‘Could sell ice to the Eskimo’: 122 creditors left out of pocket as Adelaide Exposed Concrete goes bust

An Adelaide businessman “sold the dream” to more than 100 families and businesses and now they may never see their money again after going bust.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

An Adelaide businessman gone bust owes approximately $1.7m to 122 couples, families and businesses that may never see their money again.

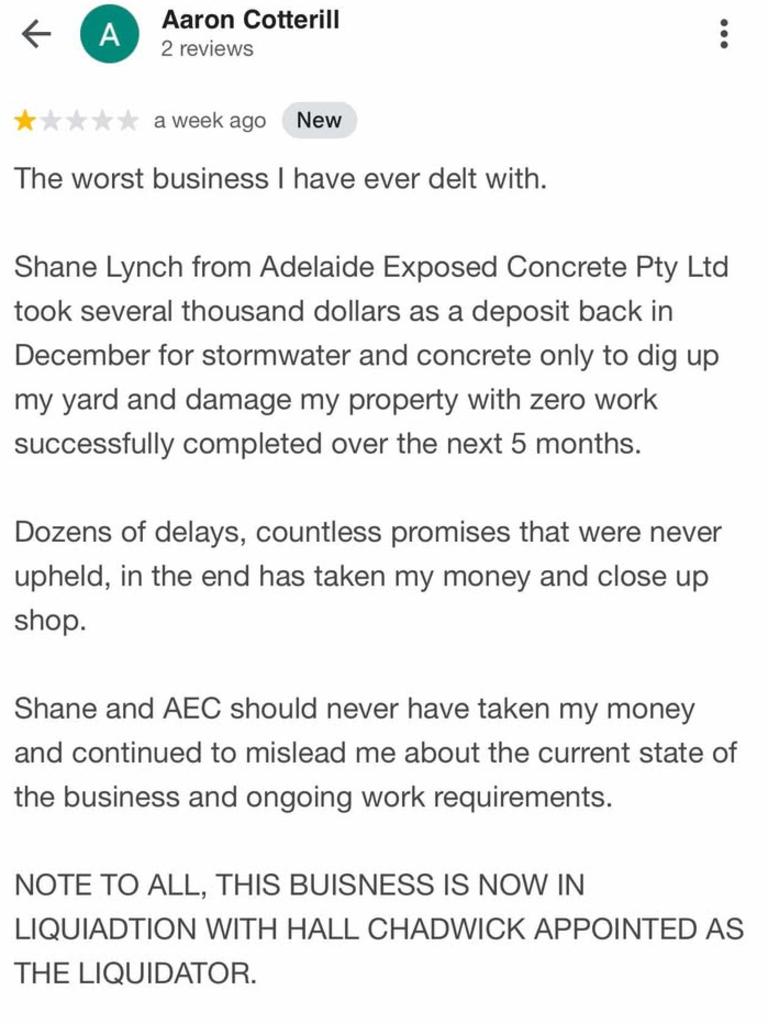

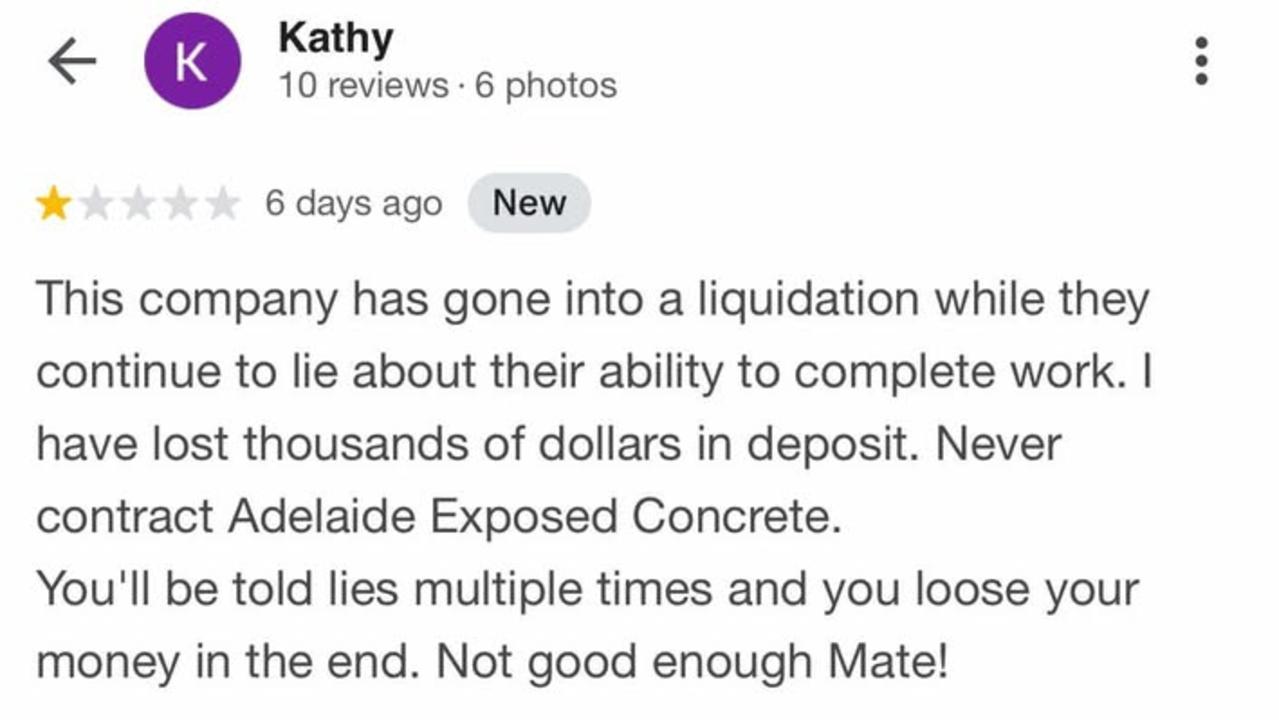

Furious creditors have been left in the lurch by Shane Lynch and his concreting business Adelaide Exposed Concrete (AEC) after the business was wound up on May 7.

AEC was voluntarily wound up by a liquidator after the company was unable to pay its debts to creditors, totalling approximately $1.7m to unsecured and secured creditors.

A secured creditor has a security interest, like a mortgage or loan, over some or all of a company’s assets.

The largest creditor, Nissan Financial Services Australia, is owed $116,482 by AEC.

Owed $62,414, concreting supply company Ideal Mix Concrete was AEC’s second highest owed creditor.

Renato Obbiettivo took over the business, which has been operating for 42 years, from his father who passed away recently.

Ideal Mix Concrete supplied Mr Lynch with concreting supplies from December 2023.

Mr Obbiettivo said things seemed all right to begin with but “the penny dropped” mid-2024 and he stopped supplying AEC instantly.

“There’s going to be a lot of pain because of what’s happened,” Mr Obbiettivo said.

“We were poached by Shane, he spoke nicely and sold us the dream.

“He could sell ice to the Eskimo and talk underwater ... it’s quite a pill to swallow, and now we’ve got the flu.”

Adelaide Civil Works’ Andy Germain was another business owner that said he felt “misled and lured” by Mr Lynch, who owed $31,715 to the company.

“The writing was on the wall the whole time,” Mr Germain said.

“We would prep work before he (Mr Lynch) came in with the concrete.

“It really cost me closer to $50,000 because of wages, any dumping and rubble that I had to pay for as well.

“I am disappointed and unhappy ... I want him to pay the price.”

ReturnToWorkSA was another business owed a substantial $58,449, as was Taurus Finance Holdings, owed $43,093.

Many of the creditors were owed between $10,000-$30,000 — most of them individuals, couples or families looking to have concreting work done on their homes.

