Raw sugar prices push above the $500 mark as growers rejoice

Sugar cane growers who locked in contracts this week will have big grins on their faces and ‘an edge of confidence’.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Sugar cane growers who locked in contracts this week will have big grins on their faces as prices push above the $500 mark.

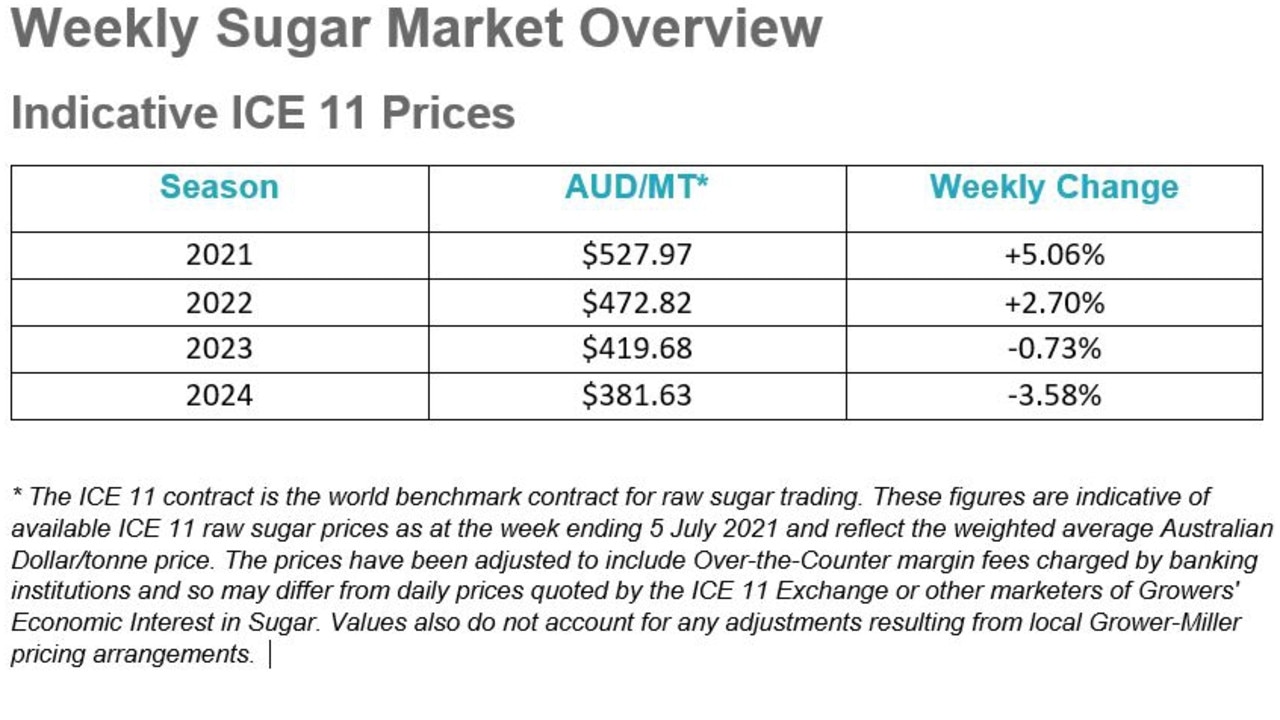

Up 5.06 per cent on the previous week, the 2021 season ICE 11 raw sugar price hit $527.97 in the week ending July 5.

The predicted price for the 2022 season is $472.82, a 2.7 per cent jump on last week’s prices.

Prices for the 2023 and 2024 seasons are slightly down at $419.68 (-0.73 per cent) and $381.63 (-3.58 per cent), respectively.

Queensland Sugar Ltd says those figures reflect the weighted average Australian dollar/tonne price and have been adjusted to include over-the-counter margin fees banking institutions charge.

They do not account for any adjustments resulting from local grower-miller pricing arrangements.

Canegrowers Queensland chairman Paul Schembri said the past week’s prices had given growers “an edge of confidence”.

He said world sugar prices had been below the price of production for the past two-and-a-half to three years.

“We would like it to be higher but sugar prices are travelling in the right direction,” the Mackay grower said.

“We have the facility in the Australian industry where we can forward price and lock in some of that pricing. It’s a strong price.

“People have started locking away prices for 2022.

“That’s a huge advantage we, as Australian producers, have. We are some of only a few countries around the word who forward price so it’s a great opportunity for us.

“Forward prices can be fickle, as quickly as they get strong, they can fade, but we have a sense it will stay strong for some time.

“Picking sugar prices, though, can be like trying to predict the winner of the Melbourne Cup.”

QSL’s latest market overview says the new prompt ICE 11 raw sugar contract, October 2021, finished last week up 84 points week-on-week, opening on the Monday at 17.16 US cents per pound (USc/lb), before peaking on Thursday at 18.49 USc/lb and then closing the week at 18.15 USc/lb.

“The July 2021 ICE 11 contract expiry was highlighted by a relatively small volume of sugar delivered to the tape, just 130,900 tonnes and all Brazilian sugar,” the overview read.

“The low volume is likely to be an indication of low sugar demand, but may also be symptomatic of the slow progress of Centre South Brazil’s harvest providing the October 2021 contract some price support.

“The latest Commitment of Traders data reported an increase on the net-long position as of 29 June 2021.

“The net speculator position is up 6000 lots to 191,000 lots net long.

“The United States Department of Agriculture has announced their grain acreage and stocks are below market expectations which should incentivise speculators to continue to invest in agricultural commodities.

“The Brazilian weather made the headlines again, but this time it was in relation to a potential frost occurring in two states that represent around 14 per cent of Centre South Brazil’s cane.

“Frosty weather can be disruptive and damaging to new crops, and the impact can be hard to measure.

“The news ignited a price spike on the October 2021 ICE 11 contract. However, it was short lived.”

The new financial year has also marked an important change for QSL cane growers in the Herbert River, Burdekin, Proserpine and Plane Creek milling districts.

New simplified GST arrangements are now in place to reflect grower feedback.

Payment paperwork has been streamlined, new-look statements are in place from July 1 and growers will be able to access key payment information and notifications via the QSL App.

The app is an industry first and lets growers price sugar on the global market while on the go.

More Coverage

Originally published as Raw sugar prices push above the $500 mark as growers rejoice