Toowoomba experts question new data that 63 per cent of households under mortgage stress

Thousands of Toowoomba residents are reportedly under pressure with their mortgage repayments. But the new research has been questioned by local experts.

Toowoomba

Don't miss out on the headlines from Toowoomba. Followed categories will be added to My News.

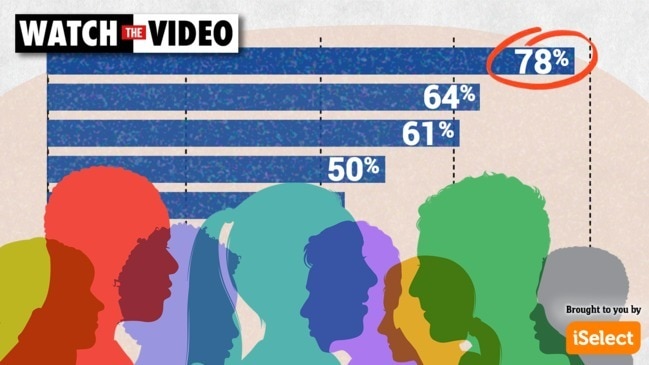

Toowoomba mortgage experts have questioned new data, which suggests more than 60 per cent of the city’s borrowers are facing mortgage stress right now.

Research from Digital Finance Analytics, which was provided by consumer group Choice, concluded there were more than 9600 households with a mortgage were under pressure in Toowoomba.

DFA principal Martin North said the data, collected from 52,000 families across Australia, was based on the notion that a household with a negative cashflow position would struggle to keep up with mortgage payments or look at refinancing to service it.

“If their cashflow is structurally negative, eventually this leads to negative issues,” he said.

“Many people have seen no real income growth since 2011, they’ve seen an increase in living costs.

“People are caught in a pattern that can lead to financial distress.

“The point is it’s the leading indicator of what’s going to happen down the track.”

Mr North also said an increase to interest rates could put even more pressure on households.

He added lenders were becoming more aggressive, offering 15 per cent more borrowing power to potential buyers this year than 12 months ago.

The data was as evidence in Choice’s push to stop the Federal Government winding back responsible lending laws.

But Mortgage Choice principal Julian Collins said he had seen no evidence of mortgage stress in his dealings with potential homeowners, questioning the methodology.

“I don’t see any people at all who are in distress — most people are ahead on their payments,” he said.

“I have no evidence to back this up — it’s in reverse with what the actual property market is showing,” he said.

“For people I’m interviewing, they’re paying more in rent than their home loans will cost them.

“That’s why they’re buying houses, because interest rates are very low at the moment.”

Mr Collins also pointed out wage growth and interest rates were interconnected.