Dr Chris Moys fears GP payroll tax will add to ED pressure

The government has rejected a prominent GP’s claim that changes to clinics’ taxes will backfire where it hurts most.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

South Australia is “going to need a longer ramp”, a prominent Adelaide GP warns as the state government’s payroll tax grab is about to hit clinics with a potential flow on effect to ambulance ramping.

A landmark court ruling last year found GPs working in clinics as contractors are deemed employees — making such clinics liable for payroll tax.

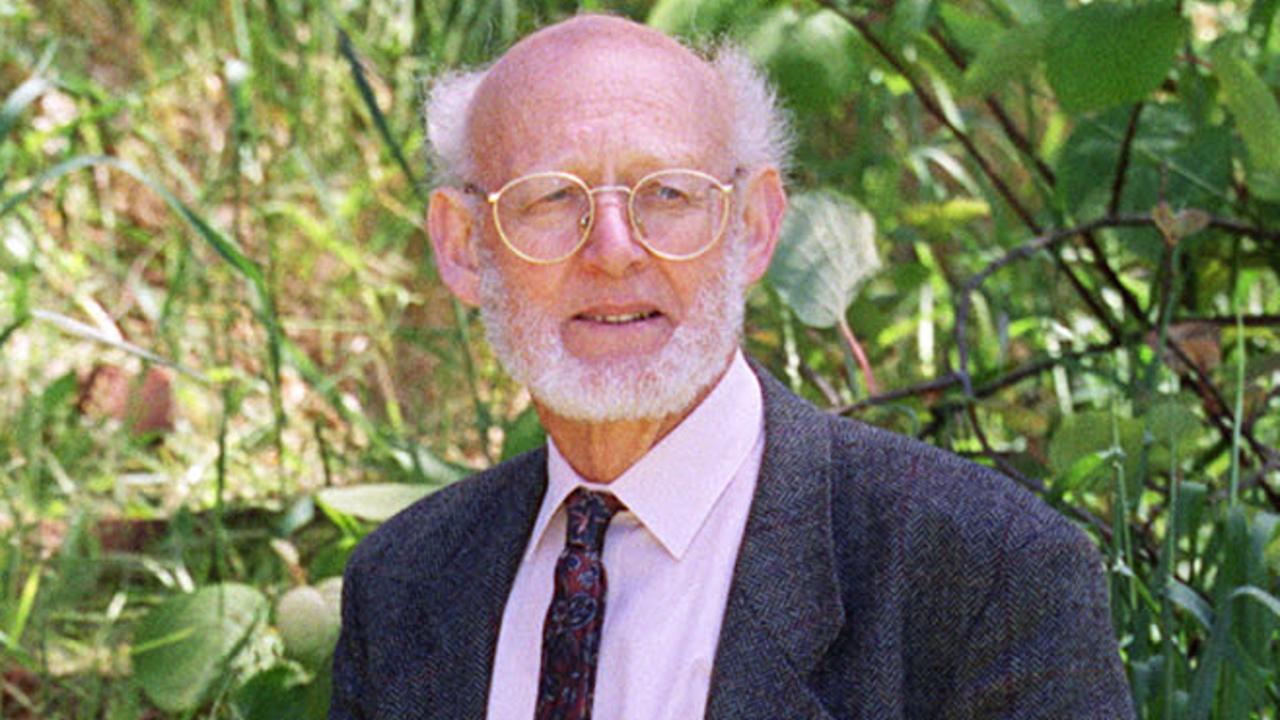

Dr Chris Moy, a former Australian Medical Association state president and national vice-president, said the tax was likely to be passed onto patients as increases in their gap and noted specialists also will be caught in the net.

“A key to minimising ramping is ensuring patients can see their doctor when they need it and get the care they need to stay well and prevent them getting sick enough to need hospitalisation,” Dr Moy writes in an opinion piece in the Sunday Mail.

“The effect of the state-based payroll tax on clinics will be to create a false economy where a patient may avoid seeing their doctor due to a resultant increased gap, get sicker, and then need a $1000 ambulance attendance or hospital admission costing thousands of dollars a day, paid by for the same state government.

“What will that do to the ramping promises?”

Referencing Hollywood movie Jaws, Mr Moy added: “In seeing how much harder it will be for patients to see their GP or specialist because of the tax, SA hospital bosses may soon be saying: ‘We’re going to need a longer ramp’.”

