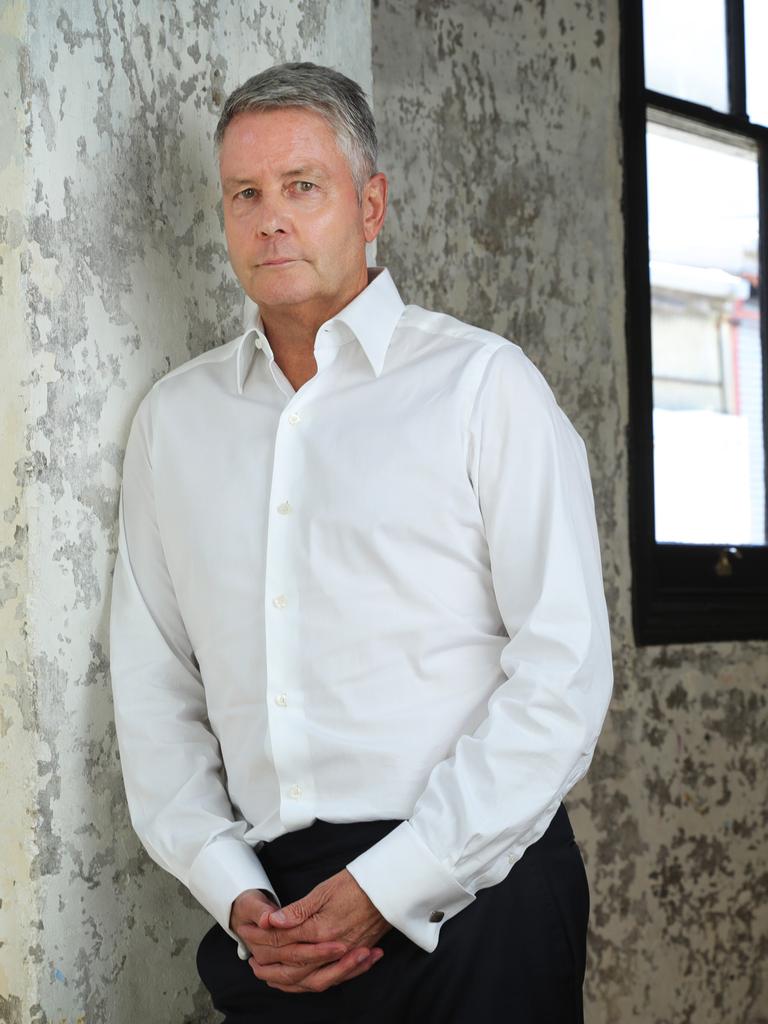

Goodman’s $100bn plan to become a digital infrastructure giant

Real estate investment trusts are spending billions of dollars on digital developments, like Greg Goodman who is planning projects across Asia, the US and Europe.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Australian investors are seeing a dramatic shift as the future of the real estate investment trust sector is reshaped by the AI revolution, with data centres starting to show their might, leaving some traditional asset classes in their wake.

The sector was hit hard by rising interest rates and the decline of office values, but the next wave of investing is taking shape with the dramatic launch of a new $4bn trust by David Di Pilla’s HMC Capital that will list on the ASX next month.

Plans for the new REIT come just a week after Goodman Group committed more than $6bn for four separate data centres across the US, Europe, Asia and Australia. It will begin construction on the centres next year.

Decades-old developers are now looking to change their business from the inside out, diverting their focus to this relatively new sector that many experts say Australia has the right tools, land and resources to build.

Others are likely to follow Goodman and HMC, with Charter Hall at its results flagging interest in its funds developing and owning data centres, and Centuria Capital taking an interest in new-generation data server provider Reset Data, with plans to roll out new-style data centres across Australia. Stockland has also developed a data centre at its MPark precinct in Sydney, and Dexus is looking at opportunities in the area.

But it is the dramatic nature of the AI revolution and the demand from hyperscalers and other data users that has the potential to transform the real estate sector and shift it away from traditional holdings in offices, shopping centres and industrial parks.

Others had weighed up the option of becoming a data centre builder and operator and decided it was better to invest. That was the case, according to its local head of investment Chris Tynan, for US alternative investment firm Blackstone, which acquired AirTrunk for $24bn in September.

Goodman is marching deeper into the sector, with plans to convert its suite of international sites and warehouses into power-hungry data centres to help fuel the artificial intelligence boom.

Locally, that includes its most recent play in Sydney’s north shore, where it will spend $1.4bn to develop the former ABC headquarters in Artarmon into a 52m-tall data centre. It picked up the site for $94.87m in July 2022. The Artarmon play is part of a broader shift by Goodman to build and deliver turnkey data centres, with operating the centres also on the cards.

That project is one of several that make up 42 per cent of the group’s 74 current projects, with a pipeline of $12.8bn. In a couple of years, data centres would make up well over 50 per cent, said Greg Goodman, the group’s chief executive.

Much like local data centre operator AirTrunk, Japan is a key market for Goodman. And if Goodman’s latest project there is anything to go by, that $1.4bn spent on the Artarmon project will make up only a fraction of its end value.

One Japanese project for Goodman, a data centre campus in Tsukuba, in outer Tokyo, has a one gigawatt capacity. “That’ll be over $30bn in value,” Mr Goodman said, with the complex to be built out in stages.

That is less than a third of the end value it predicts several of its data centre projects will be worth as the group seeks to become a digital infrastructure powerhouse. “Certainly over seven or eight years, our whole pipeline will be close to $100bn of end value,” Mr Goodman said. “We would want to be through the thick end of $30bn-$40bn worth of work over the next four or five years.”

A number of these projects will begin in the 2025 calendar year, with the ASX-listed funds manager having projects set for development in Australia, the US, Europe and Japan. Mr Goodman said Goodman would be spending at least $1bn each on a data centre in the four locations over the next 12 months.

Funding capital-heavy data centres is resulting in different investors tap multiple funds from real estate, technology and infrastructure to get a slice of the action.

HMC Capital is betting that retail investors and global institutions will chase the promise offered by the hot sector as the AI revolution takes off, with the trust flagging an aggressive strategy to roll out centres locally and in the US.

Real estate firm CBRE’s research finds that, in Australia, data centres have already become the third most sought-after investment for lenders, after industrial and built-to-sell assets. The shift had occurred as competition for data centres intensified, CBRE Pacific data centres capital markets director Darcy Frawley said.

“Occupiers are now competing aggressively to increase their data centre footprint to accommodate future business needs,” he said. “Australia is set to see a large gap between capacity and demand in the medium term, which will lead to significant rental growth and make the sector even more appealing for data centre investors.”

The outlook is strong – and even traditional sectors could benefit. JLL researchers predict that AI will increase demand for office space across CBDs, with 483,000sq m more needed by 2030. This is largely driven by a rise in AI jobs, with JLL finding that 76 per cent of AI jobs will be in Sydney and Melbourne, as AI companies forge into the market.

But for now the big play is getting enough data centres to market. Mr Goodman says he believes he has a five-year head start.

“As we saw where it was going, we just stepped up the work around the infrastructure or our sites and began converting our industrial sites to data centres,” Mr Goodman said.

“Now we’ve got a five gigawatt pipeline that takes you on a build-up basis to around $100bn in end value.”

More Coverage