Insurance prices Qld: Insurers deny ‘novelty’ policies driving up costs

More than two-thirds of Australian households were hit by insurance price hikes over the past 12 months, with an analysis of policies finding “novelty” inclusions and big exclusions.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

More than two-thirds of Australian households were hit by insurance price hikes over the past 12 months, as a major insurer offering cash for a hole-in-one or sporting record denies its “novelty” policy inclusions are driving up costs.

Queensland councils want the next federal government to take action to reduce the skyrocketing costs of insurance.

They are calling for greater transparency in the setting of premiums, affordability and availability of insurance statewide, and a review of the Australian Cyclone Reinsurance Pool to extend the claims period for cyclone and flood related damage and expand the criteria.

Local Government Association of Queensland CEO Alison Smith said: “Insurance is a critical cost-of-living issue that councils have been raising on behalf of their communities for a number of years.

“We have presented a suite of measures to make insurance more affordable and available for Queensland communities to all parties and candidates standing at the federal election.”

SCROLL DOWN FOR HOME AND CONTENTS POLICY DIFFERENCE EXAMPLES

A new Finder.com.au survey of 1009 Australians has revealed 69 per cent of homeowners had experienced a jump in the cost of home and contents insurance in 2024.

Queensland respondents reported being the most heavily impacted, with 79 per cent of residents revealing their premiums had risen over the course of the year, compared with only 58 per cent of those from NSW.

“Premium increases are a growing burden,” Finder insurance expert Peta Taylor said.

“Insuring your home is getting increasingly expensive as insurers pass on the cost of rising climate risk contributing to financial stress for many households.”

An average insurance quote for a typical four-bedroom house in Brisbane was $2803.48 in December, according to Compare the Market’s general insurance quote index.

The insurance comparison site also reported significant differences between quoted premiums.

In one example, a four-bedroom Brisbane home in the northside suburb of Bridgeman Downs was $1943.

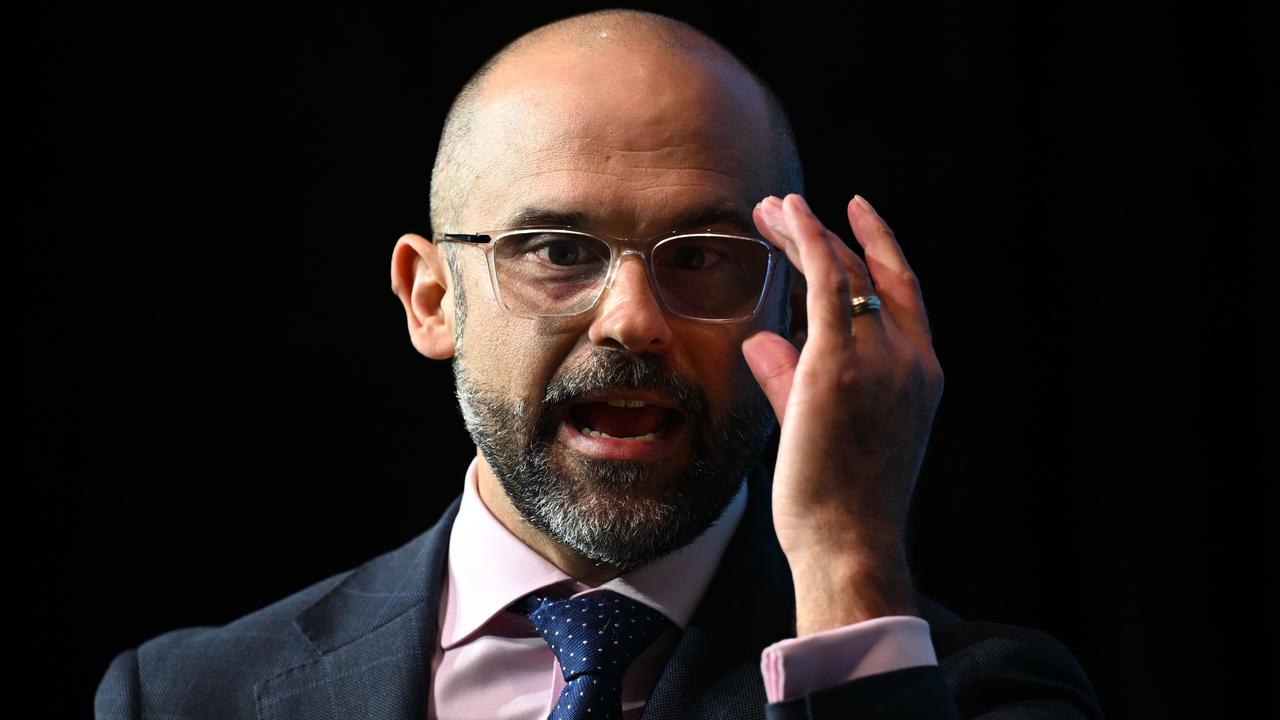

Compare the Market economic director David Koch said: “With a gap that wide, you would be crazy not to look and see what else is out there.

“The range of coverage can vary dramatically too.

“If there’s something really important to you, consider those key inclusions to make sure you’re not left in the lurch if you need to claim.”

A Courier-Mail analysis of nine home-and-contents policy product disclosure statements from major providers found a number of variations and unique home and contents inclusions.

A Queensland-based Youi content policy will pay 9$200 if a customer hits a hole-in-one in an official club competition game of golf on any Australian golf course, or breaks an officially recognised international sporting record.

Under the same policy, if a customer or a member of their immediate family who lives with them gives birth to two or more babies from the same pregnancy conceived during the term of their policy, they can be paid $100 per baby.

The policy also covered up to $1500 of out-of-pocket costs per person for sessions with an accredited counsellor resulting from an incident where a claim has been accepted.

A spokeswoman for Youi would not confirm how many times the sporting or multiple birth payments had been claimed.

She said the “novelty benefits” were legacy provisions designed to draw attention to the insurer, and products were being continuously reviewed to ensure affordability.

“Given their mostly lighthearted nature, the vast majority of these inclusions don’t influence our claims or premiums to a great degree,” the spokeswoman said.

“However, our counselling provision remains a crucial component of our cover, as trauma often accompanies significant losses, and this support is essential in helping our customers during times of need.”

Other significant policy variations included not all providers covering pet damage, identity theft, food spoilage, the belongings of visitors staying at a property, damage to landscaping and extra coverage up to 25 per cent if the total sum insured amount doesn’t cover all costs.

Ms Taylor said the wide variation of insurance pricing and coverage made it essential to compare policy inclusions.

“Insuring your home is getting increasingly expensive as insurers pass on the cost of rising climate risk contributing to financial stress for many households,” she said.

“Your house is often your biggest asset and home insurance is a vital investment to protect yourself from financial loss due to damage or theft.

“Nobody wants to read their PDS, but the benefits will outweigh the boredom if it means you can save money on your policy.”

Originally published as Insurance prices Qld: Insurers deny ‘novelty’ policies driving up costs