‘Time to worry’: Dismal growth figures paint bleak picture for UK in 2025

PM Keir Starmer’s government have only been in power for months, but damning new figures threaten to derail it.

World

Don't miss out on the headlines from World. Followed categories will be added to My News.

Serious questions are being asked of the newly elected government of UK Prime Minister Keir Starmer, following the release of dismal quarterly growth figures on Monday, local time.

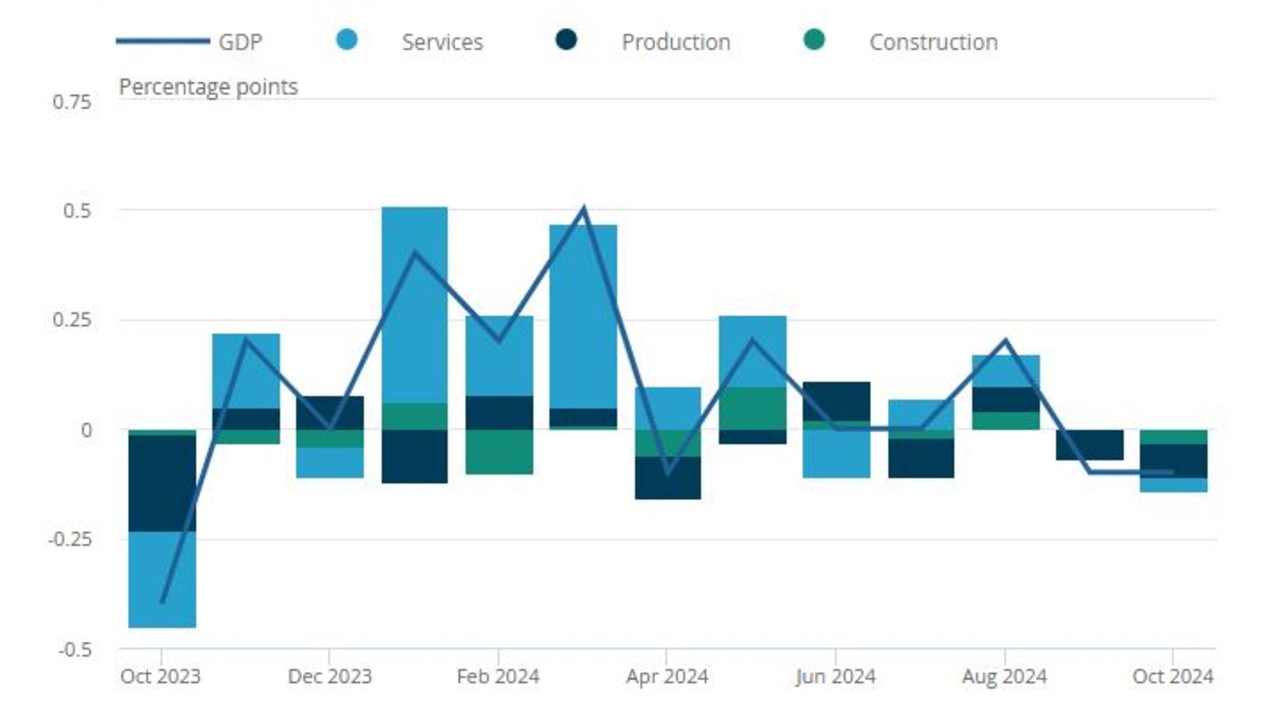

Preliminary estimates issued by the UK’s Office of National Statistics predicted a tepid 0.1 per cent of GDP growth in the three months to September. However that number was revised on Monday showing the UK economy had flatlined, failing to achieve any growth in that period.

The ONS also revised its reading of growth in the second quarter of 2024 from 0.5 per cent to 0.4 per cent.

The revisions represent a major blow to the Chancellor of the Exchequer, Rachel Reeves and the Starmer government just two months after delivering their first budget in October. In her 77 minute address to the House of Commons, Ms Reeves outlined her road map to increased growth and balanced books without increasing the burden on the working class.

“The only way to improve living standards, and the only way to drive economic growth is to invest, invest, invest … we must restore economic stability and turn the page on the last 14 years,” she said.

An extra £40 billion ($79 billion) in the government tax take is set to lift taxation levels to record highs.

The release of ONS growth figures on Monday has only added to Labour’s woes, with the economic outlook for 2025 looking increasingly bleak. Two consecutive months of economic contraction defied expectations with official estimates predicting a return to growth in October.

Over the four months since the election of the Starmer government, only one of those months saw the UK economy grow. At the time of their election the UK was the fastest growing economy among their G7 peers.

Despite the Bank of England’s (BOE) decision to hold rates steady last week, the economy saw back-to-back months of inflation rises, now up to 2.6 per cent from 2.3 per cent in the 12 months to November.

Having moderated severely from the highs of 2022, and finally falling below the BOE’s target of 2 per cent in September, the dial is now moving in the opposite direction.

On top of all of this government borrowing costs are now rising to levels not seen since the Liz Truss’ 2022 mini budget according to the Financial Times.

Tom Joseph’s, an official at the UK’s fiscal watchdog, The Office of Budget Responsibility, said last month that a 0.3 percentage point rise in government borrowing costs would eliminate all of the £9.9 billion ($19.9 billion) of space in Reeve’s fiscal margin against her key deficit rule. The budget rule mandates that day-to-day government spending must be funded by taxes, not borrowing.

In a statement responding to the ONS figures on Monday, Ms Reeves maintained the measures in the government’s October budget were suitable. “The challenge we face to fix our economy and properly fund our public finances after 15 years of neglect is huge,” she said.

“But this is only fuelling our fire to deliver for working people … The Budget and our plan for change will deliver sustainable long-term growth, putting more money in people’s pockets through increased investment and relentless reform.”

However, Ruth Gregory, an economist at Capital Economics said that momentum had all but disappeared. “Much of the improvement in economic growth happened in the first half of the year and GDP growth has slowed ever since,” she said.

Other economists propose that if Labour are to take a 180 degree turn on growth that is currently in reverse, it must find a way to address the economic handbrake that is productivity.

While British correspondent for The Economist, Archie Hall had a more positive spin on the year thus far he concluded that while, “Initial recovery in growth during 2024 was a pleasant surprise for the economy and for the government … if it cannot be sustained in 2025, it really will be time to worry.”

Originally published as ‘Time to worry’: Dismal growth figures paint bleak picture for UK in 2025