Australian Medical Association SA president Dr John Williams agreed with Dr Moy and said the tax would see increased costs to clinics which will inevitably be passed on to patients.

“For a lot of practices, this payroll tax will be the straw that breaks the camel’s back,” he said.

“For practices to survive, it will need to be passed on. There are patients that can’t afford to see their doctor and this will only reduce access for them.”

The state government granted an amnesty on the tax but will start charging from July 1.

It says it is not a new tax, just correct application of an existing tax, and has granted an exemption to bulk billed consultations.

However, the amount involved is a mystery — it was not included in this week’s 2024-25 state budget and Treasury officials told the Sunday Mail they cannot even make ballpark predictions to include in the forward estimates.

They say this is because they do not have enough information on GP wages or exemptions for bulk billed consultations and need to wait until paperwork is reconciled.

Treasurer Stephen Mullighan insists that “by and large” it should not add pressure on EDs, noting there is a $1.5m wages threshold and bulk billed consultations are exempt.

“The vast majority of GPs won’t be paying payroll tax under these measures,” he said.

However, one suburban family clinic says it will cost them more than $110,000 and this is likely to be pushed onto gap fees, in turn leading to some patients opting for “free” medical care at embattled hospital emergency department.

Dr Moy likened the situation to TV satires such as Yes Minister as the federal government tries to underpin GP clinics while the state government “undermines” them.

The tax looms at a time ambulance ramping hit a record 4773 hours in May and overwhelming demand on hospital EDs triggered statewide cancellations of more than 500 elective surgeries to free up ward beds.

It also comes as Baby Boomer GPs retire and there are historically low numbers of medical students indicating they want to be GPs.

Dr Chris Moy: We’ll need a longer ramp

From Wednesday, July 1, in the middle of both cost-of-living and ramping crises, there is a high chance you will be asked to pay an increased gap payment when you see your GP, specialist, or when you have a procedure or test. The state government’s decision to be the first in the nation to take advantage of a recent interstate tax ruling and to apply payroll tax to medical clinics and practices is likely to be passed on to South Australians as increases in their gap payments.

The ruling surrounded the definition of a contractor, a common way in which many doctors and other health practitioners have traditionally provided care to their patients. If applied, the tax will severely impact many clinics across the state who will have to decide whether to cut services or pass on the new cost, especially in the most disadvantaged areas.

Although the state government made a grudging concession last week to exempt GP bulk-billing averting a total meltdown of the health system, and putting arguments about tax law interpretation aside, the move here in SA is stark in being totally counter to all other federal and state government efforts to try to stem the ramping crisis by increasing health funding and resources.

The federal government, for example, has focused on trying to ensure patients can see a GP when they need to so that they stay well. In the face of a projected catastrophic fall in GP numbers – estimated to be 11,000 nationally by 2023 – the federal government promised $3bn to try to shore up this frontline of the health system.

The state government’s decision to charge the payroll tax for the first time will now create the farcical situation in the vein of TV shows Yes Minister and Utopia where one hand of government gives to fix a problem only for the other hand of government to take it away.

Meanwhile, the state government, in attempting to live up to their core election promise to stop ramping, has been unabashed in announcing huge new funding allocations for new ambulances and hospital beds, the latter to a great extent to make up for a Royal Adelaide Hospital which was built 250 beds too small.

Ramping, where very sick patients wait outside hospitals in lines of ambulances because they cannot enter overflowing hospitals, is a result of too many patients getting sick enough to need hospital treatment, or not enough hospital beds to accommodate them.

A key to minimising this is ensuring patients can see their doctor when they need it and get the care they need to stay well and prevent them getting sick enough to need hospitalisation.

The effect of the state-based payroll tax on clinics will be to create a false economy where a patient may avoid seeing their doctor due to a resultant increased gap, get sicker, and then need a $1000 ambulance attendance or hospital admission costing thousands of dollars a day, paid by for the same State Government. What will that do to the ramping promises?

In the movie Jaws, Chief Brody, when seeing the shark utters the famous quote, “you’re going to need a bigger boat.” In seeing how much harder it will be for patients to see their GP or specialist because of the tax, SA hospital bosses may soon be saying: “we’re going to need a longer ramp.”

Dr Chris Moy is a GP and former AMA president

More Coverage

Originally published as Dr Chris Moys fears GP payroll tax will add to ED pressure