houses in that price range.

The report found affordable Brisbane rentals at that price range were “few and far between” now, with houses the toughest to find after virtually halving in market share in the past year.

PropTrack senior economist Eleanor Creagh said “strong demand, bolstered by rising immigration, is outstripping the supply of available rentals”.

“As a result, the cost of renting is climbing and the share of rental listings below $400 is set to remain low.”

At the start of the pandemic, 43 per cent of houses in Brisbane were priced below $400 a week in March 2020, and 18.7 per cent just a year ago.

Regional Queensland is doing it toughest of all regional rental markets, Ms Creagh revealed, with its share of affordable rentals falling from 50.5 per cent in March 2020 to just 19.3 per cent in April 2023 – the smallest share of all regions.

Mr Khan cautioned that if investors followed through with their threats to sell up, it could lead to a glut of properties hitting the market.

“Generally, if we got a flood of properties hitting the market at once, the price of properties will come down,” he said.

“That will create a buyers market so those that can get into the market will, and that will lead to even fewer rentals.

“And that won’t help the demographic that is generally renters.”

More Coverage

Originally published as ‘It’s like they are trying to change the meaning of property ownership’: Landlords threaten to sell up over further reforms