Sunshine Coast high-flyer's fight back from bankruptcy, $72m debt

Four years ago, Sunshine Coast developer Scott Juniper raced after the family Range Rover as it was being repossessed to grab his daughter's baby seat.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Four years ago, Sunshine Coast developer Scott Juniper raced after the family Range Rover as it was being repossessed to get his daughter's baby seat out of the back.

Only weeks earlier, he had obtained the paperwork to register for active bankruptcy with debts totalling $72 million.

He handed in the paperwork on his 40th birthday.

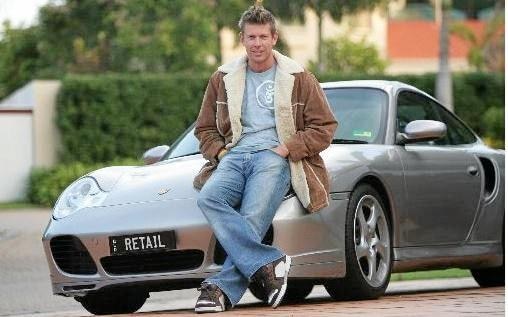

The high-flyer who loved his fast cars and was involved with many developments across Queensland had to move back in with his parents and his valuables were repossessed.

The son of one of the Sunshine Coast's most successful developers, Graeme Juniper, had reached rock bottom.

Mr Juniper has, for the first time, revealed what went wrong and how his financial collapse has made him a stronger, more careful property developer with several new projects on the go.

He has also spoken about the awful court case with John Roberts, who was 88 years old when he sued Mr Juniper and won over the controversial sale of his multi-million dollar Mooloolaba property.

In 2007 no one, least of all Mr Juniper, could have imagined how the tables would turn.

"I had an enormous amount of projects on the go with lead funders such as Bankwest and Capital Finance Australia Limited," he said.

He was meeting his monthly repayments, had committed tenants in place eager to move in and had no reason to suspect anything would change.

Then, in an "apocalyptic lending storm" it all collapsed.

Capital Finance was taken over by the Bank of Scotland which stopped lending on projects.

Bankwest followed suit.

"I went from all loans in line and great projects to nothing," he said.

"It had the domino effect and in a three-month period, 30 companies went down."

Mr Juniper went from "hero to zero".

He was forced to look at bankruptcy as there was no way he could pay his 12 creditors.

"I owed Bank of Scotland nearly $50 million and Bankwest $22 million."

The rest were smaller amounts due, including around $150,000 to Mr Roberts for the lawsuit over the sale of Mr Roberts' Mooloolaba house that Mr Juniper was able to get out of on a legal technicality.

An angry Mr Roberts wasn't about to let it go and successfully sued Mr Juniper.

But what he didn't know was Mr Juniper hadn't tried to weasel out of the sale, he was in extreme debt.

"John couldn't believe I didn't have the money. He was thinking 'Your dad's a successful developer why not bail him out?'.

"How do you bail someone out from $72 million?

"Here is this nearly 90-year-old man who got burnt. In the back of this, I'm living in my mum and dad's house with my wife and baby.

"I had no cars, nothing."

He finally reached an out-of-court settlement with Mr Roberts in February 2014.

In a move "unheard of in corporate history" the Bank of Scotland accepted a payout and Mr Juniper was able to avoid bankruptcy by paying creditors a mere $70,000.

He almost broke into tears as he remembered chasing after the repossessed Range Rover to fetch his little girl's baby seat.

"That was the lowest point in the whole thing," he said.

As Mr Juniper was never declared bankrupt and had reached a settlement, he was able to begin developing the next day.

But with no money and no confidence, he didn't know where to begin.

However, the many prominent Sunshine Coast businessmen he had dealt with over the years knew he had the magic touch and involved him in their projects.

"I started developing when I was 17. People realised I was doing it tough and they said, 'Hey, I'll do a project with you'."

He started to syndicate deals and looked for small, high-quality, low-risk projects, like Entrance Island at Kawana.

Instead of building 'matchbox' homes in a prime location, he took the unusual move of creating large lots for the upmarket home owner looking for extra space.

His company Cube Developments has numerous projects on the go, including a residential development in Mudjimba and Palmwoods.

But one of the newest and more exciting is Vibe in Coolum Beach.

A syndicate Mr Juniper helped put together bought the block of land in Elizabeth St for $4.4 million in August 2015 with approval for 90 units.

In a controversial move council officers tried to oppose it as it was "too small". They changed the plans from a big unit complex to small beach houses with an estimated value now of $33 million.

Nearly 17 of the 40 beach houses have sold off the plan.

"One good thing out of all this is I look at projects differently," Mr Juniper said.

"Entrance Island wouldn't have happened if I hadn't gone through this experience.

"Same with Vibe in Coolum. I now look to low-density, low-scale, small-lot houses and the market loves it."

He has also learnt to value the simpler things in life.

"I used to love the cars. I don't love them as much any more," he said

His only lasting regret is for Mr Roberts, a millionaire in his own right, who was too ill to answer the Daily's call.

"I never wanted to have a fight with John. I felt so sad, so many times on the way," he said.

"If you are broke, you are broke, but it never sat well with me.

"We did reach an out-of-court settlement in 2014 but still."

Originally published as Sunshine Coast high-flyer's fight back from bankruptcy, $72m debt