Federal budget 2024: What it means for Mackay, Gladstone, Rockhampton

Industry at Gladstone has been given a boost by the federal government in its 2024 budget, which primarily focused on the housing and cost-of-living relief, and offering some help to small business owners too.

Gladstone

Don't miss out on the headlines from Gladstone. Followed categories will be added to My News.

Gladstone’s green energy industry is expected to continue thriving as the federal government continues its investment in the hydrogen, with a $6.7 billion investment in the clean energy source nationwide in its 2024 budget.

The city, home to a new commercial scale hydrogen electrolyser manufacturing facility, is expected to emerge as a winner of this year’s budget thanks to ongoing investment in the industry.

This year’s budget included a new tax incentive of $2 per kilogram, starting from 2027-28, and another $2 billion for another round of the Hydrogen Headstart program to scale up the energy industry as the push for clean energy picks up across the world.

Hydrogen Headstart provides revenue support for large-scale renewable hydrogen projects.

The investment was one of the few specific highlights for the Mackay, Gladstone and Rockhampton regions in Dr Chalmers’ budget brought down Tuesday night, with the areas failing to rate a mention during his speech which primarily focused on cost-of-living and housing relief.

In his third budget, Dr Chalmers announced only the second surplus in the past 16 years amid uncertain economic times and an election on the horizon.

While the region’s where otherwise unreferenced, they are expected to benefit from $437 million in funding for the Bruce Hwy previously announced by the government.

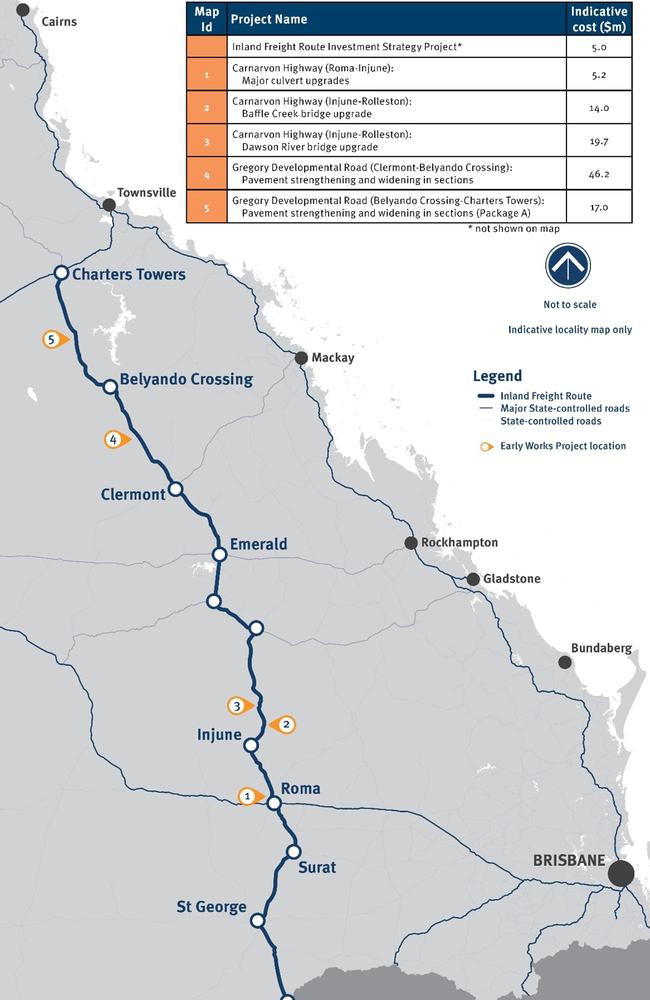

Drivers along the state’s main road in the regions will likely benefit from continued efforts to build an inland freight route as an alternative to the Bruce Hwy.

Dr Chalmers characterised this year’s budget as one “for the here-and-now” and “a budget for the decades to come”.

“More homes means more affordable homes and a better deal for buyers, builders and renters alike,” he said.

“The current housing pipeline is backed up (so) we’ve already allocated $3.5 billion to address bottlenecks and slash red tape – and this budget includes another $1 billion to help states and territories build more housing sooner.

“We’re providing $89 million for 20,000 additional fee-free TAFE and VET places to train more construction workers to do the work we’ll need.”

However, Real Estate Institute of Australia Queensland spokesman Andrew Bell said the measures, while welcome, would do nothing to deal with the immediate housing crisis gripping the city.

“Some of these measures are good but there is too much blockage in the bureaucracy whereas we need policies which can get developments underway sooner than later,” he said.

“The level of certification for buildings are of such a high standard now that the average building is just not interested because it takes eight to ten months to qualify and that is too hard and many of those who work in regional areas (across the state) don’t think it’s worth it.

“It’s one thing to throw money at housing and development but if they never land it is of no benefit.”

Mr Bell said measures which would provide immediate benefit would be capital gains tax reform, the slashing of infrastructure charges and government incentives for developers to build affordable housing, along with time-frames to ensure their projects are delivered within five years.

However, in a win for tens of thousands of small business operators across the state, Dr Chalmers announced a surprise continuation of the $20,000 instant asset write-off which was expected to end on June 30, a move which is expected to be welcomed by business groups across the city which had lobbied for the measure.

“We want Australian small businesses to share in the big opportunities ahead as well,” Dr Chalmers said.

“That’s why we are extending the $20,000 instant asset write-off until 30 June 2025, providing $290 million in cash flow support for up to four million small businesses.

Dr Chalmers announced a $9.3bn budget surplus, despite previous years’ budget papers tipping a deficit.

However forward estimates forecast deficits to return across the next four years.

Dr Chalmers said the economic outlook was “framed in fraught and fragile global conditions”.

“The world economy is resilient in parts but subdued overall (and with) inflation lingering in North America, growth is slowing in China and tepid in Europe, tensions have escalated in the Middle East and persist in Ukraine, global supply chains are fragmenting,” he said.

“This uncertainty combines with cost of living pressures and higher interest rates to slow our economy, with growth forecast to be just 1.75 per cent this financial year and 2 per cent next.

“Treasury is now forecasting inflation could return to target earlier, perhaps even by the end of this year (while) at the same time, around 780,000 jobs have been created under this Government, a record for any first term.

“This is stronger jobs growth than in any major advanced economy, real wages are growing again for the first time in almost three years and business investment is now expected to record its longest annual expansion since the mining boom – and we’re addressing the pressures caused by population growth, with net overseas migration next year now expected to be half what it was last year.”

Gross debt will top $904bn this year before increasing past $1tn in 2025-26

Other key points of the budget include: $22.7bn across the next decade for the government’s Future Made in Australia manufacturing policy; The impact of the government’s revamped stage three tax cuts which will come into effect on July 1 and will see every tax payer receive some financial relief; A $300m energy rebate for power prices, with small businesses receiving a further rebate; $3 billion towards cheaper medicine; And he capping of indexation of student debt, wiping $3bn.