Keith Diener needed a retaining wall fixed as it was starting to “give way and fall”, posing a safety hazard at his Woodcroft home.

Mr Diener also wanted to relanscape his lawn and concrete around his pool — but he’s been left with two massive piles of dirt as a back garden instead.

Owed $8,373, Mr Diener said he was pretty sure he was “not going to see a cent”.

“The last time I saw Shane on site was April 24,” he said.

“His employee came back on the Monday after that (April 28), was there for about an hour and then said he had to go home because he wasn’t well.

“We got some text messages (from Mr Lynch) over the next couple of days saying (the employee) was still sick, there wasn’t anyone else to drive the truck, and the employee needed another week off.”

Mr Diener said the AEC employee contacted them personally on May 7 and said “I don’t know what’s going on, I think Shane’s in trouble,” and “I don’t think I’ll have a job next week”.

“I tried to ring Shane ... he said ‘we’d be there in the morning’, after he’d already started the liquidation process,” he said.

“I don’t know how to explain it, I don’t see how someone can basically steal from us and not face repercussions.”

Mr Diener has since had two other businesses quote to take on the job that was left “not even halfway” finished by AEC.

Craig and Paula Miels from Mt Barker felt like they’d “been given excuse after excuse” after contracting AEC to repair their driveway for a quoted $24,000, to be left stuck with a half-done job and unable to park at their own home.

The couple only ended up paying $14,336 of the total quoted amount to fix the driveway before the job got parked indefinitely.

“We can’t even use our driveway,” Mr Miels said.

“Three weeks ago the mesh was dropped at the bottom of the driveway and (Mr Lynch) said he’d do it.

“On Tuesday (May 6) he said ‘I won’t be doing it’.

“We’ve lived in this house for 20 years and have never had a proper driveway, and now this.”

“What are we supposed to do?”

David Trim, who is the appointed liquidator from accounting company Hall Chadwick, said his team had fielded a number of queries from creditors already and encouraged any creditor who believed they had a claim to contact the Hall Chadwick Adelaide office.

The Advertiser attempted to make contact to Mr Lynch for comment.

More Coverage

Originally published as ‘Could sell ice to the Eskimo’: 122 creditors left out of pocket as Adelaide Exposed Concrete goes bust